If you are on the flat rate scheme for VAT, HMRC are making a change this April that may affect you.

From April 1st 2017, businesses with limited costs using FRS, will have a new rate of 16.5%.

Am I affected?

HMRC have defined a limited cost trader as someone whose total expenditure on goods is either:

- Less than 2% of your turnover in a year (including VAT)

- Greater than 2%, but less than a £1000 a year.

Goods does not include expenses of: capital, food or drink or fuel* and must be exclusively for the use of the business.

Potentially affected businesses

Typically this will affect service businesses or consultants. Examples include:

- IT Contractors

- Gardeners

- Accountants

Anything else?

As this change takes effect from the 1st April, HMRC have also made provisions to prevent people delaying the impact of this change.

When you issue an invoice, or receive payment, before the 1st April for services performed after, then this invoice should be treated under the new rules. Where some services are performed before and after, then a reasonable proportion should be considered under the new rules.

If you’re not certain what this means for your business, please consult with your accountant.

What do I need to do?

If you plan to continue using the Flat Rate Scheme for VAT, and are affected, you’ll need to update the rate in KashFlow to accommodate the crossover between both new and old rates

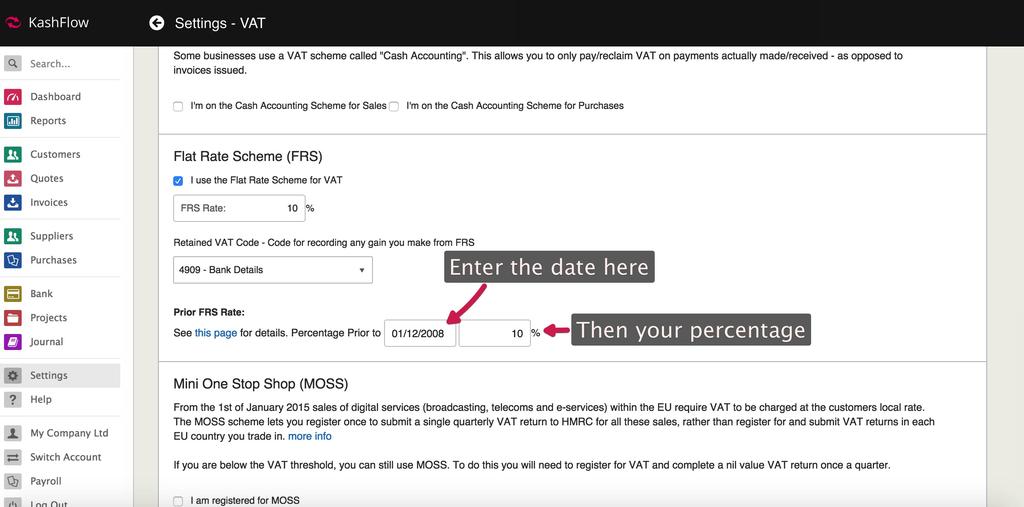

Go to Settings -> VAT Settings.

Set the new rate of 16.5% in the FRS Rate box. In the section labelled “Prior FRS Rate” you’ll need to set your date in the “Percentage Prior to” box to 1st April 2017 along with your previous rate next to it.

Alternatively, if you plan to leave the flat rate scheme or de-register from VAT, you should talk to your accountant first.

Further Information:

- HRMC FRS Notice: https://www.gov.uk/government/publications/vat-notice-733-flat-rate-scheme-for-small-businesses/vat-notice-733-flat-rate-scheme-for-small-businesses

- HRMC Blog: https://www.gov.uk/government/publications/tackling-aggressive-abuse-of-the-vat-flat-rate-scheme-technical-note/tackling-aggressive-abuse-of-the-vat-flat-rate-scheme-technical-note

- KF KB: https://www.kashflow.com/support/kb/vat-flat-rate-scheme/

- KF KB: https://www.kashflow.com/support/kb/frs-vat-and-crossover-periods/

- Find an accountant: https://www.kashflow.com/accountant-search/

* Please check with your accountant or HMRC on exactly what expenditures you have that may or may not count towards whether you are affected by the new legislation.