This article guides you through the process of recording employee statutory leave for maternity.

From the company dashboard, click on the Go to employee drop down at the top of the page and select the employee. The next page contains an overview of their details.

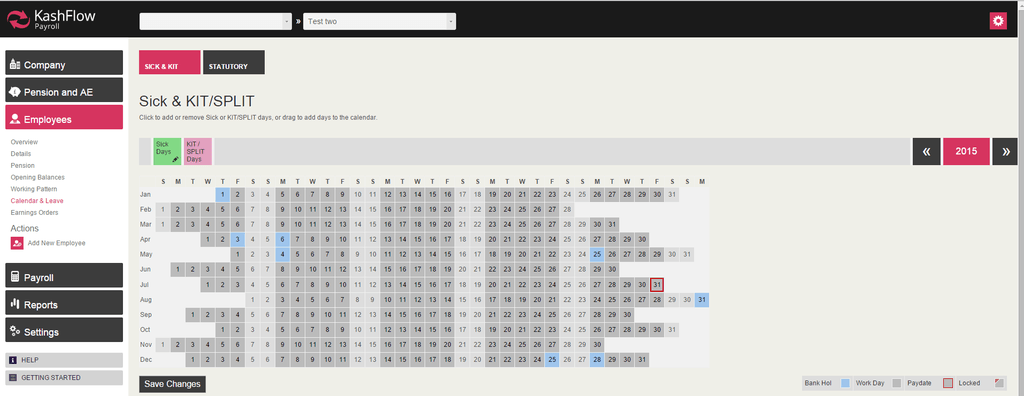

Select Employee in the left-hand side menu and navigate to Calendar & leave | Statutory | Add New Absence | Statutory Maternity Pay.

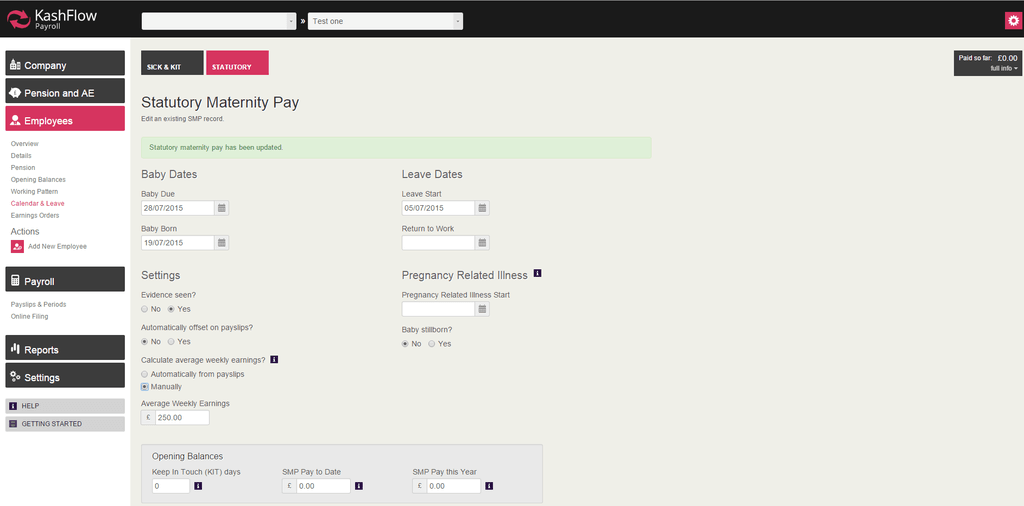

Enter Baby Dates and Leave Dates, and select the relevant settings.

Select Yes on Evidence seen? when you have seen the employee’s MATB1 certificate with the details for the pregnancy. A pay run which includes an SMP payment can only be finalised once evidence has been seen.

We recommend that you use the information on the MATB1 form to complete the rest of this screen.

Click Submit when you are finished.

If there is no Average Weekly Earnings record for the employee, you will see the following message:

Oops! Insufficient data to calculate AWE because missing Employee Header Rates (-3011)

To resolve the issue you can use either one of the following options:

- Select Manually to calculate average weekly earnings. You could also select Automatically offset on payslips if you would like the system to deduct maternity pay amount off any basic pay automatically

- Navigate to Payroll | Payslips & Periods | Create Payslip. Below Employee Rates enter in the average weekly earnings amount and click Create Payslip. You can then go back and complete the maternity setup.

If the employee has not been employed by the company long enough then you will receive the following message:

Oops! The employee has not been with the Company long enough to qualify for this statutory pay (based on what is called the ‘Continuously Employed Weeks’). Please complete paper form SMP1. (-3204)