In this article, we will go through the new Taxes dashboard and your Self-Assessment submissions.

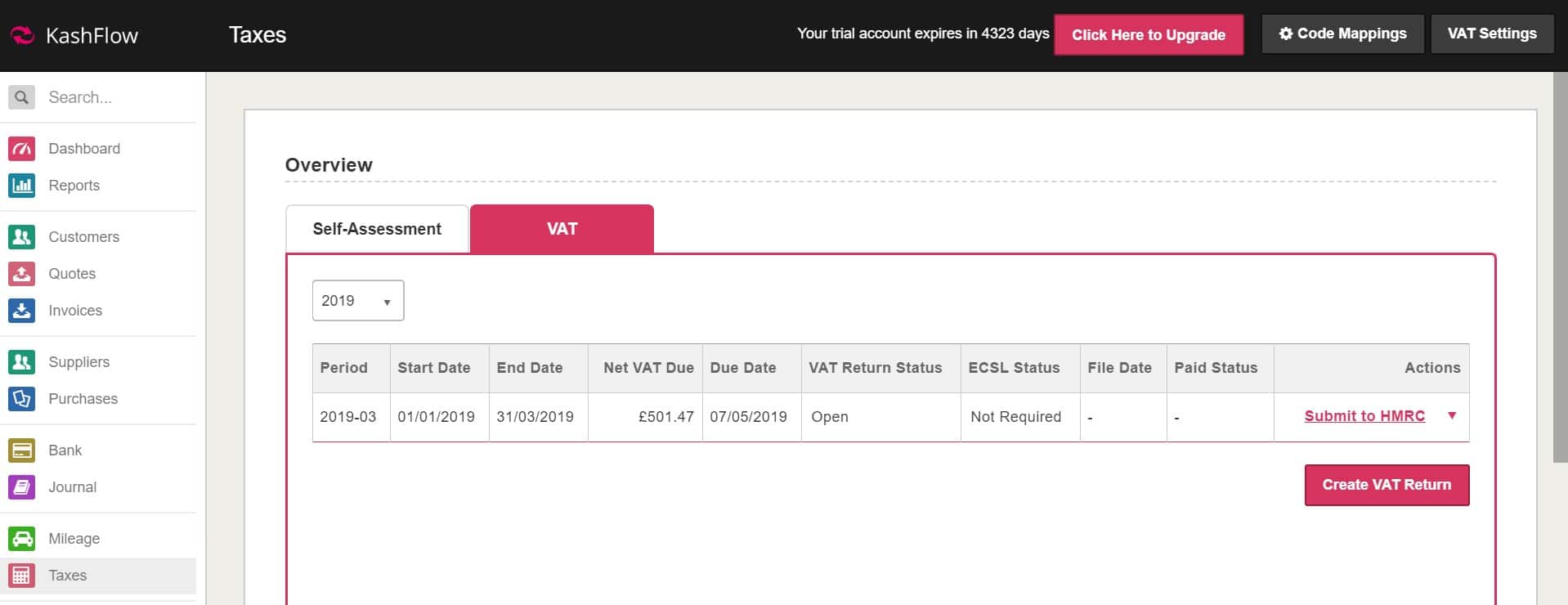

Under the Taxes tab, you will find your new Taxes dashboard. This dashboard replaces the use of the Self-assessment report, which you would usually find under your reports tab.

Self-Assessment

Choosing the Self-Assessment tab will switch you over to just your Self-Assessment submissions.

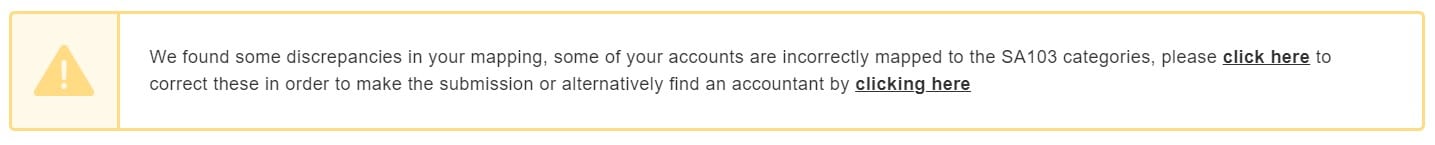

First, you will need to choose Code Mappings at the top right of your screen to ensure that all applicable codes are available should you submit a Self-Assessment. KashFlow will show you an error should a code that seems applicable not be applied to a Self-Assessment code. It will look something like this:

