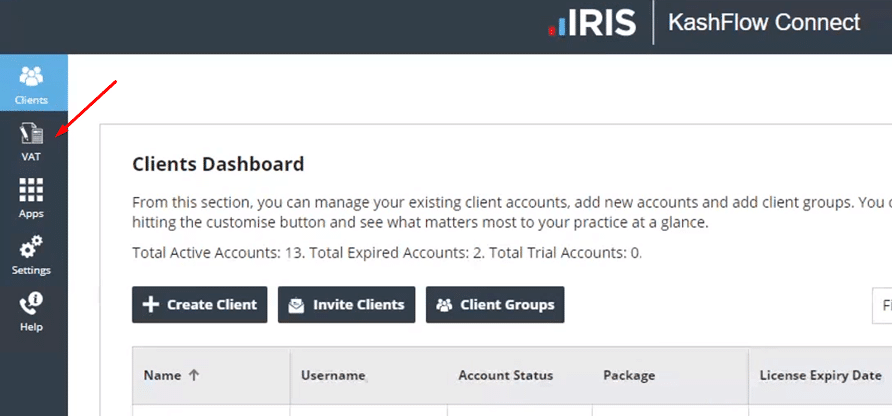

VAT Dashboard

You are able to submit VAT returns for more than one client at a time from the VAT dashboard in your IRIS KashFlow Connect account.

