In this article, we will go through the new Taxes dashboard and your VAT submissions.

Under the Taxes tab you will find your new Taxes dashboard. This dashboard replaces the use of VAT Management and Reports which you would usually find under your Reports tab.

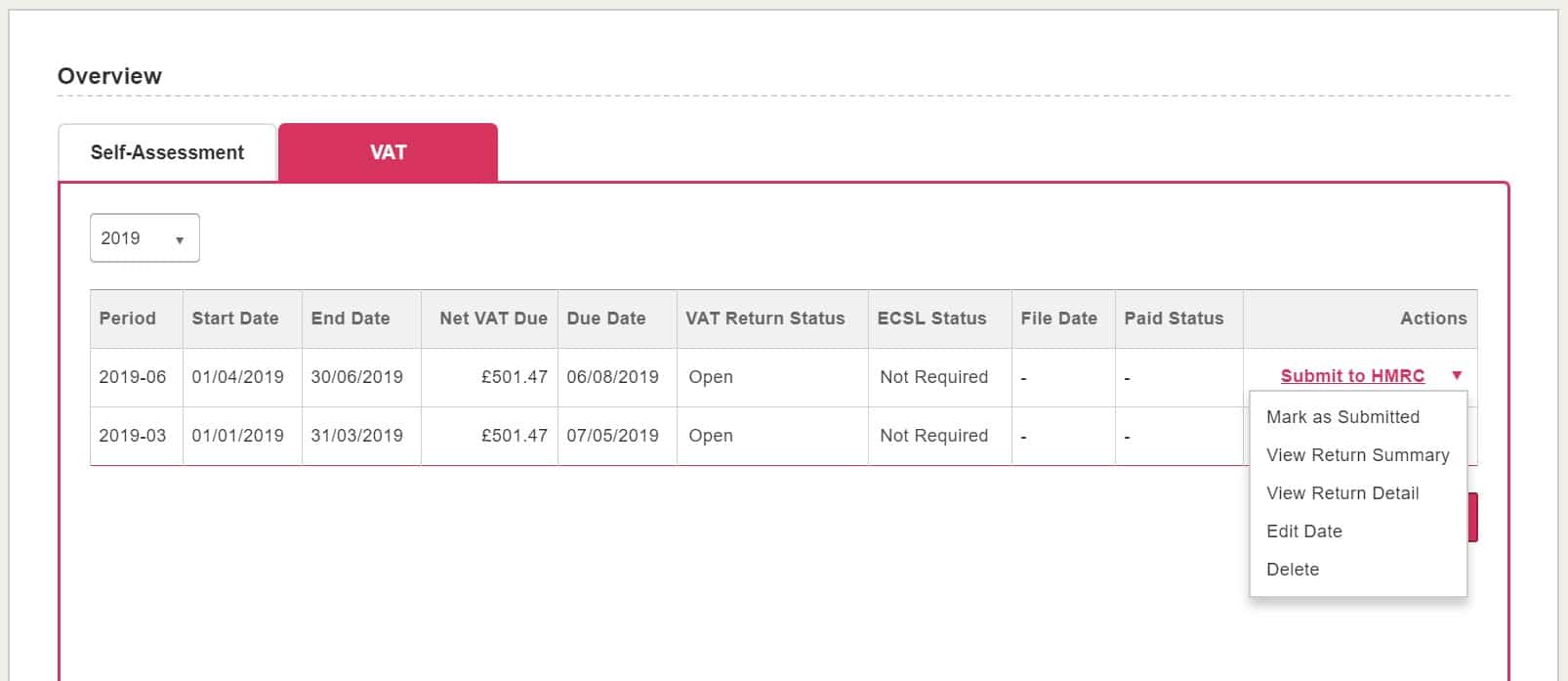

Clicking onto your VAT tab will show you an overview of your previously submitted reports at glance.

First, we’d recommend going through your VAT Settings just to ensure they’re all correct. You can do this by clicking on the VAT Settings button top right. Once clicking this you will see the more familiar looking VAT Settings. This is also accessible through Settings> VAT Settings.

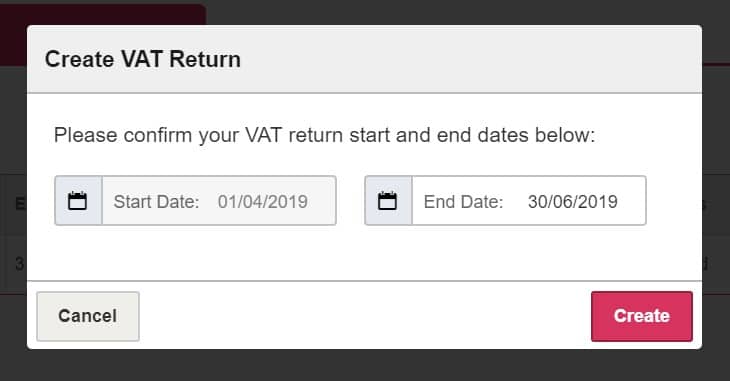

Once you’re happy then you can look to submit a VAT return directly to the HMRC. This is done by clicking on the Create VAT Return. You will then be asked for a date range for your VAT, this is automatically taken from your previously submitted and your VAT settings. You can, however, change the end date if you need too.

Once done you will be brought back to the Taxes dashboard where you will see your submission now in the table ready for action.

You can now,

Mark as Submitted – You would use this option if you have already submitted this outside of KashFlow. Submitting this again through KashFlow will cause it to fail due to duplication.

View Return Summary – Here you will be taken to another screen which shows you the VAT liability as well as Boxes 1-9. You may also want to customise your document by adding a logo, export, email or print your report. You can do all of this through here.

View Return Detail – Using this option tells you exactly whats contributing to each box in your VAT return. For example; Invoice 1 – £100.00 – Box 1 of your VAT Return. You can also export, print and email this option.

Edit Date – Using this option will change the dates of your VAT return.

Delete – Deleting your VAT return will completely remove it from KashFlow. It’s not possible to recover any deleted returns in KashFlow.

Once you’re ready to submit just use the Submit to HMRC button on the right of your VAT return. You will then be presented with your VAT return boxes ready for submission. Ensure you double check everything and tick the box to confirm your understanding of the following;

“This report is based on the settings you have previously provided. You can edit these settings through VAT Settings.

When you click Submit to HMRC, we will send your VAT Return to HMRC and update your accounting records with your VAT return values.

Once you pay the VAT (or get your VAT repayment) you should record it as a bank transaction against the VAT Control account.

When you submit this VAT information you are making a legal declaration that the information is true and complete. A false declaration can result in prosecution.”

Finally – Click Submit to HMRC. You will be contacted should your submission be successful or if HMRC has declined your report.

Now that it has been submitted you will be brought back to your Taxes dashboard where you can download your report summary using the same dropdown as you did to submit.

FAQ

What happens if I delete a transaction that has been included in a previous VAT return?

– KashFlow won’t delete the transaction, however we will offer to create a reversal of the transaction in question. This will then be added to your next VAT return to account for the deletion.

I’m already submitting my VAT returns through HMRC directly. Can I still use KashFlow?

– As of April ‘19, you will need to submit your VAT returns through an online software, however for now you can still submit through HMRC then use the “Mark as Submitted” button in KashFlow.

Why can’t I edit any previous VAT return dates? – You can only edit the start and end date for the first open VAT return.

Why can’t I edit the start date for my latest return? – In KashFlow you can only edit the end date of the latest open return.

Can I delete previously submitted returns? – KashFlow only allows you to delete your latest return, if it is open.