Welcome to your software update for Tax Year 2020/2021.

This update of the software includes some new features and enhancements, together with any necessary legislative changes. These notes provide information on all the improvements to the software. For details of changes to Rates and Allowances, click here.

- P60 changes and delivery via ESS, details below

- Termination Pay changes, details below

- Statutory Parental Bereavement Pay, details below

- Employment Allowance changes, details below

- Car & Fuel Allowance changes, details below

- A change in the ShPP form leave record to match the new SPBP leave record format for consistency

- The rates and bands in the software for Tax, National Insurance, Statutory Payments, Student Loans, Auto Enrolment etc., have been updated for 2020/2021

- Employee and Employer NHS Pension Rates updated

- CO2 Lookup values updated

- VCA Car database updated

- P60 forms updated to report for year end 2019/2020

- There are no tax code uplifts announced this tax year.

Overview

We have updated the Employee Self Service (ESS) to include the delivery of P60s. P60s are delivered to any employees who are set up to receive payslips via ESS.

P60s are delivered to relevant employees via ESS either on the 5th April or the day of completion of the final pay period of the tax year if that is performed later.

We have also made changes to allow you to select and print more than one P60 at a time.

Software Changes

To update the use of P60s we have made the following changes:

We have updated the template for P60s to match HMRC’s look and feel.

On the Reports | Statutory | P60 tab:

- We have made P60s available from 5th April each tax year end, to remove the chance of an incomplete P60 being used incorrectly

- You can select individual P60s using the checkboxes under the Print column or use buttons to select all P60s, those sent via ESS only or those printed only

- Use the Print Selected P60s button at the bottom of the Print column. Selected P60s can be printed to PDF as a group, each P60 on an individual page

- Column headers allow you to see the following information:

- Employee name

- Whether a P60 is set to be Dispatched via ESS or printed as default

- To ensure you can check all P60s have either been sent via ESS or printed and stay compliant with legislation:

- The Dispatch Date for a P60 sent via ESS

- The Printed Date for when a P60 was last printed as a pdf

Overview

Termination payments are payments which are made in connection with the termination of a person’s employment.

From April 2020, any non-contractual termination payments will be subject to 13.8% Class 1A to the extent that they exceed the existing £30,000 exemption which also applies for income tax.

The additional costs that this charge will add to employers’ HMRC liability is reflected in FPS submissions to HMRC.

Software Changes

To accommodate the new rules for Termination Payments in the software, we have made the following changes:

On the Payslip screen:

- We have added a new manual payslip item to cater for any payments or adjustments, to be displayed in the Payments and Deductions sections, Lump Sum| Termination| Redundancy

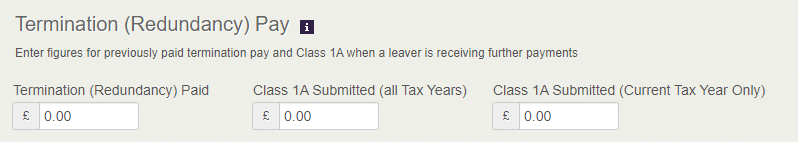

On the Employees | Opening Balances tab:

- Enter figures for Termination Payments and Class1A when entering an existing employee into KashFlow Payroll

On the Company| Payments and Receipts tab:

- A field showing Class 1A liability is included in each month’s pdf

On FPS submission:

- Class1A liability is included in employee entries when relevant

All reports, where applicable, have been updated with Class1A information.

The Termination Payment changes will only appear starting from the 2020/2021 Tax Year.

Statutory Parental Bereavement Pay

Overview

From April 2020 employed parents have a statutory right to a minimum of 2 weeks’ leave if they lose a child under the age of 18, or suffer a stillbirth from 24 weeks of pregnancy, irrespective of how long they have worked for their employer. Parents are able to take the leave as either a single block of 2 weeks, or as 2 separate blocks of one week each taken at different times across the first year after their child’s death, within 56 weeks of each other.

Parents with 26 weeks’ continuous service or more with their employer and weekly average earnings over the lower earning limit are entitled to Statutory Parental Bereavement Pay (SPBP), paid at the statutory rate or 90% of average weekly earnings where this is lower.

