Important note: Before importing Purchase Receipt Payments make sure you have created your Purchases in KashFlow – the guidance below contains the required and optional fields and describes how they should be formatted. The receipts must currently already be created in KashFlow

Required Fields

The Purchase Payments import requires three critical fields;

- Receipt Number – this is the Purchase Number that the Payment will be applied to – it must already exist in KashFlow– i.e. “222” will be applied to receipt KF222

- Paid Date – this is the date that Purchase was paid, it must be in DD/MM/YYYY format – i.e. “01/01/2012”

- Paid Amount – this is the amount that was paid against the Purchase, it must be a number to a maximum of two decimal places and not include the currency symbol– i.e. “10.99”

Optional Fields

The other optional fields you can have are listed below, along with a description, how it should be formatted and example text:

- Paid Account – this is the nominal code of the Bank Account that the Payment was paid from, the Nominal Code is available in your Chart of Accounts – i.e. “1201”

- Payment Note – this can be a Note regarding the Payment – i.e. “Payment was a day late”

- Payment Method – this is the method that you paid the supplier – it must already be defined in your Payment Methods – i.e. “BACS”

Uploading the template

To import

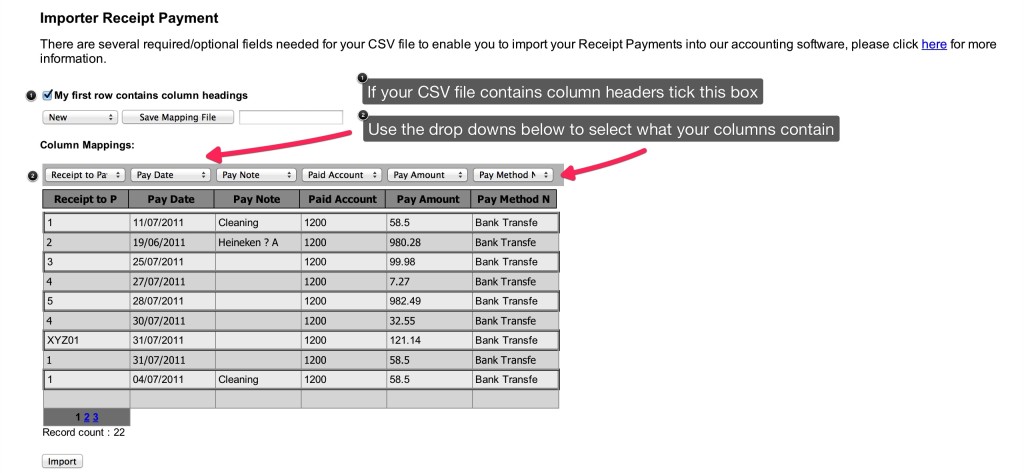

Settings > Import Data > Import CSV Files > Enter in your Username & Password (Please note if you have specified an alternative API Password you would need to use it here) > CSV > Receipt Payment > Upload your file > Tick the box ‘ My first row contains column headings; if appropriate > Use the drop downs to map the file > Import

Please note, if the CSV file contains any special characters such as, ‘ ; ( ) {} & * £ $ “ ” <> ? / @ ~ # etc… Please remove as these may cause errors to the import process.