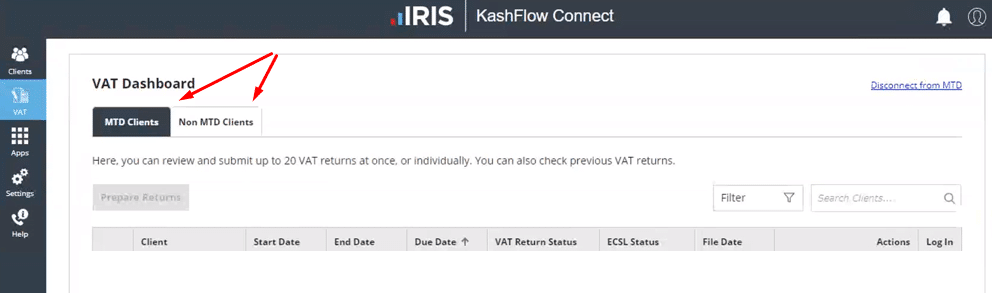

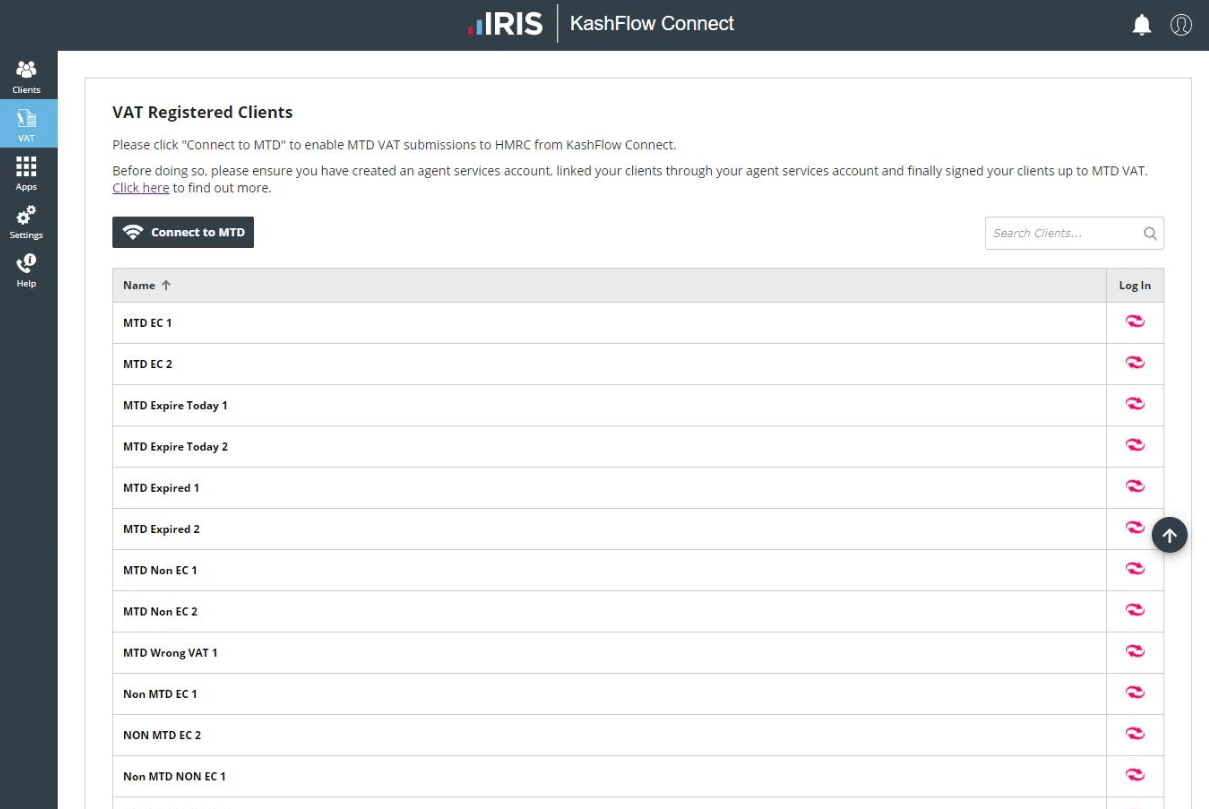

From this window you will see two tabs; one for your MTD registered clients and one for any non-registered MTD clients.

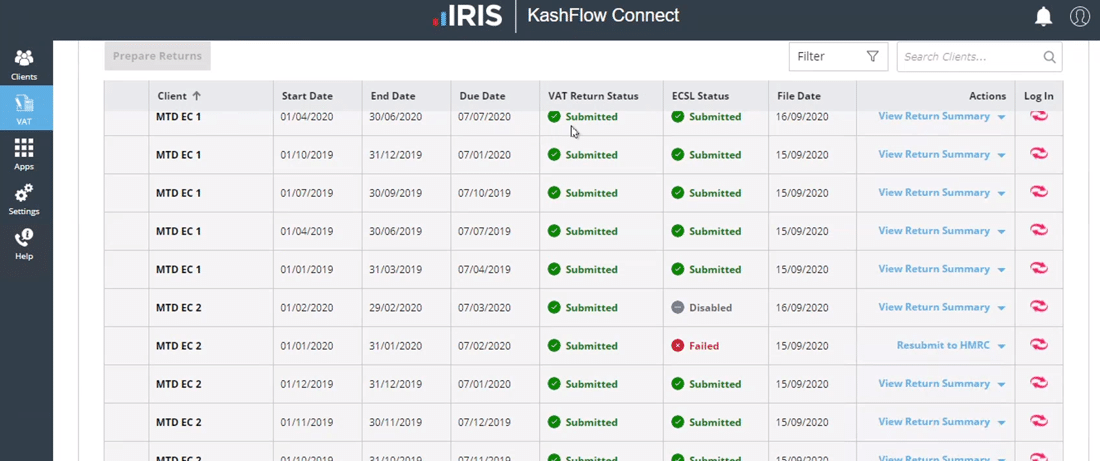

From the VAT dashboard view, you will see all of your clients and their VAT return details. You will also see what status each VAT return is currently in. The status options available are:

