Error Message: You are not authorised to submit VAT returns through MTD for the given VAT registration number. Please check your VAT registration number in VAT settings or Connect to HMRC using valid Government Gateway credentials.

If you are seeing the error “You are not authorised to submit VAT returns through MTD for the given VAT registration number” this error is being sent from directly HMRC who are not accepting the details entered. This means that the HMRC credentials that you are trying to use is not linked to the VAT registration number entered within KashFlow, to what HMRC have on their records. It could be that you are trying to send VAT submissions through MTD but you have not yet successfully registered for MTD.

End-User:

If you are an End User of the software and you are seeing this error message, can you ensure that you have followed the below steps to set up your MTD correctly:

- Sign up to MTD for VAT. Please note, once you complete the sign-up process you should wait for confirmation via email from HMRC, which may take up to 72 hours.

- Connect your KashFlow account to HMRC using your government gateway user ID and password. To do this log in to your KashFlow account, navigate to Taxes > VAT > Connect to HMRC, and follow the on-screen instructions.

- Manage and submit your VAT returns by navigating to Taxes > VAT.

Please note: If you are an end-user and you have been experiencing this same error message for more than a week, I would advise you to go to the Taxes tab and click “Disconnect from HMRC” and then re-connect.

Accountant via KashFlow Connect:

If you are an Accountant trying to connect for an End User of the software and you are seeing this error message, can you ensure that you have followed the below steps to set up your MTD correctly:

- Create an Agent Services Account if you do not have one already

- Link your clients to your Agent Services Account

- Sign up each of your clients to MTD for VAT. Please note, once you complete the sign-up process you should wait for confirmation via email from HMRC, which may take up to 72 hours.

- Go to Settings> VAT Settings and tick the box for “I am signed-up for MTD”.

- Connect your KashFlow Connect account to HMRC using the government gateway user ID and password issued when you created your Agent Services Account. To do this log in to your KashFlow Connect account, navigate to Settings > Connect to HMRC and follow the on-screen instructions.

- Log in to your client’s KashFlow account to manage and submit their VAT returns by navigating to Taxes > VAT. You will need to enable the client to submit via MTD by going to Settings> VAT Settings and set the option for “I have signed-up for MTD” as “Yes”.

If you have a 64-4 form in place for your client only, this does not necessarily mean that you are also automatically able to submit the MTD obligation on the client’s behalf. You will need to ensure that the clients are linked to your HMRC Agent Services Account when you log into the HMRC Online Portal.

We do also advise when entering your Agent Services Account details on Step 5 to ensure that you enter this number without any spaces. For example, your Agent Services gateway ID may be in a format of 12 23 34 45 56 67 with HMRC, you would need to enter this as 122334455667.

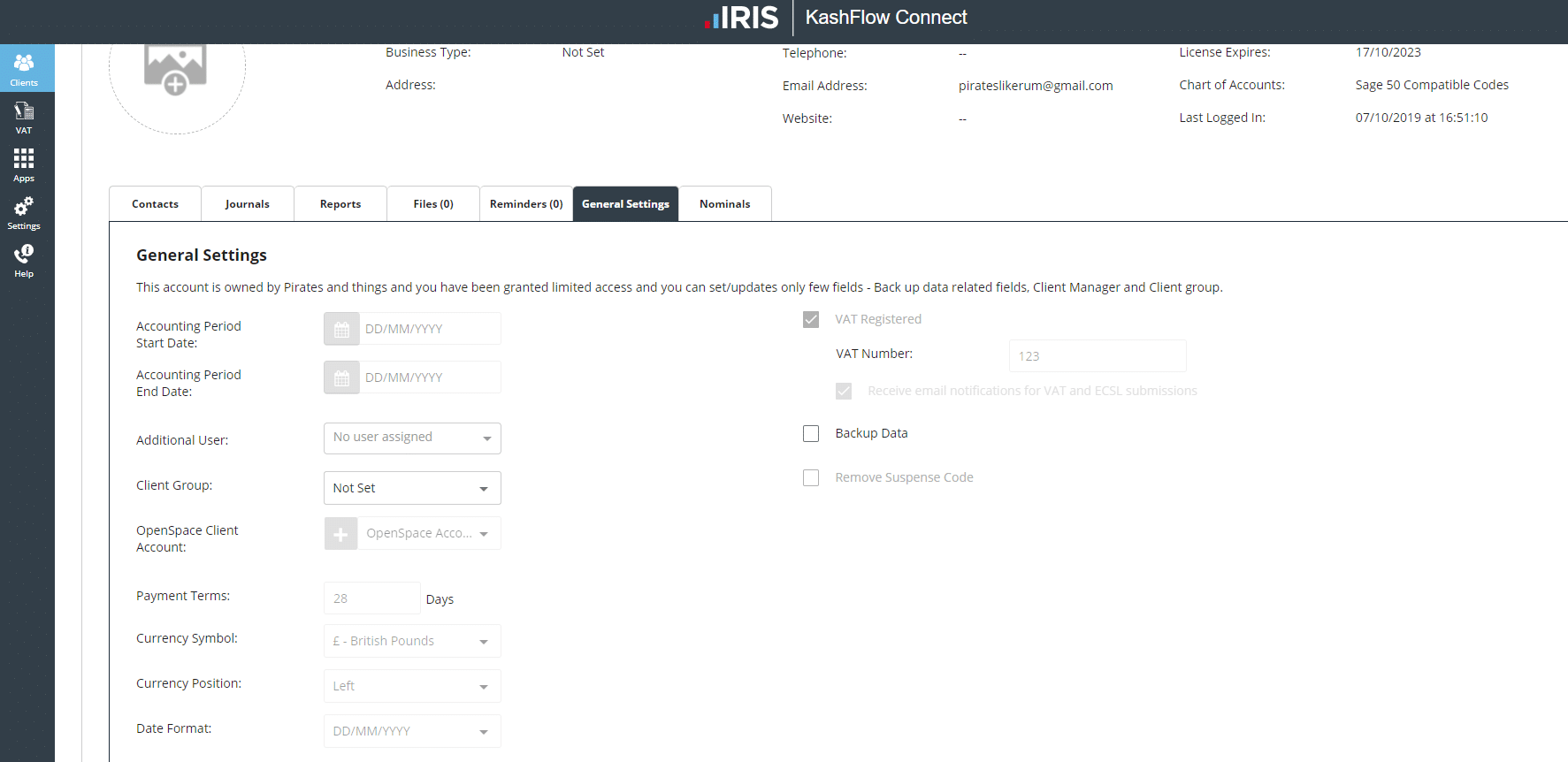

You will also need to ensure that your clients are “Directly Attached” to your Connect account. If they are not directly attached then you will also see this error message. You can check whether your clients are directly attached or not by logging into Connect and go to the Clients record and click on the “General Settings” tab. If you can see that some of the below options are greyed out and unavailable to select, then that client is not directly attached.

If this is the case, then you and your client will need to email the support team ([email protected]) to grant permission to be directly attached to your Connect Account. The reason we need to have the client’s permission to do this, as being directly attached means you as the accountant have full access to the data and have the option to set restrictions to parts of the software for your clients and your client should be aware of this. As soon as we have received permission from both parties, we will action this request and inform you once completed.

If you have done all of the above, and you are sure that the HMRC credentials you have are linked correctly to the VAT registration number, then you will need to contact HMRC to find out why they sending back this error message to see if there is any fault or discrepancy with the details they have for the credentials and VAT registration number.