This update of the software is focused on legislation amendments. These notes provide information on all the improvements we have made.

Scottish Rate of Income Tax (SRIT)

The Scotland Act 2012 gives the Scottish Parliament the power to set the Scottish rate of income tax. The Scottish rate of income tax (SRIT) comes into effect from 6 April 2016.

KashFlow Payroll will now allow users to allocate a Scottish tax code to employees.

HMRC will determine whether or not you are a Scottish taxpayer based on where your main place of residence is. You need take no action, as HMRC will be writing to you to confirm whether or not you are a Scottish taxpayer.

The existing tax codes for England, Wales and Northern Ireland will be known as (rUK) ‘Rest of United Kingdom’.

Tax Code Uplift

There have been changes to the annual tax allowance. The tax codes have been increased depending on the tax code suffix. The standard L rate has been increased by £400. This means the new standard tax code is 1100L. M tax codes have increased by £440 while N tax codes have been increased by £360.

All tax codes will be uplifted automatically once the year-end process has taken place.

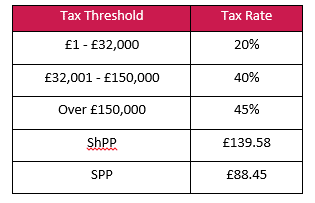

Tax Thresholds

In tax year 16/17 the thresholds will be the same for both rUK and SRIT.