If you work under the Construction Industry Scheme or WHT is applicable in your country (or the country some of your customers are in) then you will sometimes receive less than the full amount of your invoice as the customer has to withhold a percentage of the invoice amount to pay it direct to the tax authorities.

There is a feature in KashFlow to help you deal with this.

Set Up

Go to Settings -> CIS Options.

Tick the box to enable the option for customers and/or suppliers.

If your tax is called something other than CIS then you can rename it here.

Set the default rate for the tax. Under the UK Construction Industry Scheme this is usually 20%. You’ll be able to adjust this rate on a per customer/supplier basis if you need to.

Finally, select the nominal code to use to record the tax deductions. If you’re not sure what to select hereyou can either check with your accountant or use the “Create this code for me” option.

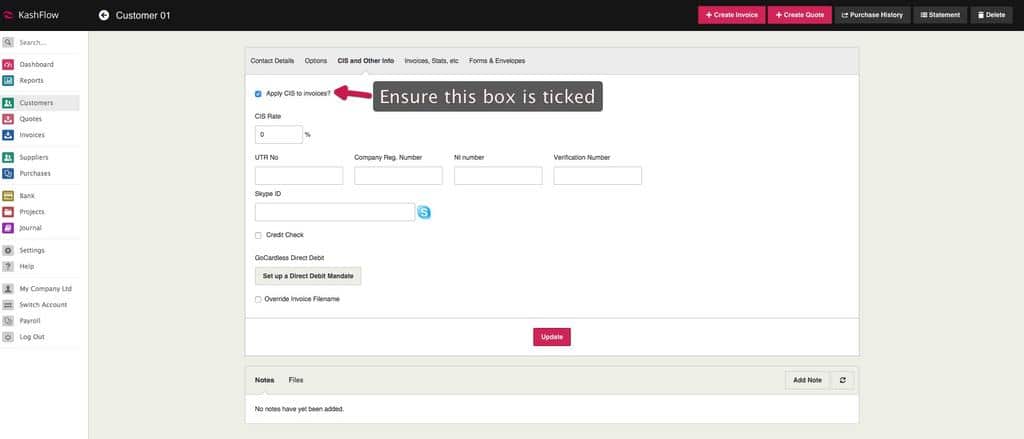

Now you need to go the relevant customer or supplier page (by clicking on the Customers or Suppliers tab and then choosing a customer/supplier).

In the “Other information” section you’ll see a tick box to say you want to apply CIS to invoices. Tick this box and change the rate if you need to.

Now, when you create invoices you’ll see a button appear saying “Add Deduction for CIS”. You should only click this button once you have added all other lines to the invoice to which the tax applies.

When you click the button a new line will be added to the invoice for a negative amount. The value is automatically calculated as the relevant percentage of the invoice.

When you print the invoice, the deduction will not show in the main list of items on the invoice. It’s instead shown as a deduction after the total on the invoice.

In Reports -> General Reports is a “CIS Summary Report” (or “WHT Summary Report” if you renamed CIS). This report gives you a summary of all sales and purchases containing WHT deductions.