The totals for “Assets Less Current Liabilities” and “Capital & Reserves” should match. If these totals do not match, it is likely that you have created a sales invoice or purchase invoice and used the wrong type of nominal code.

The types of nominal codes that should not be used are:

- Bank Account

- VAT Control Account

- Debtor/Creditor Control Account

To check if any of your invoices have been entered with the wrong nominal code, you can follow these steps to find it:

- Go to Reports> Business> Audit Trail.

- Set the date range to include all historical data.

- Ensure that you have only ticked in the box for “Include Invoices” (or “Include Purchases” if you are looking at the Aged Creditor report) and click “Run Report”.

- At this point you have two options:

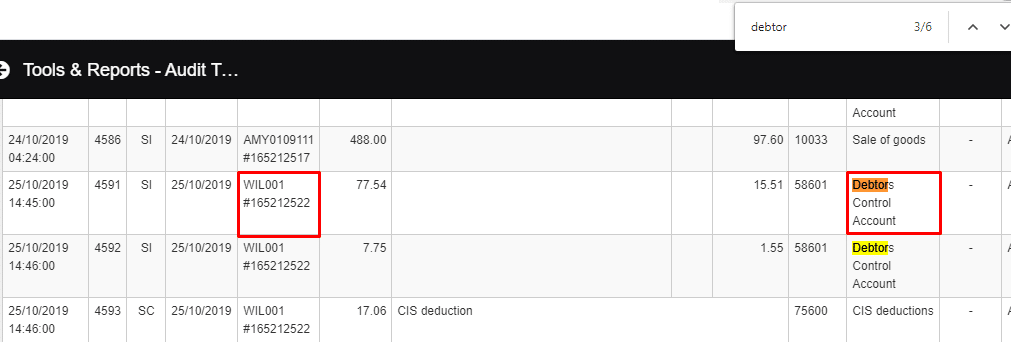

- Click on the control and F key on your keyboard to bring up the search browser option. If you are searching in the browser, you will need to type in the nominal code names/numbers of any bank accounts that you may have, the VAT Control Account, or the Debtor/Creditor control accounts code. In the below example, I have searched for “Debtor” and found the highlighted invoice. This invoice will need to be edited and the correct sales or purchase code will need to use.

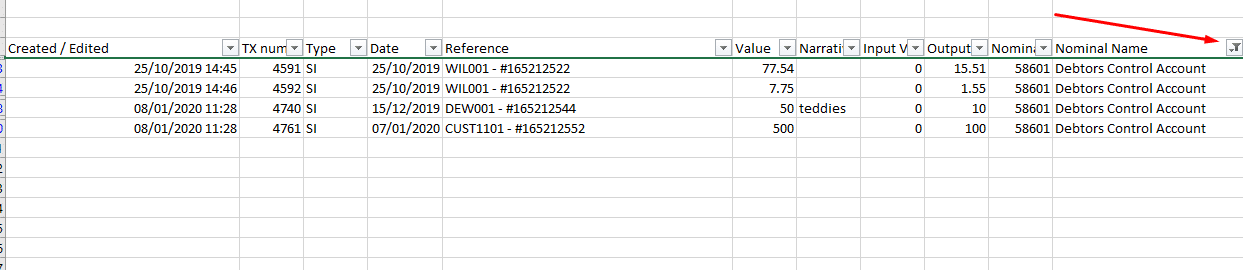

- Click on “Download CSV” in the top right corner and open the file in Excel. When opened in Excel, highlight the headers row and add a filter. From here, you can then filter down on the nominal codes that shouldn’t be used to see if any invoices have been allowed to this code. You will then need to go back to the software and find these invoices, open them and change the nominal code to the correct sales or purchase code.

- Click on the control and F key on your keyboard to bring up the search browser option. If you are searching in the browser, you will need to type in the nominal code names/numbers of any bank accounts that you may have, the VAT Control Account, or the Debtor/Creditor control accounts code. In the below example, I have searched for “Debtor” and found the highlighted invoice. This invoice will need to be edited and the correct sales or purchase code will need to use.

Once you have done the above, you can then re-run the Balance Sheet report and the two totals should now match.