- Open

- Submitted

- Pending

- Failed

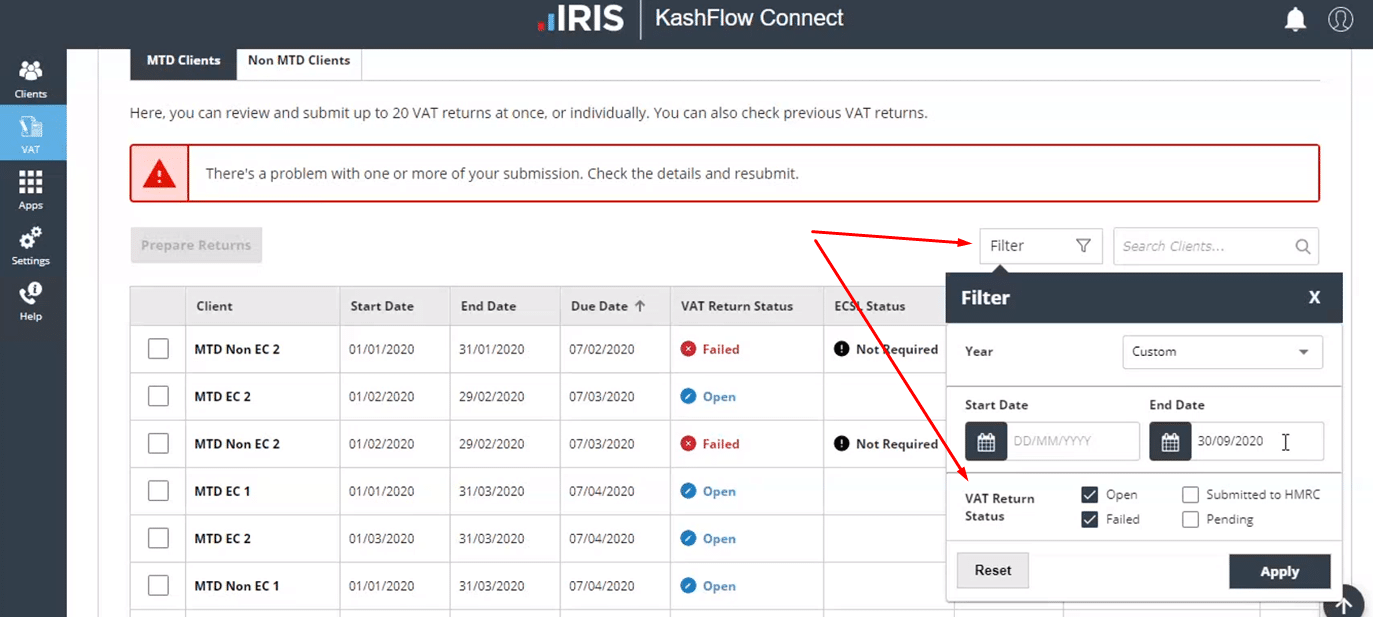

You can filter any of these statuses by clicking on the Filter field above the list of clients.

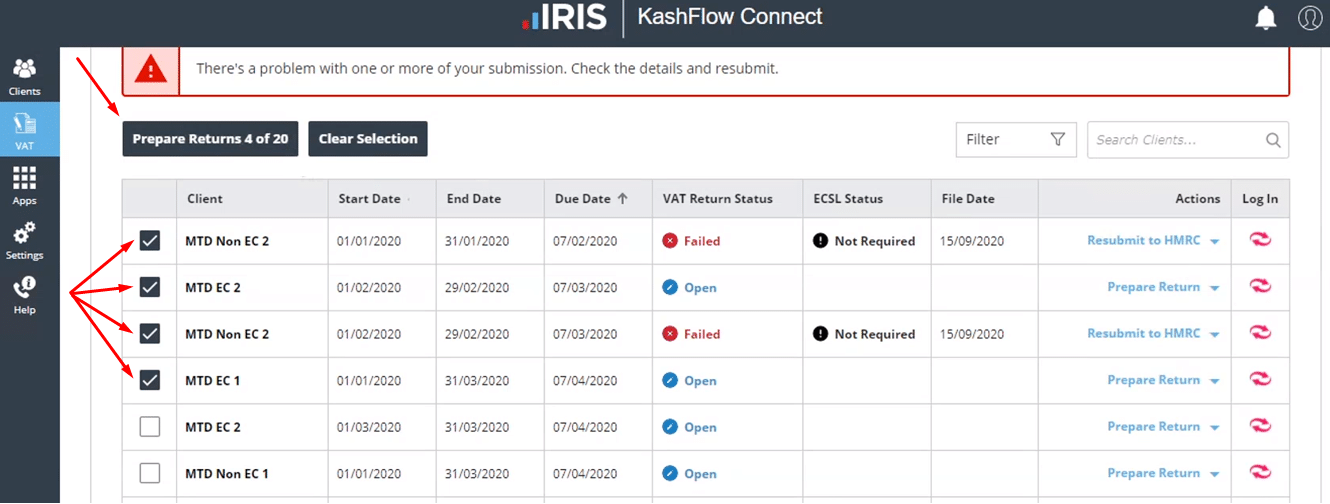

How to send a bulk VAT submission for several clients

When you are ready to submit the VAT return for more than one of your clients, put a tick in the box found on the first column of the client list. Once you have several clients selected, you can see how many clients you have ticked to prepare the VAT returns from the button at the top of the client list. At the moment, there is a maximum of 20 clients you can submit a bulk VAT return for.

Once you have selected the clients you wish to include on your bulk VAT return, click on the button “Prepare Returns X of 20” button.

