When you have the option to file your VAT return and EC sales list enabled in KashFlow, you may find that in some cases you receive an error message referring to the VAT validation. In order to be able to submit a VAT return via KashFlow, you will need to ensure that online filing is an activated service within your HMRC Portal. Providing it is an activated service, the cause of the VAT validation failure mentioned can be found below:

VAT Return

“Authentication Failure. The supplied user credentials failed validation for the requested service”

This error will be caused by one or more of the following issues below:

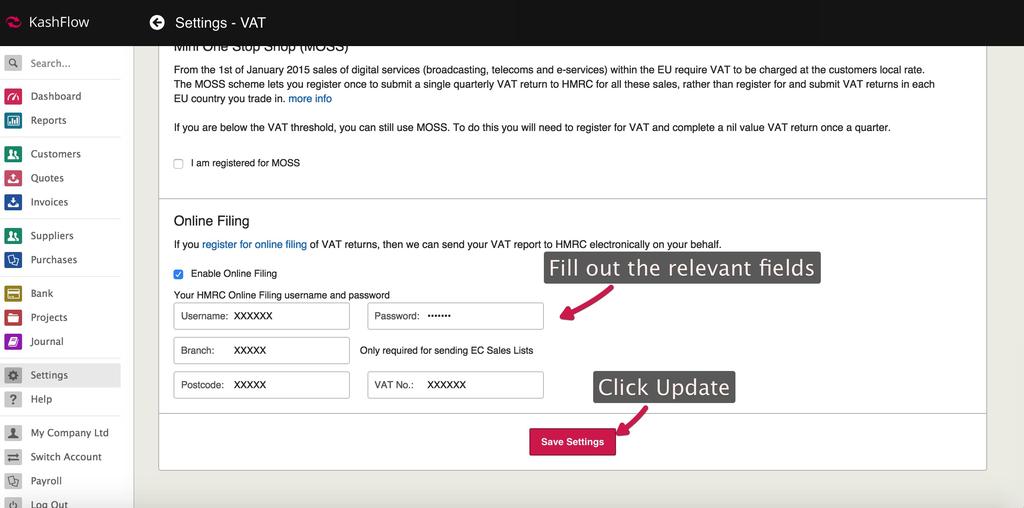

- 9 times out of 10 VAT validation has failed because there is a typo within the username or password. You can check this by going to Settings > VAT Settings, then checking the details entered in the online filing section are correct. This should be the exact same username and password you use to log into the HMRC Portal. If you are unsure what this should be, you will need to contact HMRC.

- Sometimes this issue can be caused by the postcode. You will need to ensure the postcode entered is the same postcode that your online filing account is linked to, this normally comes from your business address.

- One more thing that can cause a VAT validation error is the VAT number itself. You will need to ensure that your VAT number is entered exactly as it appears on your HMRC Portal. This is usually without spaces and without the country code.

Once all of these details have been checked, you will need to press update then try to submit the return again.

“The VAT Period you have entered YYYY-MM for the VRN 123456789 was not found, please check and resubmit if necessary.”

There are two potential problems that can cause this error message:

- The first cause of this issue is that you have a gap in the period that you are running VAT returns for, i.e. in KashFlow you have submitted Q1 and Q2, skipped Q3, and then tried to submit Q4. You will need to fill this gap by recording a return as submitted without sending to HMRC, something this link will help you with.

- Solving the first potential problem detailed above should solve the second issue, which is that you are trying to submit a VAT return that HMRC is not expecting. If you’re still having this issue then it is recommended that you contact HMRC to let them know what period you are trying to submit and what they are expecting to receive.

Once these issues have been resolved, you will need to press update and then try to submit the return again.

EC Sales List

“Authentication Failure. The supplied user credentials failed validation for the requested service.”

You may find that your VAT return has successfully been sent and received by HMRC, however you still receive an error because your EC sales list has failed, the two possible reasons for this are:

- We find the most common cause of this is that in your HMRC credentials, there is no branch number entered or the branch number is incorrect. To check this you will need to go to Settings > VAT Settings, then check what has been set in the online filing section. In most cases the branch number ‘0’ is used, if this does not work though, HMRC can advise you on what this should be.

- Alternatively the reason for this failing would be that submitting your EC sales is not an allowed service in your HMRC Portal. To check this you will need to log into HMRC and then check that submitting an EC sales list is allowed. To do this:

- You will need to login to HMRC online (https://online.hmrc.gov.uk)

- Under the heading ‘Services you can add’ You will find ‘VAT EC Sales List (ECSL)’ or similar

- Then choose ‘Enrol for this service’

- Then you enter the details requested by HMRC and HMRC will send you an activation number by post. When they receive this you log back onto the HMRC website and enter the code and they will be set up.

Once all of these steps have been followed, you will find that your online filing section should look similar to this:

If you do need to contact HMRC to obtain any information to help with the above, their contact details can be found just here.

Although VAT validation errors can be a bit worrying when they pop up most are easily resolved by following the guidelines above and, as ever, our Support team are on hand to help if you need some assistance!