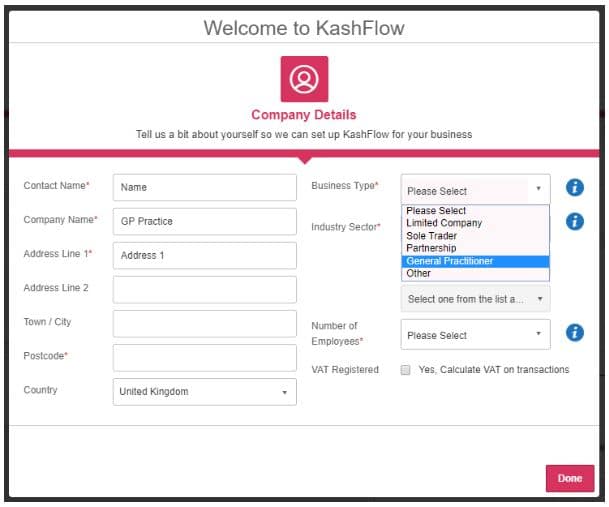

You can now set up a new KashFlow account tailored for use by a General Practitioner. To do this, go to www.kashflow.com and register for a free trial, or select the option for Buy it Now.

After registering the new account and confirming your email address, you will be asked to enter the company details. Under Business Type you need to select “General Practitioner”.

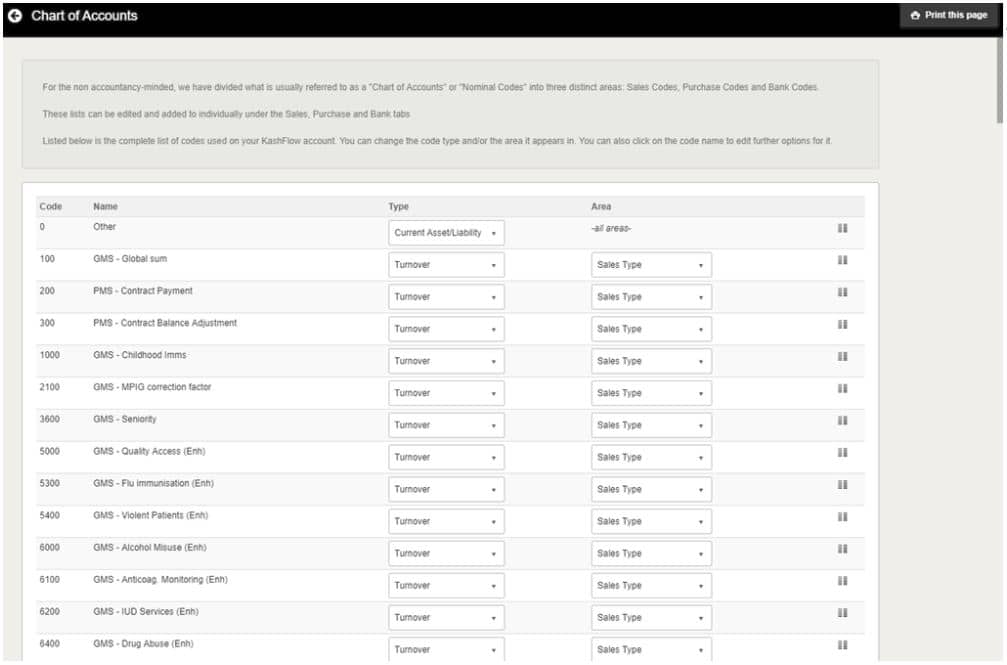

Once you have completed all the details, click “Done” and the General Practitioner Chart of Accounts will be applied to your account. You can view the nominal codes by going to Settings> Chart of Accounts.

Here is a full list of the default nominal codes that make up the General Practitioner Chart of Accounts.