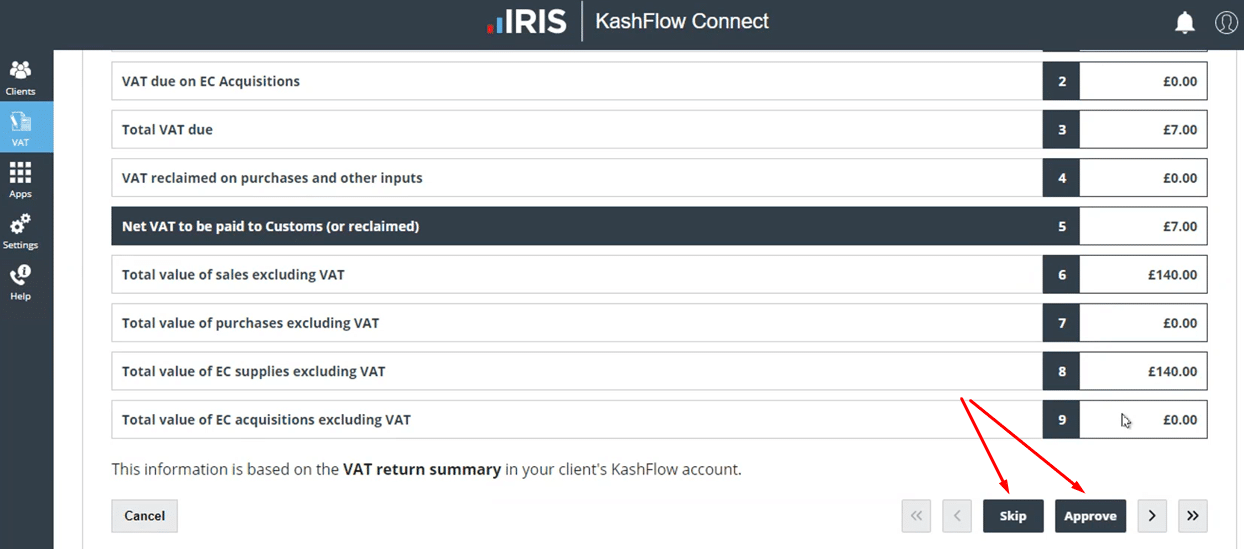

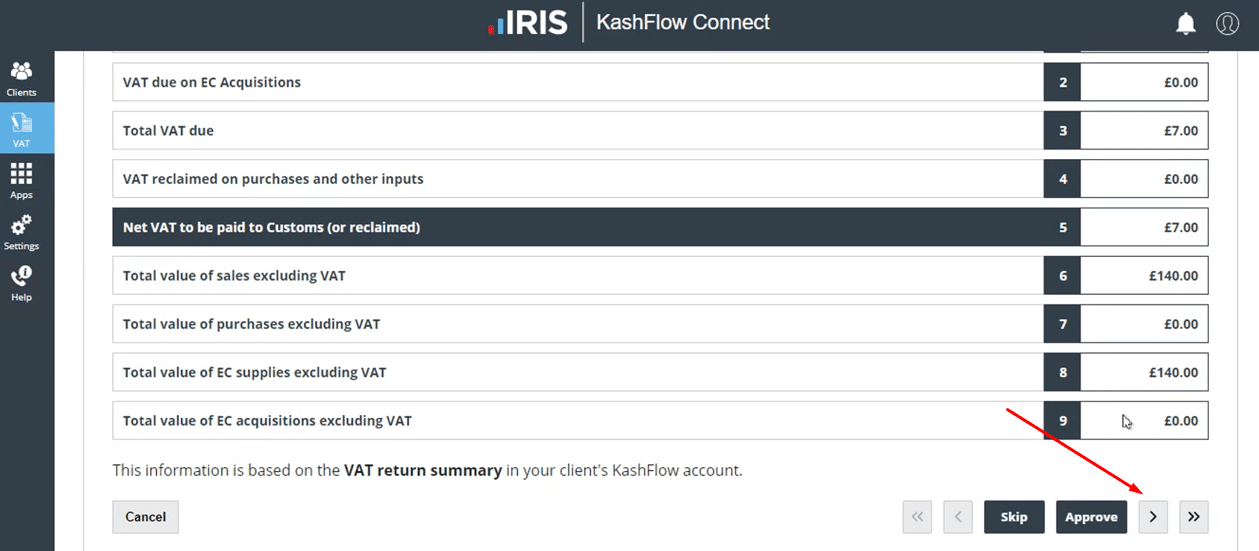

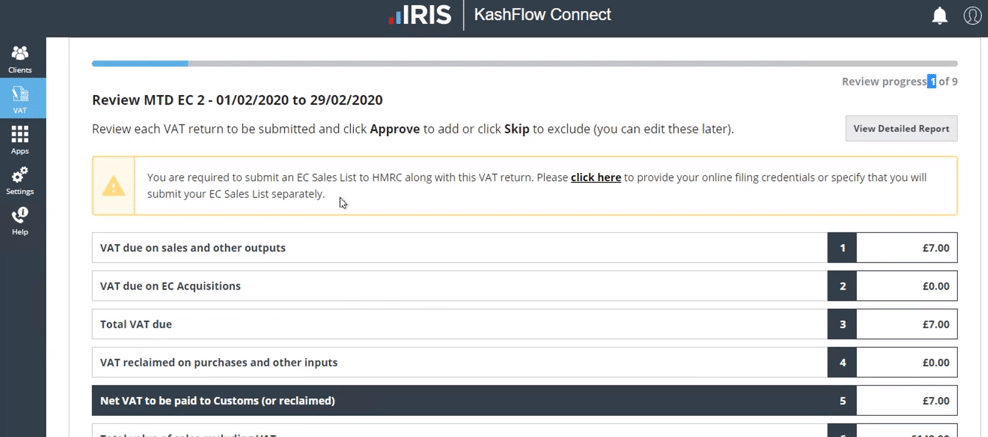

You will then be asked to review each VAT summary per client. At the bottom of each VAT summary, you see will a button for “Skip” and “Approve”. Once you click on these buttons you will then be navigated to the next VAT return summary.

