On 1 Apr 2019 Making Tax Digital (MTD) VAT will become mandatory for all companies who have an annual turnover greater than £85,000.

Within the software you will see the following changes take place on 1st April 2019:

- The MTD Public beta will end, all options for this will be removed from the software.

- You will be prompted to specify whether your turnover is above the VAT threshold when you access VAT dashboard/settings if you have not done so already

- You will be able to connect to HMRC even if you have not enrolled into the public beta.

- If your company is above the VAT threshold, you will only be able to submit through MTD. You will no longer be able to create VAT returns, submit through online filing or mark as submitted.

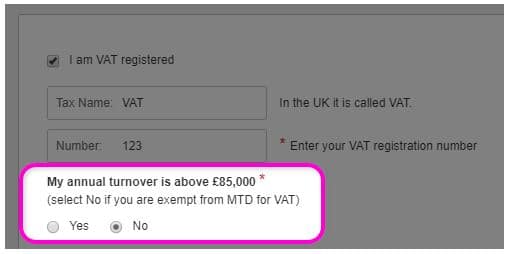

- If your company is part of the MTD VAT Deferral Group or Hybrid VAT Scheme, you will need to select “No” to the setting “My annual turnover is above £85,000” in VAT settings in order to continue with VAT submission through online filing or the HMRC portal (mark as submitted).

Please Note:

According to MTD VAT legislation, businesses must submit through MTD for their first VAT return starting on or after 1 Apr 2019. If you have not yet signed up to MTD for VAT and would like to submit for a period starting before 1 Apr 2019 (e.g. 01/03/2019 – 31/05/2019), you will need to temporarily go to Settings > VAT Settings and select “No” for the option of “My annual turnover is above £85,000” in order to submit through online filing (even though your company may be above the threshold).

Once you have done this, you will be able to go back to the Taxes menu and you will see the button for “Create VAT return” as normal.

If you company is above the VAT threshold and once you have completed all VAT returns with a start date before 1st April 2019, you will need to register for MTD with HMRC and and go back into Settings > VAT Settings and select “Yes” for the option of “My annual turnover is above £85,000”. This will enable the software ready for your first MTD submissions.

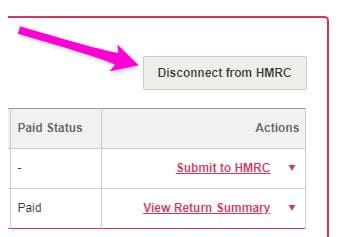

Please Note: If you have already signed up for MTD for any VAT returns starting on or after 1 Apr 2019 but you still require to submit VAT returns before this date on the old method, you will need to click “Disconnect from HMRC” from the Taxes tab in order to create and submit your VAT returns.

If you have any questions in regards to Making Tax Digital you can take a look at our FAQ’s page or send an email to support at [email protected].