Please note, whilst every effort has been made to ensure this information is correct, please check with HMRC if unsure.

Income Tax

| Tax Bands rest of UK | |

| Rate | Band(£) |

| 20% | 0 – 37,500 |

| 40% | 37,501 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Wales | |

| Rate | Band(£) |

| 20% | 0 – 37,500 |

| 40% | 37,501 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Scotland | |

| Rate | Band(£) |

| 19% | 0 – 2,049 |

| 20% | 2,050 – 12,444 |

| 21% | 12,445 – 30,931 |

| 41% | 30,931 – 150,000 |

| 46% | Over 150,000 |

Tax Codes rest of UK

Emergency Tax Code – 1250L

L Suffix Uplift +0

M Suffix Uplift +0

N Suffix Uplift +0

Tax Codes Wales

Emergency Tax Code – C1250L

L Suffix Uplift +0

M Suffix Uplift +0

N Suffix Uplift +0

Tax Codes Scotland

Emergency Tax Code – S1250L

L Suffix Uplift +0

M Suffix Uplift +0

N Suffix Uplift +0

Student Loans

Threshold Plan 1 – £19,390

Threshold Plan 2 – £26,575

Rate – 9%

Postgraduate Student Loans

Threshold £21,000

Rate 6%

National Insurance

National Insurance Thresholds

Employee and employer thresholds are as follows:

2020 – 2021:

| Frequency | LEL | PT | ST | UEL | UST | AUST |

|---|---|---|---|---|---|---|

| Weekly | 120 | 183 | 169 | 962 | 962 | 962 |

| Monthly | 520 | 732 | 792 | 4167 | 4167 | 4167 |

| Annually | 6240 | 9500 | 8788 | 50000 | 50000 | 50000 |

NI Rates

Employee and Employer Rates are as follows:

| NI Rates (Employee) (%) | ||||

|---|---|---|---|---|

| Band | A, M, H | B | C | J,Z |

| < LEL | Nil | Nil | Nil | Nil |

| LEL to Threshold | 0% | 0% | Nil | 0% |

| Threshold to UEL | 12% | 5.85% | Nil | 2% |

| ST to UST/AUST | N/A | N/A | N/A | N/A |

| > UEL/UST/AUST | 2% | 2% | Nil | 2% |

| NI Rates (Employer) (%) | |||

|---|---|---|---|

| Band | A, B, C, J | M, Z | H |

| < LEL | Nil | Nil | Nil |

| LEL to Threshold | 0% | 0% | 0% |

| Threshold to UEL | N/A | N/A | N/A |

| ST to UST/AUST | 13.8% | 0% | 0% |

| > UEL/UST/AUST | 13.8% | 13.8% | 13.8% |

Statutory Payments (Weekly)

SAP/SMP Rate – 151.20

SPP/ShPP Rate – 151.20

SPBP Rate – 151.20

SSP Rate – 95.85

Small Employers’ Relief Threshold

£45,000

Automatic Enrolment & Pensions

Weekly Pension Rates need to be adjusted:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

|---|---|---|

120 | 192 | 962 |

- Monthly Pension Rates need to be adjusted:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

|---|---|---|

520 | 833 | 4167 |

- Annual Pension Rates are:

| Qualifying Earnings Lower Threshold | Auto-enrolment Trigger | Qualifying Earnings Upper Threshold |

|---|---|---|

6240 | 10000 | 50000 |

From 6 April 2019 onwards Employer Minimum Contribution is 3%, Total Minimum Contribution is 8% (Including 5% Employee Contribution)

Company Cars

Appropriate Percentage (2020/2021)

Cars registered before 6 April 2020

| CO2 Emissions | Electric Range (miles) | % |

| 0g/km | N/A | 0% |

| 1-50g/km | >130 | 2% |

| 1-50g/km | 70-129 | 5% |

| 1-50g/km | 40-69 | 8% |

| 1-50g/km | 30-39 | 12% |

| 1-50g/km | <30 | 14% |

| 51-54g/km | N/A | 15% |

| Each additional 5g/km | +1% | |

| Maximum | 37% | |

| Add 4% to a maximum of 37% for Diesel Cars, but not Diesel cars meeting RDE2 standard |