If you click “Skip” then this VAT return will not be included in the final bulk submission. If “Approve” has been selected then this will be included, you can change this selection at a later point before submitting the bulk VAT returns.

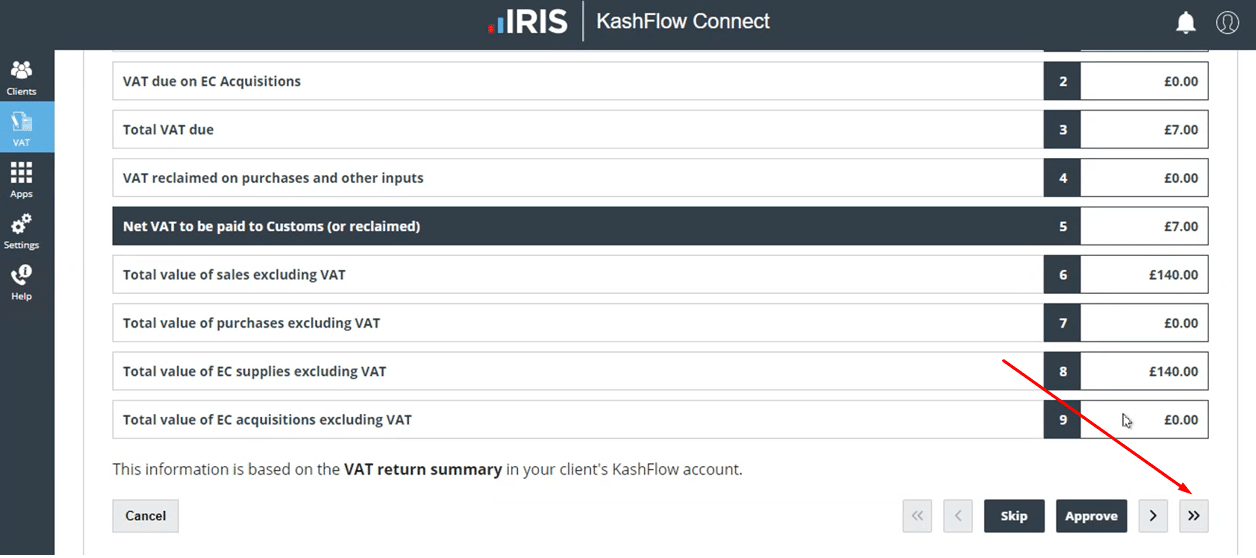

The record will automatically be skipped if you click on the single arrow navigation button, which will move you to the next VAT return.

If you click on the double skip button then all following VAT returns will be set as “Skipped”.

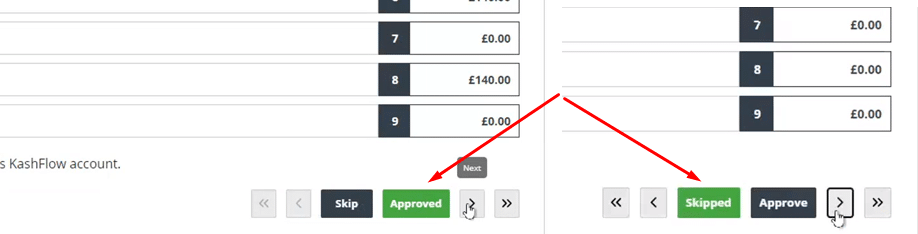

If you navigate back to previously viewed VAT returns you will see if that particular VAT return has been marked as “Skipped” or “Approved”. You can change your selection on this screen if you wish to.

