The Profit & Loss Report (commonly known as P&L) is along with your Balance Sheet and Trial Balance one of the most crucial reports when running a business. A Profit & Loss report lists your Turnover less your Cost of Sales to give you your Gross Profit. Expenses are then subtracted from your Gross Profit to give you your net profit.

Running the Report

Access your Profit & Loss report by going to Reports > Financial > Profit & Loss Report.

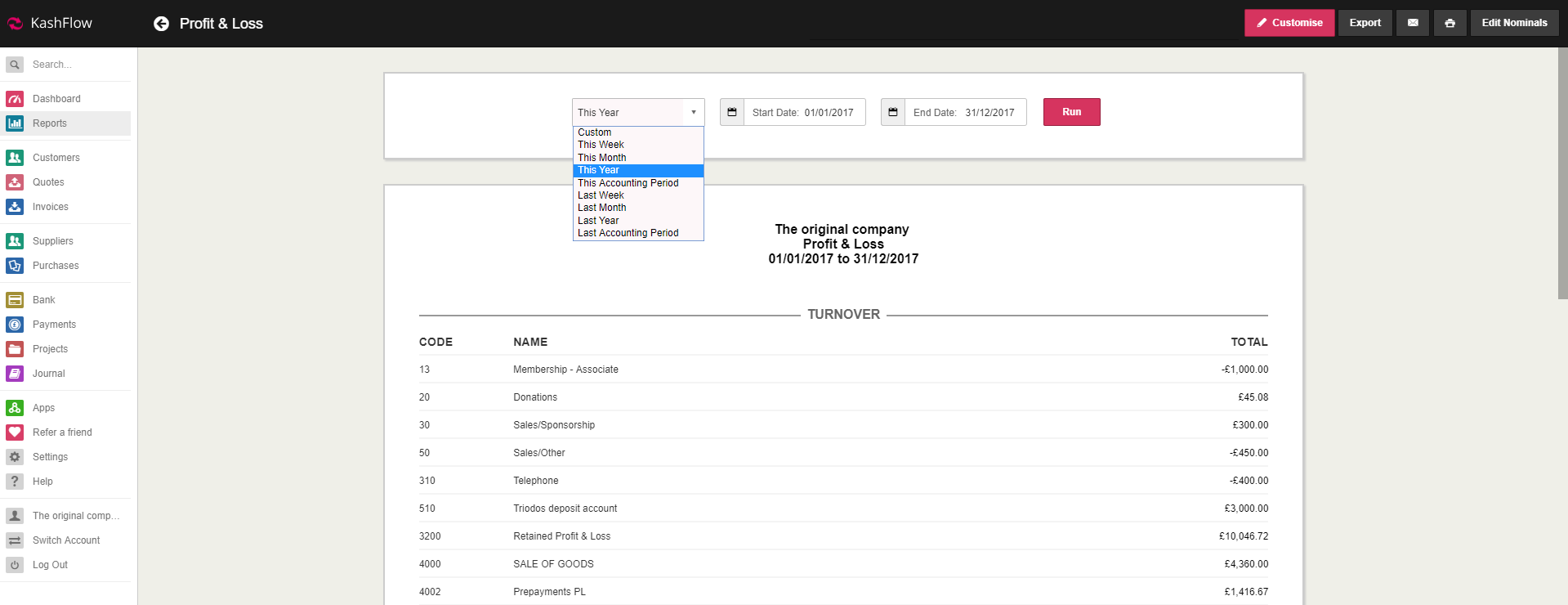

Using the date fields specify the Start Date and End Date for the report. P&L reports are usually run for financial years, meaning your Start Date should usually be the financial year start and the End Date would be the last day of your financial year.

Alternatively, use the dropdown menu on the left to select one of the following options: Today, This Week, This Month, This Year, This Accounting Period, Last Week, Last Month, Last Year, Last Accounting Period.

When ready, click Run Report.

Understanding the Report

The next page of your report will list your whole P&L. It will give you a total of how much each Nominal Code has made (or lost) over the period you have selected. By totalling all these figures and subtracting the appropriate amounts you will be left with a Gross Profit and a Net Profit.

A ‘Notes’ field is provided at the bottom where you can leave any relevant comments. These will be saved while you are preparing the report and they will appear on the exported CSV or PDF file, though they will not be stored in KashFlow to refer to at a later stage.

