If the VAT periods you are reporting on overlap a change in VAT Flat Rate Scheme rates, then your VAT report needs to be calculated partially on the old rate and partially on the new rate.

KashFlow makes that easy.

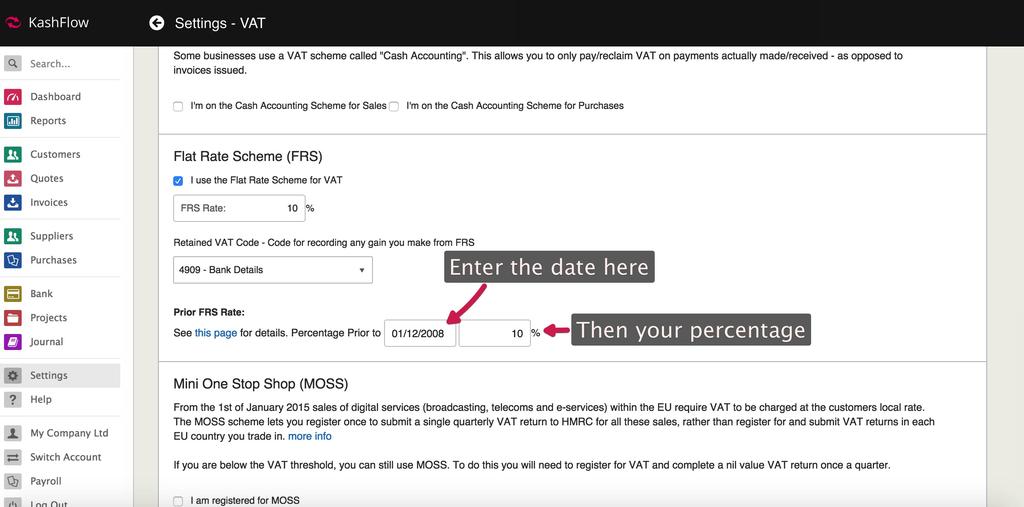

Go to Settings -> VAT Settings.

Set your current FRS rate as normal

If you have ticked the box to say you’re on the Flat Rate Scheme then there is a section labelled “Prior FRS Rate”

Here you set the old rate and the date on which it changed to the current rate.

Example: If you are using 10% up until 31st December 2010 and 12% from 1st January 2011 then you would enter the rate current rate as 12% and the rate and date for “Prior FRS Rate” as 10% with a date of 1/1/2011.