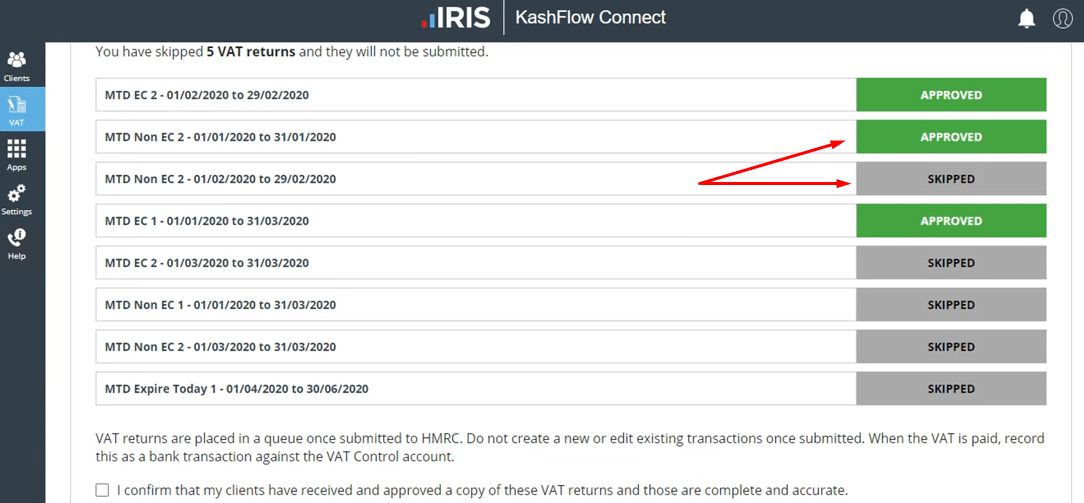

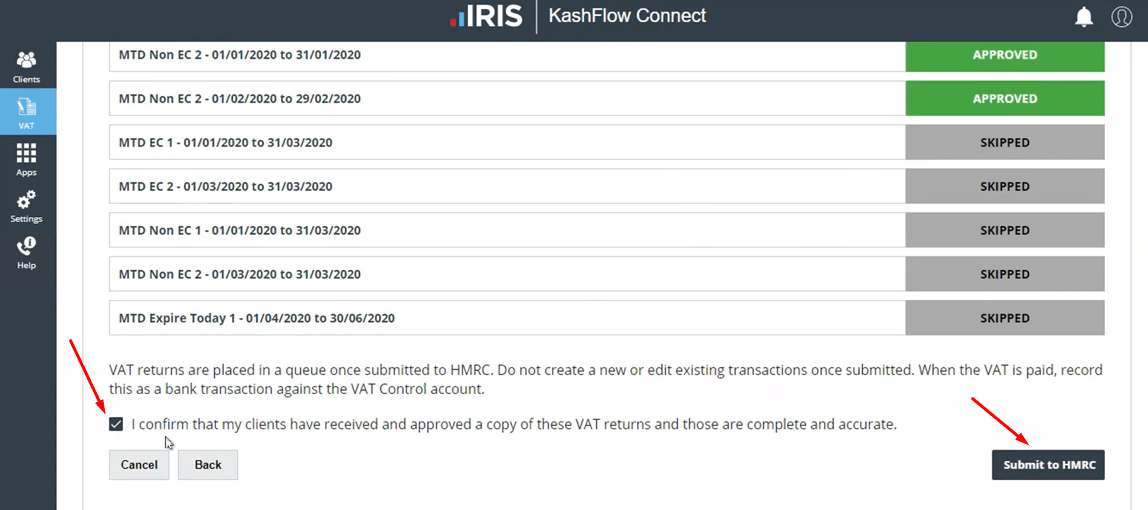

Once you have reviewed all selected VAT returns, you will see a list of all clients which will state if they have been “Approved” or “Skipped”. If you wish to change the selection of a particular VAT return then you can click on the status for the client and you will be navigated back to the review screen.

Once you are happy with which VAT returns you wish to submit, you will need to tick the box to confirm that you are happy with the information included on each VAT return and then click “Submit to HMRC”.

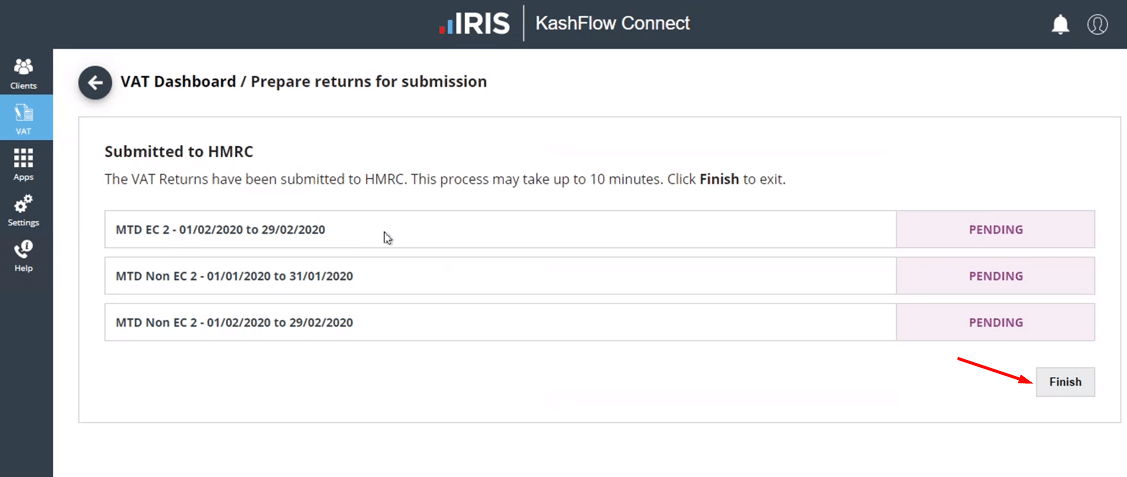

You will be shown a summary of the VAT returns submitted. To exit the screen, you can click on the “Finish” button and the bulk submission process is complete.

