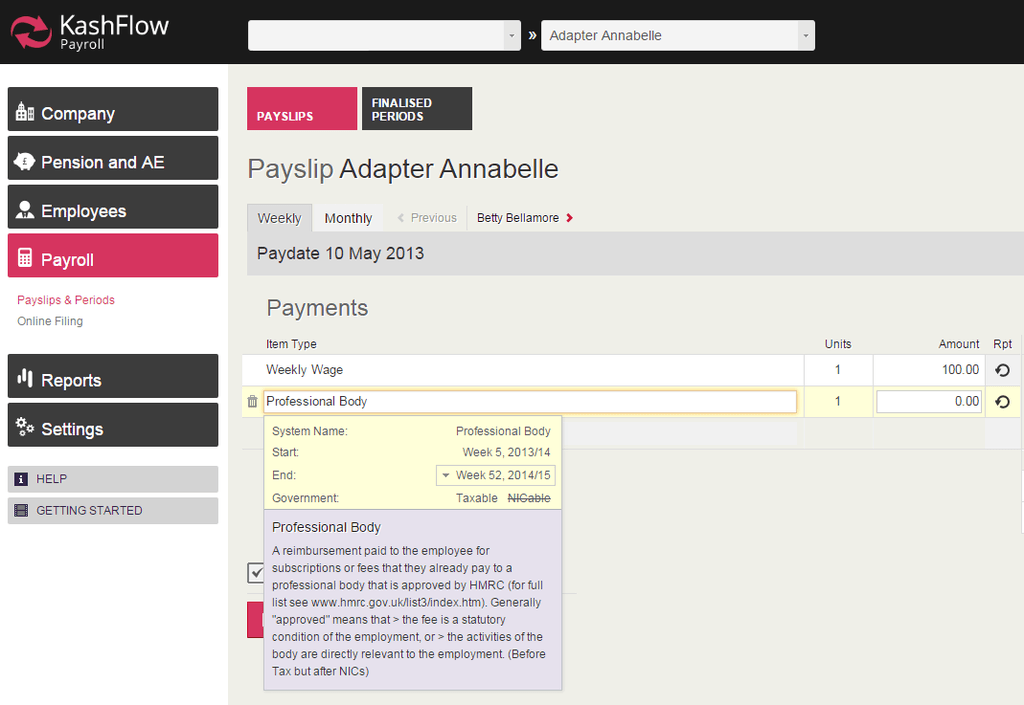

This article will guide you through the process of selecting a payslip item that would be subject to tax deductions, but it will be exempt from NI deductions.

In order to do so, please follow the instructions below:

1. Please access the Payroll tab in the left-hand dropdown menu.

2. You will then need to navigate to Payslips & Periods.

3. Please click on Create payslip next to the relevant employee.

4. You will need to click on New Item > Basic > Fees > Professional Body (approved)

Please note, you will be able to change the item description to something more suitable.