This update of the software is focused on legislation amendments. These notes provide information on all the improvements we have made.

UAP Removal

From 6th April 2016, following changes by the Chancellor announced in the Autumn Statement 2015, employers will no longer be required to report NI Earnings between the (PT) Primary Threshold and (UT) Upper Accrual Point & Upper Accrual Point to Upper Earnings Limit (UEL). Instead, they are to report only NI Earnings between the Primary Threshold and the Upper Earnings Limit (as they did prior to 2009).

New Category H – For Apprentices Under 25

There will also be a new National Insurance exception for apprentices under 25. Employers will no longer be required to pay secondary National Insurance contributions up to the Apprentice Upper Secondary Threshold (AUST). This will be set at the same rate as the Upper Earnings Limit. A new NI rate (H – Apprenticeship) will be available.

Threshold Changes

The UEL is the only rate to see an increase this year, from £42,385 per year to £43,000 per year.

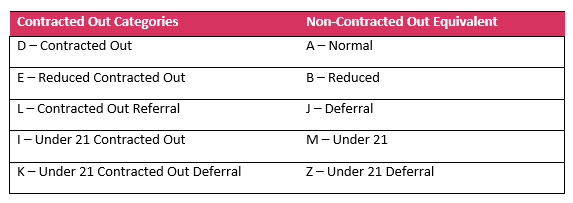

Contracted Out Categories

All contracted out National Insurance categories have been abolished in the new tax year. Upon completing your year-end process, any employee using a contracted out rate will have their NI category automatically changed to the non-contracted out equivalent.