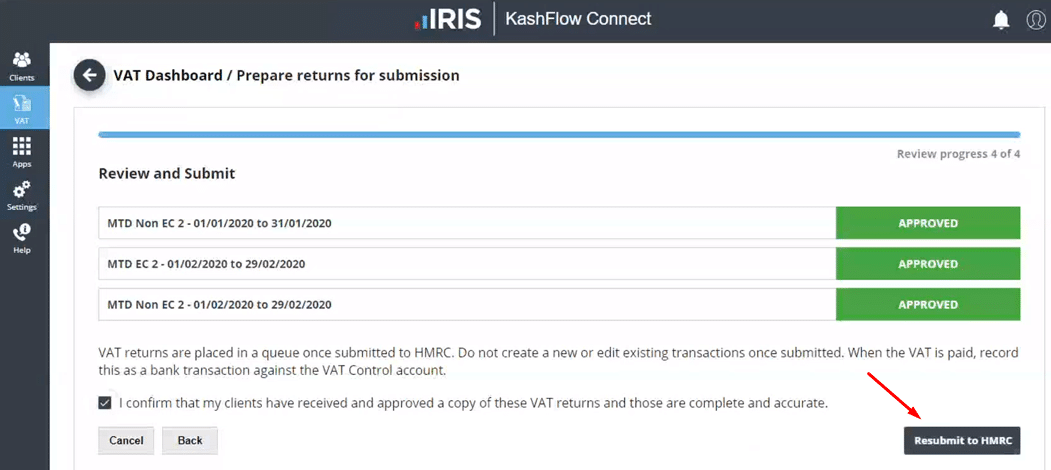

Resubmitting failed VAT returns

If you wish to resubmit VAT returns that had previously failed, you would need to follow the same steps as above for those clients. When you come to submit the VAT returns, the final button will say “Resubmit to HMRC”.

Troubleshooting and errors

Unable to select clients for bulk VAT submission

- Check that you have connected to HMRC on VAT Dashboard

- Reset the filters on VAT Dashboard. If the filter to set to “Submitted” only, there will not be a box available for you to select.

Example of view when not connected to MTD.

Example of view when status “Submitted” is selected on the filer:

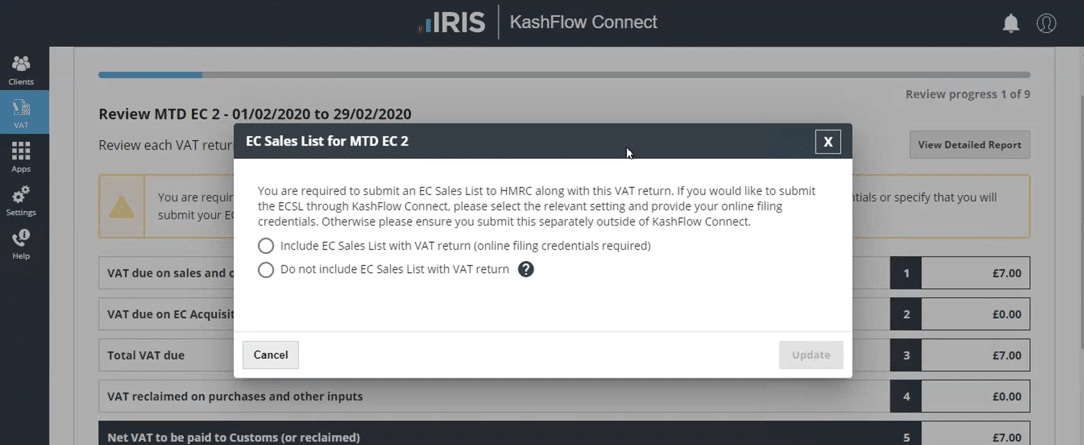

Unable to “Skip” or “Approve” due to the warning “You are required to submit an EC sales list to HMRC with this VAT return. Please click here to provide your online filing credentials or specify that you will submit your EC Sales list separately.”

If you click on the “Click here” link you will be taken the following screen. Once you make your selection you will be able to select the “Skip” or “Approve” buttons.