Software Changes

To accommodate SPBP in the software, we have made the following changes:

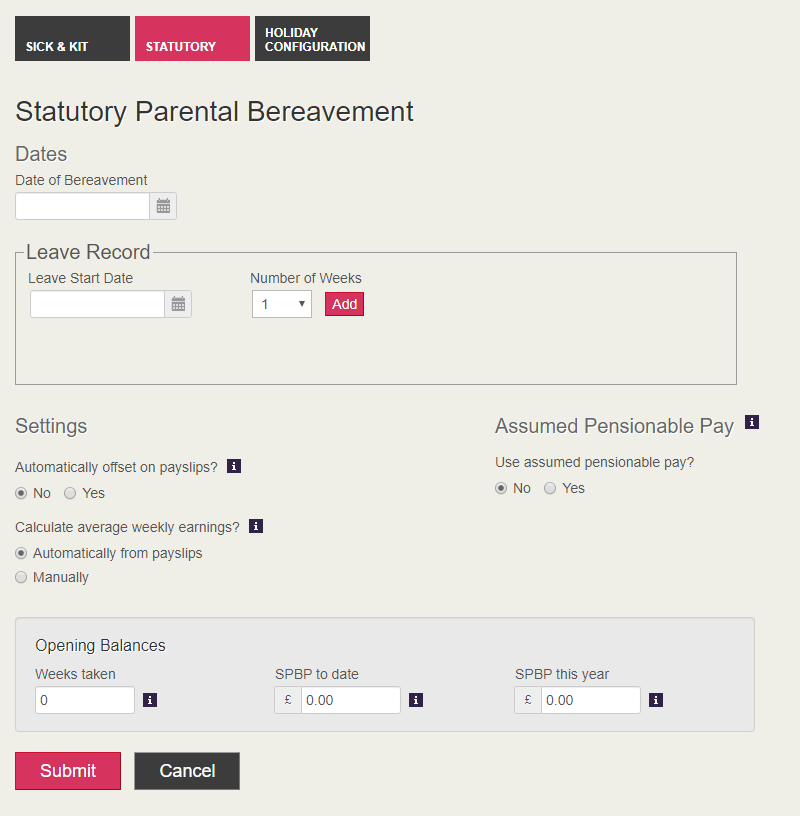

On the Employees | Calendar & Leave | Statutory tab:

- Choosing Add New Absence gives the option for Statutory Parental Bereavement Pay

- We have updated the Shared Parental Pay leave record format to match the new SPBP form above

On the Company | Setup Details | Opening Balances screen:

- New SPBP fields for companies entered into KashFlow Payroll from 2020/20201 Tax Year onwards.

On the Payslip screen:

- We have added a new automatic payslip item for SPBP Payments.

- We have added a new manual payslip item to cater for any adjustments, to be displayed in the Payments and Deductions sections, Adjustment | Statutory | Statutory Parental Bereavement Pay

- Applying an SPBP adjustment will adjust the YTD value that is stored against the Employee

On FPS submission:

- SPBP is included in employee entries when relevant

On EPS submission:

- SPBP recovery and compensation are included

On the Company| Payments and Receipts tab:

- Fields showing SPBP recovery and compensation are included in each month’s pdf

All reports, where applicable, have been updated with SPBP information.

The SPBP changes will only appear starting from the 2020/2021 Tax Year.

Overview

From April 2020 extra rules come into force to determine if a company is eligible to claim Employment Allowance (EA).

EA is still claimed through EPS submission but claims will not renew and you need to make a new claim for EA each year.

From April 2020 EA is £4000 per annum.

(Secondary) Class 1 NIC must be be below £100,000

From 6 April 2020 you can only claim EA if your total (secondary) Class 1 National Insurance contributions (NICs) liability is below £100,000 in the tax year before the year of claim. Any deemed payments you make, such as to off-payroll workers, do not count towards the £100,000 employers (secondary) Class 1 NICs total. You cannot claim EA for these workers.

Add together the employers (secondary) Class 1 NICs liabilities for each payroll, if you have more than one payroll (in the tax year before your claim).

If the total amount is:

- £100,000 or more you will not be eligible to claim EA

- under £100,000 you should decide which one makes the claim

Where companies are connected, you should add together the total employers secondary Class 1 NICs liabilities for all companies in the group.

If this total is:

- £100,000 or more – none of the connected companies will be eligible to claim EA

- below £100,000 – the group must decide which one company will claim

De minimis state aid

From 6 April 2020 EA will operate as de minimis state aid. This means it will contribute to the total aid you are allowed to get under the relevant de minimis state aid cap in the relevant 3 year period.

De minimis state aid rules apply if your business engages in economic activity, providing goods or services to the market.

You do not have to make a profit. If others in the market offer the same goods or services, it is still an economic activity and de minimis state aid rules will apply. So de minimis state aid will apply to most businesses claiming the EA.

You’ll need to make sure that you have space under your business sector ceiling to get the full amount of EA available.

You’ll not fall under the de minimis state aid rules if you do not engage in economic activity, for example, if you:

- run a charity, including a community amateur sports club

- employ someone to provide personal care

However, you may still be eligible to claim EA.

You’ll need to look at other de minimis state aid you got in the claim year and the previous 2 tax years. This is the relevant 3-year period.

Most businesses will not have received de minimis state aid before so will not need to do further checks to check if they are eligible for the EA.