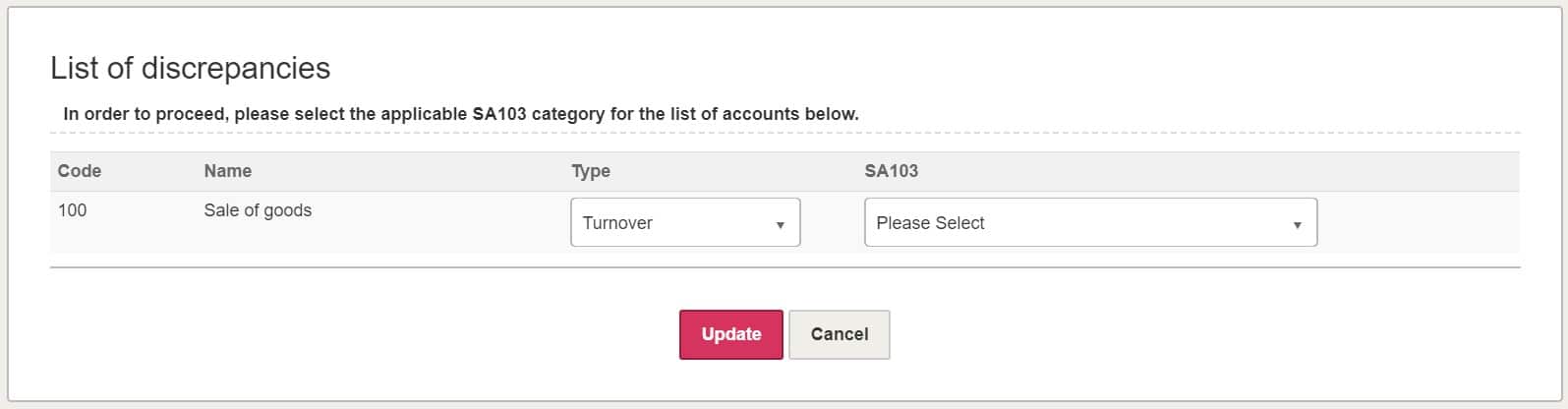

Clicking on the “Click here” hyperlink will take you directly to the Code Mappings screen. We will then list the codes which haven’t got a category against them.

If you’re not sure on what Self-Assessment category you would have for your code – Then we would recommend talking to your accountant. Don’t have an accountant? Click here to find one near you.

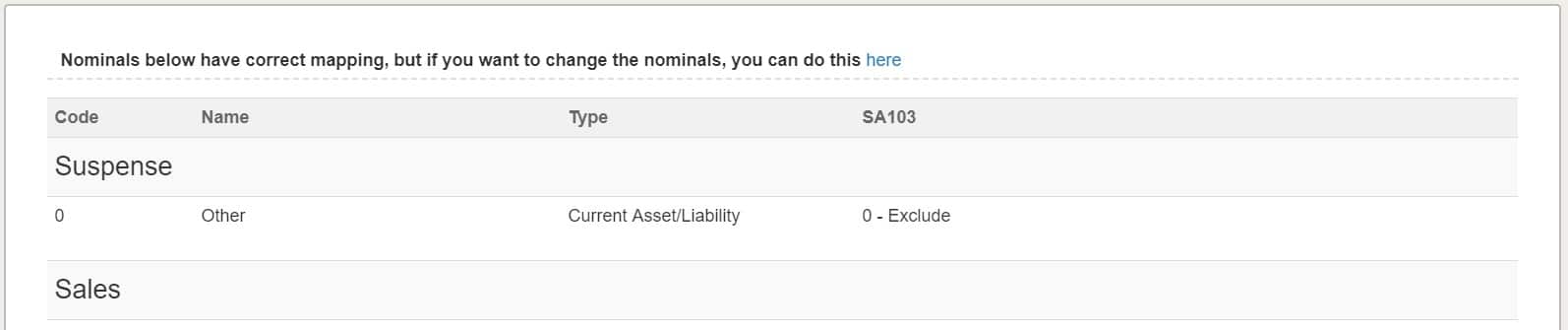

We would recommend scrolling down the page to find your existing codes with their categories already attached. Should you want to change anything just use the hyperlink Click Here.