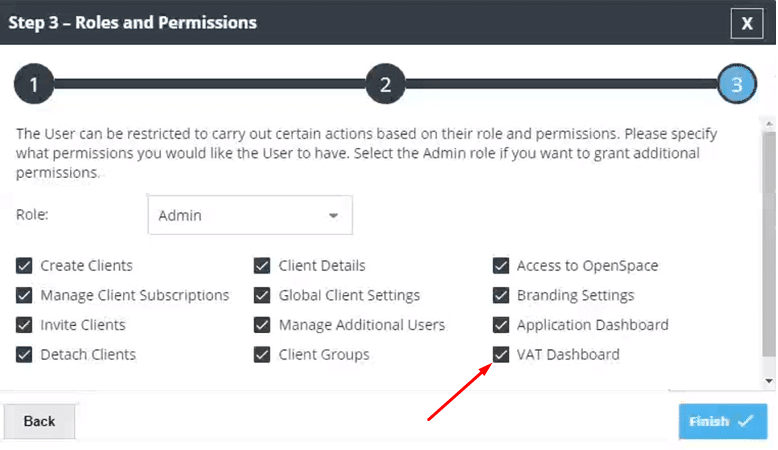

Unable to see VAT Dashboard

If you are an additional user of IRIS KashFlow Connect but cannot see the VAT dashboard, it is likely that your user has not been enabled to be able to view the VAT Dashboard. The master user of IRIS KashFlow Connect will need to edit the configuration of your role.

Error – “You should ideally submit your VAT return period 20XX-XX before you submit this VAT return. Are you sure you want to submit this VAT return?”

You will see this message if you have selected a VAT return for a client that already has an earlier VAT return that is still showing as open. The VAT returns should be submitted by the oldest open VAT return first.

Error – “You are unable to submit this VAT return until the period has ended. Please wait until the VAT period has ended and try again”.

You will see this message you have selected a VAT return in which the end period is a future date. You can only submit VAT returns with an end date that is in the past.

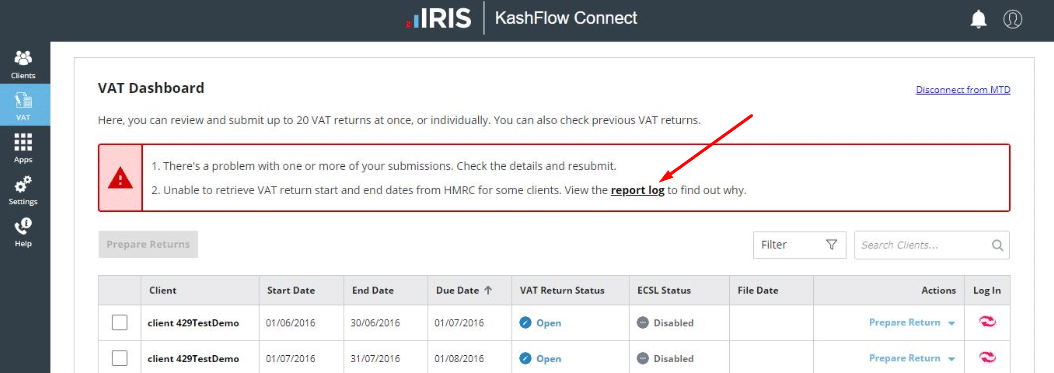

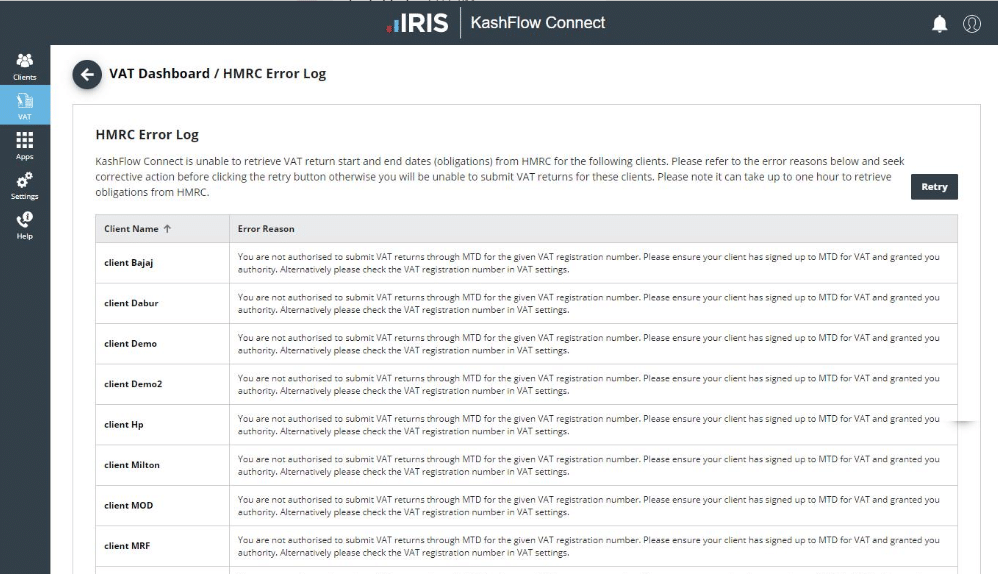

How to view HMRC Error Logs

If you have had an issue submitting a VAT return for a client, you will be shown a warning message at the top of the VAT Dashboard.

When you click on the link for “Report log” you will be taken to the below screen which will show you the error messages explaining why the submission has failed.