The figures can be downloaded as a PDF or CSV file by clicking the Export button in the top right corner. You can also email the report to your client or print the file using the icons next to the Export button.

Report Settings

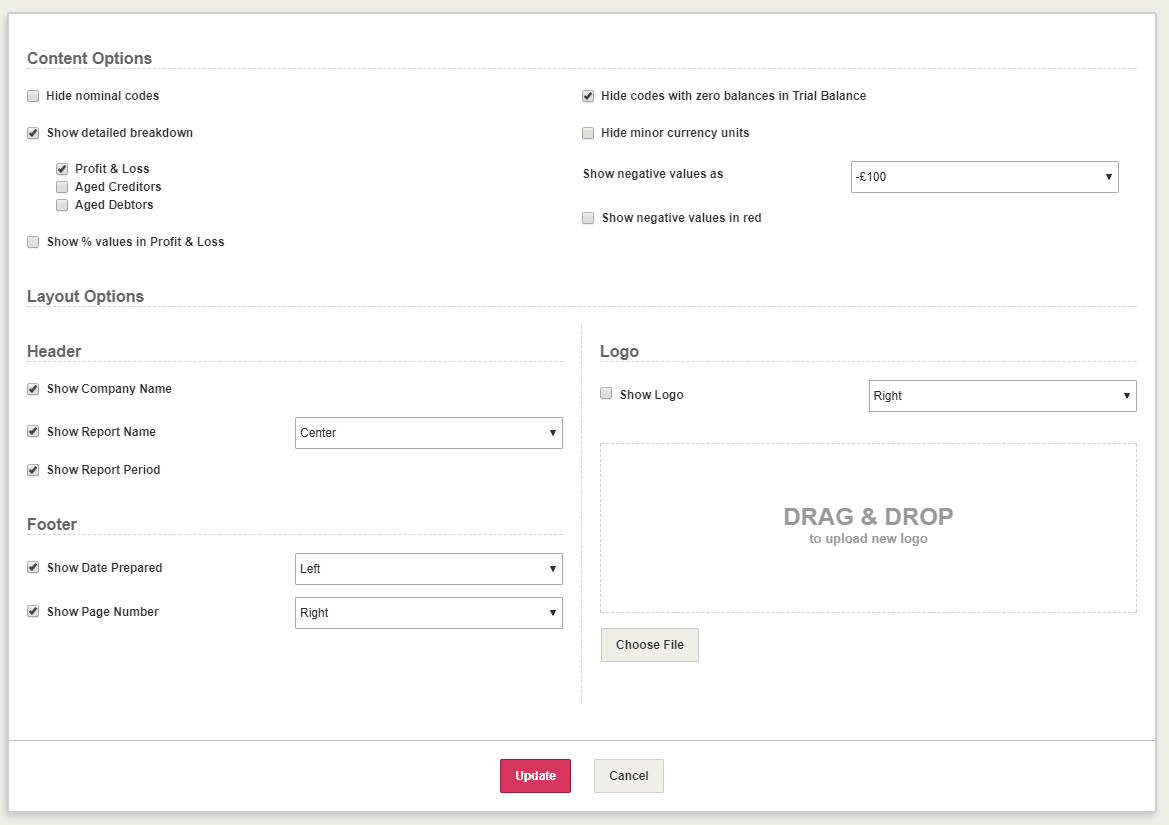

If you require a breakdown of the figures, you can use the Customise button in the top right which will take you to a new page where you need to select ‘Show detailed breakdown’. You can also select the reports to which the setting should apply.

Here you can configure the layout of the header and footer of the Profit & Loss report. You may also upload your company logo which will appear on the printed report.

Troubleshooting

Nominal Code in the wrong section

If you have noticed that you have got a nominal code recorded as Turnover when it is an Expense, then you have misclassified the nominal. You can easily correct this by clicking the Edit Nominals button in the top right corner. From the next page, classify your nominal code using the selectors under ‘Area’.

Nominal Code should be on the Balance Sheet

If you have got a nominal code on your P&L report when really it should be on your Balance Sheet, then you have misclassified the nominal. You can easily correct this by clicking the Edit Nominals button in the top right corner. From the next page, classify your nominal code using the selectors under ‘Type’.

Please note, we cannot advise on where your nominal codes should be classified, if you are unsure you should talk to your accountant.