From the 6th April 2018 the minimum employee and employer contributions for automatic enrolment pensions are increasing, this is known as Phasing. During the Year-end Restart Process a warning message will be displayed advising you to check your contribution rates – it is important that you carry this out to comply with the regulations. The amount you must contribute to the pension scheme is determined by the scheme’s rules. However, if you are using the scheme for automatic enrolment, there are minimum contributions you must pay.

You do not need to take any action if you do not have any employees in an automatic enrolment pension scheme, or if the contribution amounts are above the increased minimum amounts. The increases also do not apply if you are using a defined benefits pension scheme.

This table shows the minimum contributions and the dates they must increase. The first takes place from 6th April 2018 and the second from the 6th April 2019. All employers with an automatic enrolment pension scheme must make sure that the correct minimum contributions are being paid from these dates. For further information on the TPR minimum contribution rates click here.

If you are unsure about any aspect of phasing, please speak to your pension scheme provider

| Date | Employer minimum contribution | Total minimum contribution |

| 06/04/18 – 05/04/19 | 2% | 5% (including 3% staff contribution |

| 06/04/19 onwards | 3% | 8% (including 5% staff contribution) |

After moving into the new 2018/2019 tax year, you must check the employee and employer contributions before processing payroll.

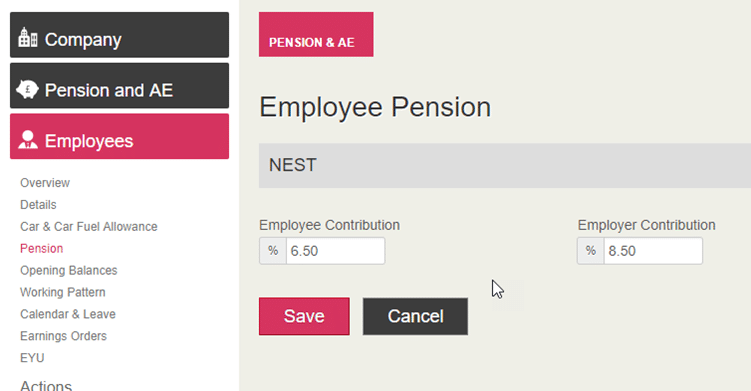

To check and change an individual employee’s and employer’s pension

- From Go to Employee, choose the individual

- Go to the Employees | Pension

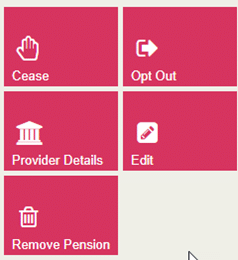

- Click Edit

- Check, and if necessary, change the Employee Contribution for the the minimum requirements

- Check, and if necessary, change the Employer Contribution for the Employee Pension to meet the minimum requirements

The overall minimum contribution is 5%. The employer minimum is 2%, therefore if the employer pays the minimum (2%) the employee must pay the difference which is 3%

- Click Save

- Repeat for each employee

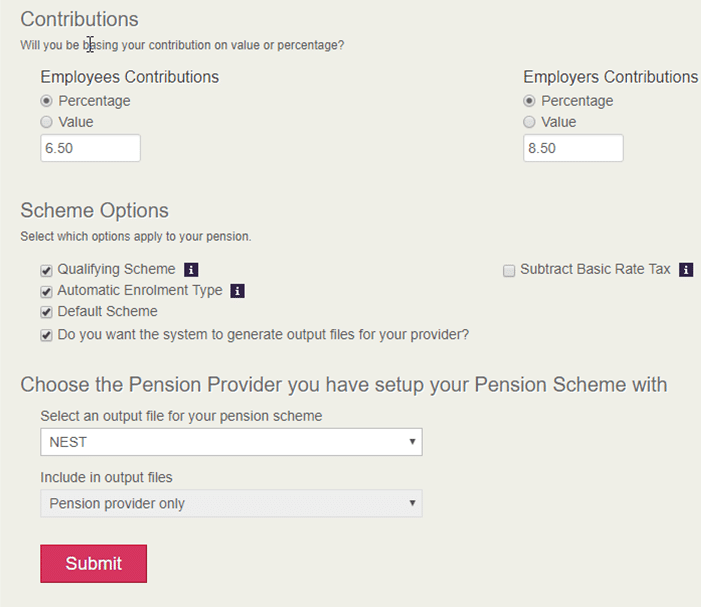

Default Pension Contributions

You also need to check and change (if necessary) the default contributions. This is to ensure that any new employees who are enrolled into an automatic enrolment pension scheme meet the legal minimum requirements from April 2018. If you have more than one scheme used for automatic enrolment, you will need to check and change each one.

- Choose Company | Dashboard

- Select Pension and AE | All Pension Schemes

- Click on the relevant Pension Scheme

- Scroll down to the Contributions section

- Check and if necessary change the Employees Contributions Percentage

- Check and if necessary change the Employers Contributions Percentage

- Click Submit

If you do not do this and new employees are enrolled with the wrong rate you may be fined by The Pensions Regulator