Small Employer Relief Status

A companies small employer relief status will dictate what they can claim from HMRC when paying employee statutory payments.

A company would qualify for small employers relief if the total NIC (National Insurance Contributions) bill (Ee’s + Er’s) for the previous tax year is less than £45,000. If the total NIC bill from the previous tax year was greater than £45,000 HMRC would class them as a medium or large company and they cannot apply for small employers relief.

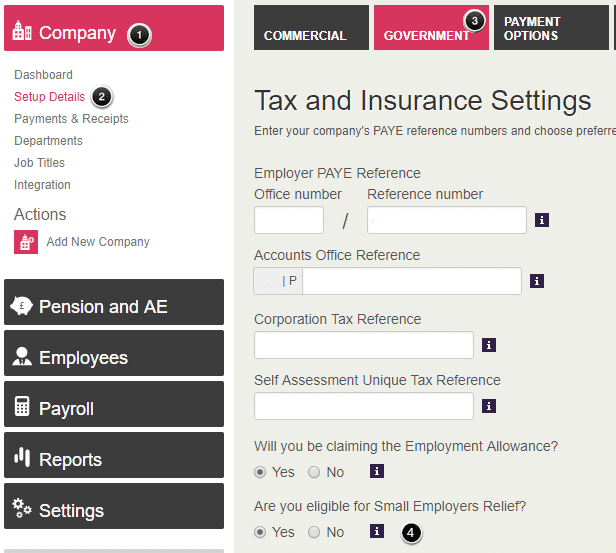

Small Employers Relief is enabled (or disabled) from “Company” | “Setup Details” | “Government“. Simply set the status to yes or no appropriately:

Small Companies.

Small companies can claim back 100% of the value of statutory payments made as “Recovery” and a further 3% of the value as “Compensation”.

Users will need to make sure they have the small employers’ relief option activated in Kashflow. The relief is applied when you finalise the pay month, reducing the balance to be paid to HMRC. Any recovery or compensation amounts will be reported to HMRC via an EPS submission.

Medium or Large Companies

Medium and large companies can claim back 92% of the value of statutory payments made as “Recovery” only. They cannot claim anything as “Compensation”.

Users will need to make sure they have the small employers’ relief option deactivated in Kashflow. The relief is applied when you finalise the pay month, reducing the balance to be paid to HMRC. Any recovery or compensation amounts will be reported to HMRC via an EPS submission.

Please Note: SSP (Statutory Sick Pay) is no longer recoverable. Companies are not allowed to reduce payment to HMRC because of SSP paid to employees. As such there is no requirement to submit an EPS to report on SSP