Cars registered from 6 April 2020

| CO2 Emissions | Electric Range (miles) | % |

| 0g/km | N/A | 0% |

| 1-50g/km | >130 | 0% |

| 1-50g/km | 70-129 | 3% |

| 1-50g/km | 40-69 | 6% |

| 1-50g/km | 30-39 | 10% |

| 1-50g/km | <30 | 12% |

| 51-54g/km | N/A | 13% |

| Each additional 5g/km | +1% | |

| Maximum | 37% | |

| Add 4% to a maximum of 37% for Diesel Cars, but not Diesel cars meeting RDE2 standard |

Cars registered on or after 1st January 1998

| Engine Size (cc) | Other (%) | Diesel (%) |

| 1400cc or less | 23 | 27 |

| 1401 to 2000cc | 34 | 37 |

| Over 2000cc | 37 | 37 |

| All rotary engines | 37 | 37 |

Cars registered before 1st January 1998

| Engine Size (cc) | Other (%) |

| 1400cc or less | 23 |

| 1401 to 2000cc | 34 |

| Over 2000cc | 37 |

Car Fuel Benefit (2020/2021)

The charge is £24,500

Current Approved Mileage Allowance Rates

| First 10,000 miles | Each subsequent mile | |

| Privately owned car | 45p | 25p |

| Bicycle rate | 20p | 20p |

| Motorcycle rate | 24p | 24p |

| Passenger rate (each) | 5p | 5p |

Miscellaneous

| National Minimum Wage | ||||

| Apprentice Rate (U19) | Apprentice Rate | Age 16 and 17 | Age 18 and 20 | Age 21 to 24 |

| £4.15 | £4.15 | £4.55 | £6.45 | £8.20 |

| National Living Wage | ||||

| Age 25+ | ||||

| £8.72 | ||||

| Construction Industry Scheme | |

| Registered Rate (Matched Net) | 20% |

| Unregistered Rate | 30% |

| VAT Rate | 20% |

Employment Allowance

£4,000

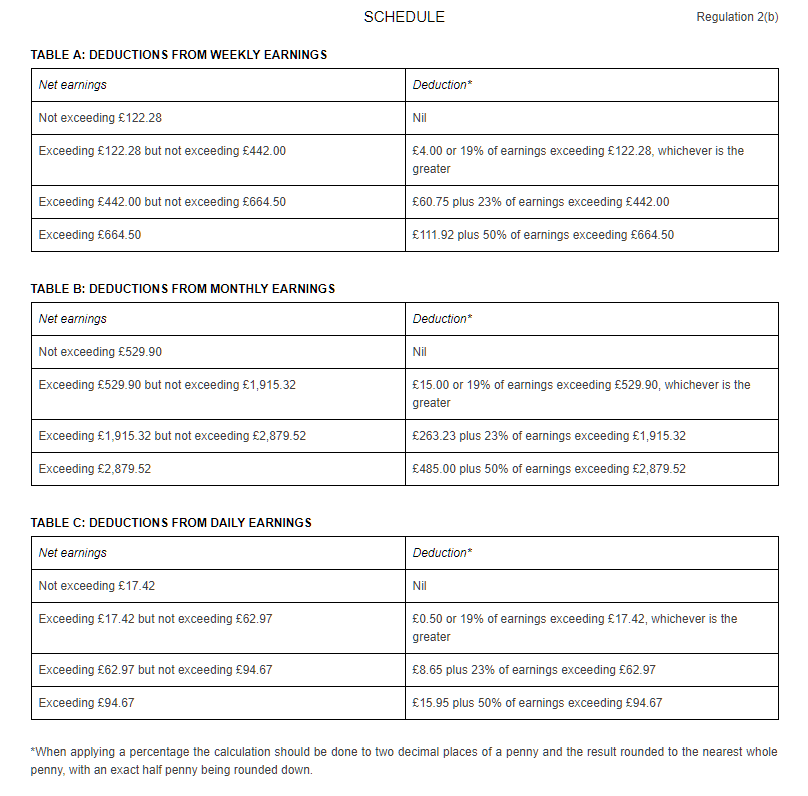

Scottish Earnings Arrestment Orders