This article will explain how to record Expenses of the business paid with the personal money by your staff, or yourself, that you then wish to reclaim or simply record. The method by which we do this is by creating a Bank Account entitled “Expenses”.

Setting Up

To begin, you will want to create a new Bank Account by :

Bank > Add New Account

The three most important fields you should enter on the next page are;

- Account Name ; This should easily identify the bank account, i.e. ‘Jack Burton’s Expense Account’

- Start Date ; This should be a date before the first transaction. To make things easy we advise that you enter 01/01/1970 here.

- Starting Balance ; This should be 0.00

When you are done, click Add Account. Your Expense account is now ready to use.

Recording Expenses

Whenever any Expenses are paid for with personal money, you will want to record it by creating a Purchase as normal, or a direct Money Out Transaction from the Expense Bank Account; much like you would a normal Purchase or spend. If creating a Purchase please ensure to record its Payment has been paid from the Expense Account.

These Transactions will create a negative Total for the Expenses Bank Account to represent what the company owes for the Expenses paid with personal money. Like any other Bank Account with Kashflow, you will be able to view the balance for the Expenses Bank Account from both the Dashboard, and Bank screens.

Reimbursement

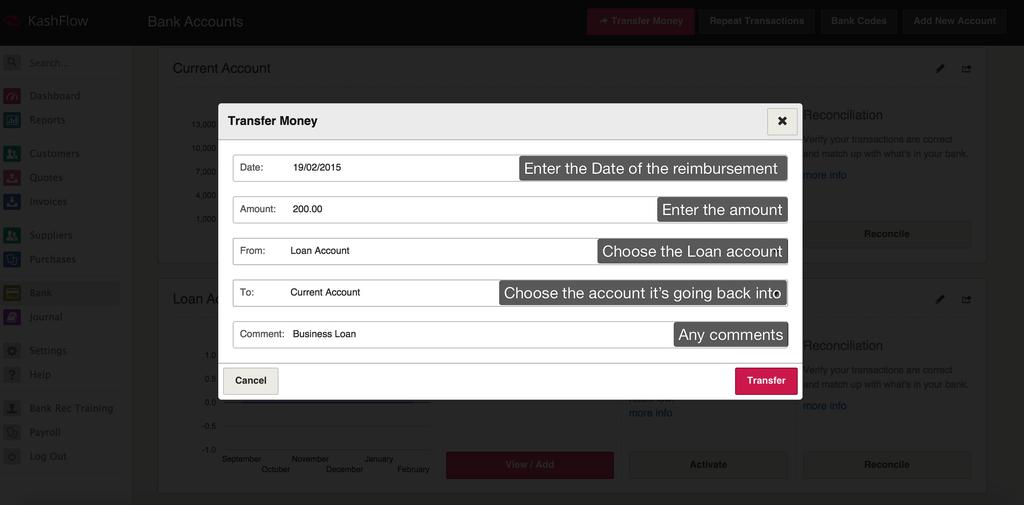

When you reimburse your staff, or yourself, you may want to create a Transfer from the Business Current Account (or similar) to the Expenses Bank Account via:

Bank > Transfer Money > Edit the appropriate fields to fulfill the criteria, ensuring From is specified as the Business Account and To is specified to the Expenses Account > Transfer

You will be able to monitor this Account much like you would any other, via the “Balance Sheet” and “Trial Balance” Reports.