Change the VAT Rate

From 1st January 2021, you may need to record your EC Sales with a 0% VAT rate instead of at the rate for the recipient’s country

There are a couple of ways to do this in KashFlow and you can choose which option is best suited for you

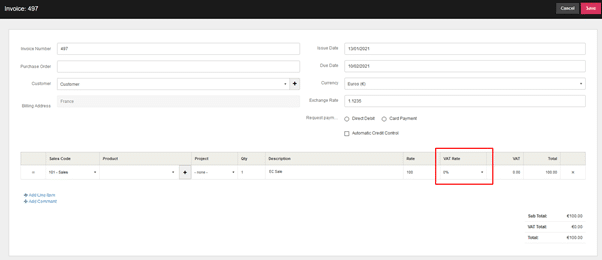

Manually amend the rate

When creating a new invoice, you can set the VAT rate manually on the line item by choosing from the VAT rate dropdown

This may be the easiest way if you only have a couple of EC sales to record

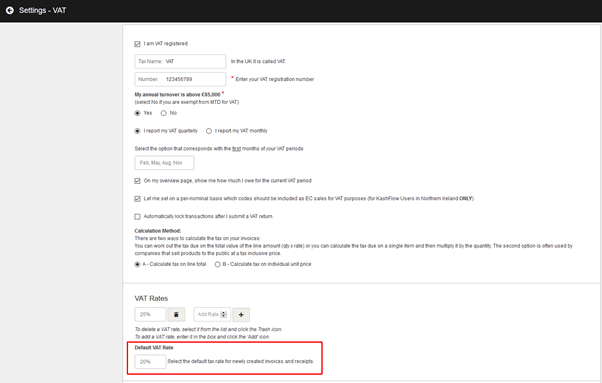

Default VAT Rate

You can set the default VAT rate on your account by going to Settings > VAT Settings and choosing 0% under the Default VAT Rate option

Once this is selected, every invoice you create will automatically set to 0%. This is useful if you sell all or most of your products to EC countries to save you from amending it each time. You can change the VAT rate on each invoice using the method above if you do have some that need to be set to a different rate.

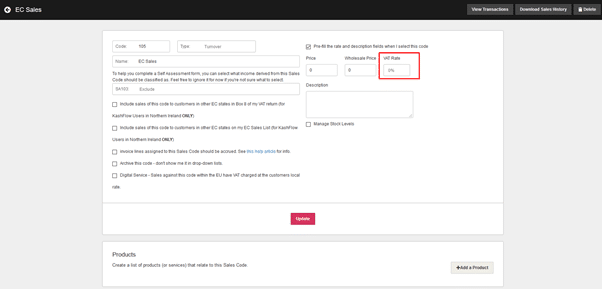

Default VAT Rate on sales code

It may be easier to set the VAT rate on the sales code you will be using for your EC Sales to 0%. This could eliminate the need to manually change the rate on any invoice once it is set up simply by choosing the right sales code.

This can be set in Invoices > Sales Codes and select the code you will be using. In here you can tick the box to ‘Pre-fill the rate and description fields when I select this code’ and enter a VAT rate of 0%

When this is updated, the next time you create an invoice, it will automatically apply the VAT rate assigned to this code.