VAT Cash Accounting Scheme

The Cash Accounting Scheme for VAT allows you to pay for or claim back your VAT only when the Invoice or Purchase has been paid rather than when they are issued. This can help small businesses ensure that they have received the money from their customer before having to pay it across to HMRC.

Please note that this is only applicable if your business has an estimated turnover of £1.35 million or less in the next 12 months. For more information, please see HMRC’s website: https://www.gov.uk/vat-cash-accounting-scheme

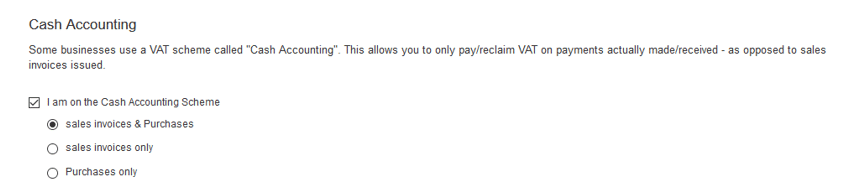

Setting up Cash Accounting

To set up KashFlow for Cash Accounting, you must first ensure you are VAT Registered under Settings > VAT Settings and ensuring the option for I am VAT registered is selected and your VAT number has been entered.

You can then choose the option ‘I am on the Cash Accounting Scheme’ and select the option that is relevant to your business.

Choosing Sales invoices only will mean that KashFlow will treat only sales and money in transactions as Cash Accounting and purchases will be calculated using the normal Accrual accounting scheme rules and vice versa

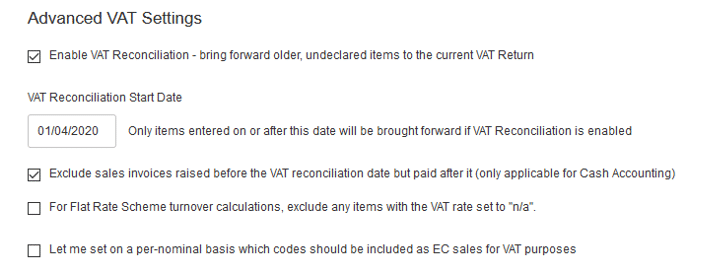

Exclude older invoices

There may be times you need to exclude invoices from the current VAT return that have been raised in an earlier period but have only just been paid, for example, if you have recently moved over to the Cash Accounting Scheme. In this instance, you can set the VAT Reconciliation Date under Settings > Advanced Settings and then select the option to ‘Exclude sales invoices raised before the VAT reconciliation date but paid after it’ under the VAT reconciliation date.

EC Sales and Acquisitions on Cash Accounting

If you are on the Cash Accounting scheme and make any sales or acquisitions to EC countries, these invoices and purchases in KashFlow will be treated as if you are on the Accrual accounting scheme and any VAT will be reported on the date of the invoice rather than when it is paid in KashFlow.