Submission

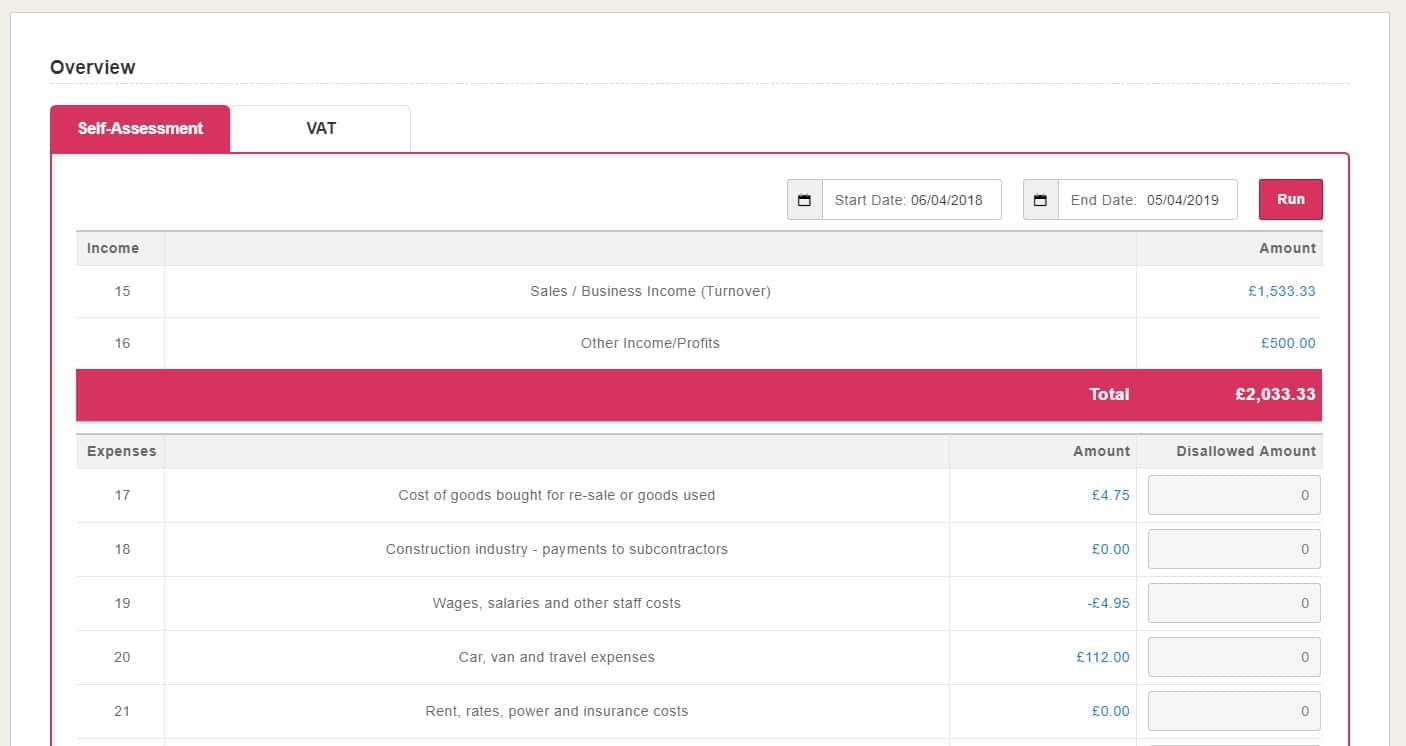

Now that your codes are up to date and are correct you can look to submit. Click onto your Self-Assessment tab, choose the dates you wish to submit and click Run.

You will then see your amounts against your respective Self-Assessment category. Ready for you to pull and submit into HMRC’s portal. It is not possible to post this directly through KashFlow, however this is something we’re looking to introduce in the future.

Should you want to drilldown on the amounts, you can do so just by clicking on the number.