De minimis state aid and the relevant thresholds are worked out in euros. You should have been told in writing if other aid you have received was de minimis state aid. The letter should also tell you how much you got.

If an individual or business, has not received this notification but believe it is de minimis state aid or wish to check, they should contact the administrator of that scheme.

If not you should convert other aid you have received, and the full amount of EA for the claim year into euros using the exchange rate for April of the relevant year. You can then be sure you do not exceed the relevant de minimis state aid ceiling.

Check the exchange rates you need at the HMRC website. You need to make de minimis state aid calculations starting from tax years 2020 to 2021.

If companies are connected, you’ll need to:

- add the totals for each of the companies together

- make sure that, together, they are not more than the relevant sector threshold

The table shows the de minimis state aid ceilings for the relevant 3-year period for tax year 2020/2021. These are set by the European Commission.

| Business sector | Ceiling |

|---|---|

| Primary production of agriculture products | €20,000 |

| Fisheries and aquaculture sector | €30,000 |

| Road freight transport sector | €100,000 |

| Other, industrial (everyone else) | €200,000 |

For businesses that cover 2 or more sectors you need to have enough space under all your sector ceilings together to get the full amount of EA available.

You do not need to have enough space under each individual ceiling or a single ceiling to receive the full amount of EA.

You can:

- only claim EA against the liabilities of an employee working in a sector until that sector ceiling is met

- continue to claim the EA against the liabilities of an employee working in another sector, as long as there is still space under that business sectors ceiling

It may be that a business works between 2 or more sectors but only has space under the ceiling of 1 sector to receive de minimis state aid. But they do not have any employer (secondary) NICs liabilities in that sector.

In this case, although the business will be eligible for the EA, there are no liabilities to set the allowance against and a claim should not be made.

Software Changes

To accommodate the new rules for Employment Allowance in the software, we have made the following changes:

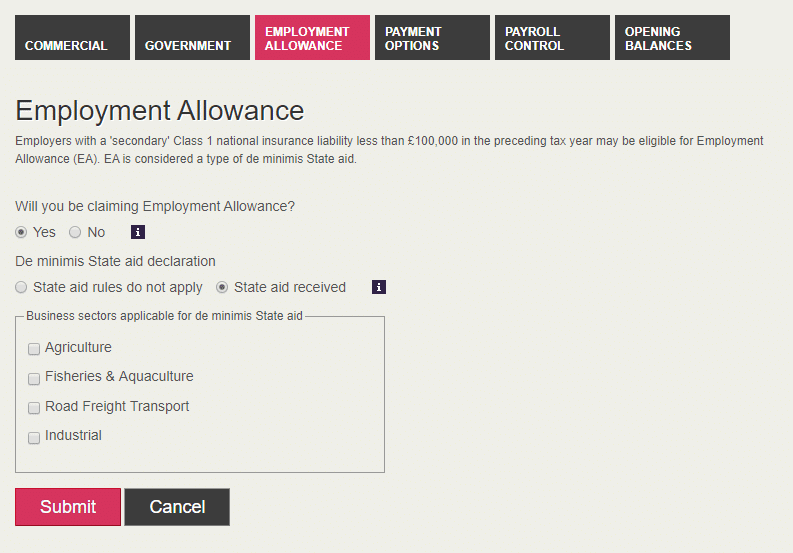

Under Company| Setup Details there is a new tab for Employment Allowance

On the Company | Setup Details | Employment Allowance screen:

- This screen must be completed in order to claim EA.

The Employment Allowance changes will only appear starting from the 2020/2021 Tax Year.

Overview

Employees provided with a company car which they can use privately must pay income tax on the value of the benefit in kind. Their employer must also pay Class 1A National Insurance contributions (NIC).

For cars registered from 6 April 2020 this benefit in kind is calculated as a percentage of the list price of the car, including any accessories. The percentage depends on the CO2 emissions of the car and is determined by the Worldwide Harmonised Light Vehicle Test Procedure (WLTP). If fuel is included the same percentage is applied to a set figure to calculate the fuel benefit for the year.

Company cars registered before 6 April 2020 (and after 1 October 1999) are still classified using the New European Driving Cycle (NEDC) method.

Full details of percentages and rates can be found in the Rates and Allowances page.

Software Changes

To accommodate the new rules for Car & Fuel Allowance in the software, we have made the following changes:

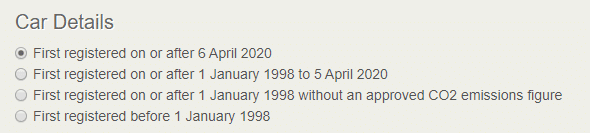

On the Employees | Car & Fuel Allowances tab:

- Choose the range within which the car was first registered to determine the rate and percentage used to calculate the taxable benefit

The Car & Fuel Allowance changes will only appear starting from the 2020/2021 Tax Year.