| 0 | Other |

| 100 | GMS – Global sum |

| 200 | PMS – Contract Payment |

| 300 | PMS – Contract Balance Adjustment |

| 1000 | GMS – Childhood Imms |

| 2100 | GMS – MPIG correction factor |

| 3600 | GMS – Seniority |

| 5000 | GMS – Quality Access (Enh) |

| 5300 | GMS – Flu immunisation (Enh) |

| 5400 | GMS – Violent Patients (Enh) |

| 6000 | GMS – Alcohol Misuse (Enh) |

| 6100 | GMS – Anticoag. Monitoring (Enh) |

| 6200 | GMS – IUD Services (Enh) |

| 6400 | GMS – Drug Abuse (Enh) |

| 7201 | GMS – Nursing Homes (Enh) |

| 7202 | GMS – Minor Surgery (Enh) |

| 7203 | GMS – Pertussis |

| 7204 | GMS – Rotavirus |

| 7205 | GMS – Shingle Immunisation |

| 8801 | GMS – Quality Money |

| 8802 | GMS – Aspiration |

| 8803 | GMS – Achievement |

| 9700 | Forex Gains |

| 10500 | GMS – Cost Rents Payment |

| 10900 | GMS – PMS Clinical Waste |

| 11500 | GMS – Trainee Expenses |

| 12101 | GMS – Trainee Payments |

| 12102 | GMS – Trainee Pay Superannuable |

| 12103 | GMS – Trainee Pay Non-Superann |

| 12601 | GMS – Dispens. Drug Pay (Non-SR) |

| 12602 | GMS – Prescrib. Drug Pay (Non-SR) |

| 14501 | Insurance Medicals |

| 14502 | Insurance Reports |

| 14600 | Crematorium Fees |

| 14801 | DWP |

| 14802 | Fostering Medicals |

| 14803 | Solicitors Medicals |

| 14804 | Solicitors Reports |

| 14805 | Travel Vaccinations |

| 18300 | Bank interest received |

| 19201 | GMS – Prescribing Drugs Basic |

| 19202 | GMS – Prescribing Drugs On-Cost |

| 19203 | Dispensing- Drug Advance |

| 19204 | Dispensing- Addition |

| 19205 | Dispensing- Oxygen Rents/Fees |

| 19206 | Dispensing- Oxygen Basic Price |

| 19207 | Dispensing- Adjustment |

| 19208 | Dispensing- Advance |

| 19209 | Dispensing- Basic (Exempt) |

| 19210 | Dispensing- Basic (Taxable) |

| 19211 | Dispensing- Fees (Exempt) |

| 19212 | Dispensing- Fees (Taxable) |

| 19213 | Dispensing- Interim Payment |

| 19214 | GMS – Dispensing Drugs |

| 19215 | GMS – Prescribing Drugs |

| 19300 | Private Prescriptions |

| 19401 | GMS – Vat allowance |

| 19402 | Dispensing – Vat allowance |

| 19403 | NHS Prescriptions |

| 20001 | Dispensing – Drug Recoveries |

| 20002 | Dispensing- Advance Recovery |

| 20003 | Dispensing- Charges Collected |

| 20004 | Dispensing- Discount (Exempt) |

| 20005 | Dispensing- Discount (Taxable) |

| 20006 | Dispensing- Elastic Hosiery |

| 20007 | Dispensing- Previous Charges |

| 20008 | Dispensing- Adjustments |

| 20009 | Dispensing- Previous Interim |

| 21001 | Administered Drugs & Vaccines |

| 21002 | Drugs – Flu |

| 21003 | Drugs – Zopiclone |

| 21004 | Medical Consumables |

| 21005 | Dispensing – Drugs |

| 21006 | Dispensing – Medical Consumables |

| 21201 | Dr Locum 1 |

| 21202 | Dr Locum 2 |

| 21203 | Dr Locum 3 |

| 21204 | Locum Insurance |

| 21205 | Locum Nurses |

| 21501 | GMS – Additional Voluntary Levy |

| 21502 | GMS – Voluntary Levy |

| 21503 | GMS – Statutory Levy |

| 21504 | PMS – PMS Levies |

| 21700 | Practice Subscriptions |

| 22100 | Medical Insurances |

| 22201 | Contract Cleaning |

| 22202 | Window Cleaning |

| 22501 | PMS – Other PMS deductions |

| 22502 | Medical Repairs & Maintenance |

| 23100 | Rent Payment |

| 23201 | Building Rates |

| 23202 | Water |

| 23401 | Electricity |

| 23402 | Gas |

| 23500 | Building Insurance |

| 23600 | Building Maintenance |

| 23800 | Security |

| 23900 | Gardening |

| 24700 | Salaries |

| 24900 | Staff Training |

| 25100 | Staff Welfare |

| 25301 | GMS – Employees Superannuation (GPs) |

| 25302 | GMS – AVC contributions |

| 25303 | GMS – Employer Superannuation |

| 25304 | PMS – Employee Superannuation |

| 25305 | Pensions |

| 25401 | PMS – GP Additional Benefits |

| 26301 | Telephone Calls |

| 26302 | Telephone Service Contract |

| 26401 | General Stationery |

| 26402 | Postage |

| 26500 | Advertising |

| 26601 | Travel |

| 26602 | Subsistence |

| 26701 | Fuel |

| 26702 | Insurance |

| 26703 | Servicing |

| 26704 | Repairs |

| 26705 | Other costs |

| 28000 | Sundries |

| 28500 | Accountancy fees |

| 28700 | Computer Consumables |

| 29600 | Forex Losses |

| 37800 | Bank charges |

| 37900 | Credit card charges |

| 41300 | Bank interest |

| 41400 | Loan interest paid |

| 42600 | Hire purchase paid |

| 42700 | Finance lease paid |

| 44200 | Tax paid |

| 47201 | Dividends paid |

| 49933 | GMS – Trainer’s Grant |

| 52301 | Plant and machinery value brought forward |

| 52302 | Plant and machinery cost |

| 52322 | Plant and machinery depreciation |

| 52401 | Fixtures and fittings value brought forward |

| 52402 | Fixtures and fittings cost |

| 52422 | Fixtures and fittings depreciation |

| 52501 | Motor vehicles value brought forward |

| 52502 | Motor vehicles cost |

| 52522 | Motor vehicles depreciation |

| 52601 | Computer equipment value brought forward |

| 52602 | Computer equipment cost |

| 52603 | Computer equipment depreciation |

| 58600 | Trade Debtors |

| 61200 | Prepayments |

| 69200 | Bank Account |

| 73501 | Output VAT |

| 73502 | Input VAT |

| 73503 | VAT Control Account |

| 73700 | Trade Creditors |

| 75500 | HMRC (Tax/NI) |

| 76700 | Other creditors |

| 78500 | Accruals |

| 90900 | Hire purchase creditors |

| 91500 | Finance lease creditors |

| 96801 | Retained profit/Loss |

| 98521 | Partner Monthly Drawings |

| 98522 | Partner Additional Drawings |

| 98523 | Partners Subscriptions |

If you have set up your new account but selected the wrong Business Type, there will be no way to obtain the correct codes once the account has been set up. They will either need to be entered manually from the list above, or you can import this CSV file by going to Settings> Import Data> Import CSV File. Enter your login details (these are usually the same as your KashFlow login details) and select the option to import nominal codes. For furhter help on importing the CSV file for the nominal codes, please see this knowledge base article.