Bookkeeping software for your business

Do you hear the word ‘bookkeeping’ and picture a process that is necessary but time consuming, complicated and boring? Plenty of people do and, let’s face it, they’re probably right. That’s why we’ve developed bookkeeping software to ease the pain of keeping the books and ensure your business can get ahead, rather than leave you with your head stuck in your accounts.

So, what does bookkeeping really entail, how does online bookkeeping work and how can our software help you? Let us explain all…

What is bookkeeping?

Bookkeeping is the process of maintaining your financial records as a business. Bookkeepers will often find themselves:

- Logging receipts

- Entering data

- Handling invoices

- Tracking ingoings and outgoings

- Filling in financial paperwork

The Federation of Small Businesses reckons that firms spend more than 30 hours a month on accounting, banking and tax.

Hate it or love it bookkeeping is extremely important, but it doesn’t have to be a chore. There are various ways of doing the books, but the easiest and quickest way is with bookkeeping software.

Choosing the best bookkeeping software for your business

In days gone by, all of these essential bookkeeping tasks had to be done by hand. Not only is this time consuming but it is also tough to get right, requiring you to crunch endless numbers and handle a lot of tricky sums.

This age-old problem gave rise to bookkeeping software which cuts time, costs and other things such as human error and workload. The best bookkeeping software should be flexible; available to you wherever you are and there for you whenever you need it, that’s why our bookkeeping software comes in several forms whether you need cloud bookkeeping or double-entry accounting software and more so you can find the ideal solution.

If you run a small business or you’re a sole trader our bookkeeping software is ideal for you too. Take a look at our small business bookkeeping solutions to find out how IRIS KashFlow can help you.

Online bookkeeping software

Online bookkeeping software, also known as web-based, digital or cloud bookkeeping software, is able to meet your demands and reduce that workload; with computer programs able to easily handle complicated calculations, including tax and VAT. However, while most programs make the sums simpler, not all bookkeeping packages are easy-to-use and you might be forgiven for thinking that you’d need a degree in accounting to be able to make any sense of them.

That’s why we’ve invested lots of time developing a user-friendly interface and welcome you to try our software totally free. Our bookkeeping software is suitable for everyone from freelancers and contractors right up to small businesses and large organisations employing a team of staff.

At the click of a button, you’ll have all the essential bookkeeping features that normally take hours to master, including:

- credit control

- an invoicing tool that converts quotes into invoices easily

- export and import features

- stock control

If you have little or no bookkeeping experience – and there’s no reason why you should when starting a business – it helps to have all of your record keeping completed and managed in one place. This helps you to stay in control of your business and can save you from big bills paying for external support.

Digital bookkeeping software also comes with the added benefit of being easier to access. Businesses can update their records wherever and whenever they wish – and don’t have to waste valuable office hours on this if they’d rather do their books at home.

Bookkeeping on the go

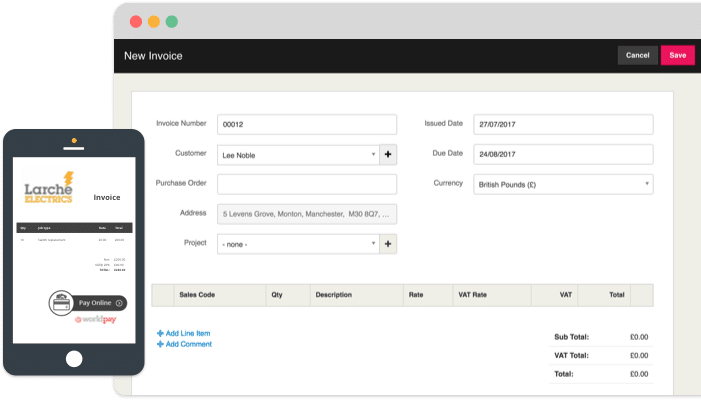

Do your books on the go with our free mobile app. Our handy bookkeeping app gives you the power of our bookkeeping software in your pocket.

No more searching for somewhere to sit and do your bookkeeping. Simply open up the app and tick off your tasks at the touch of a button.

Keep your books safe and secure

Some businesses might be nervous about switching from basic software to web-based bookkeeping unsure of the safety and security of their data. However, cloud bookkeeping software boasts a number of security features to put their minds at rest. These include:

- Secure servers

- The chance to set your own log-in and password information

- Data is stored in the cloud, meaning financial details are ‘off-site’

- 24/7 product support

Not only that, but online packages also offer a number of features that boost the convenience for the user. These include:

- Not taking up too much hard drive space

- Working equally well on PCs or Macs

- Details remain up-to-date in one centralised location

- Features and reports that naturally link with services such as Dropbox and Paypal

There really is no reason why bookkeeping has to be a bore. Start your free trial today!

Need some help using your bookkeeping software?

If you’d like to learn how to get the most from your bookkeeping software then check out our bookkeeping training. Become an expert with your software and improve your knowledge and efficiency with our online courses.

What happens if you fail to keep your books up to date?

While you should aspire to keep your records up to date so that you are in full possession of the facts about your business, it’s also important to recognise that you could face a big penalty if you fail to file financial information with the taxman.

The fine issued by HMRC for a first offence is typically £500, but could rise to as much as £3,000. By using IRIS KashFlow software, you’ll reduce your risk of falling behind with your bookkeeping.

As bookkeeping procedures evolve it’s important to keep on top of current practices. Why not brush up on your knowledge by downloading ‘The essential intro to modern bookkeeping’ for free?