Steps to complete End of Year in Kashflow payroll for tax year 2017/18

- Go to Company> Payments & Receipts and check the previous payments to HMRC are correct.

- Enter payroll details for Month 12/Week 52

- If you have any employees leaving in Month 12/Week 52 that you do not intend to pay in the 2018/19 tax year, you need to ensure that you mark this employees as leavers after calculating the final payroll of the year, but before finalising the payroll.

- You will need to double check the year to date figures for the payroll to include the final payroll, which you can do from Reports> Payroll and select all periods.

- You should also check your pension reports to ensure the year to date figures are correct.

- Once you are happy with that all the year to date figures are correct, you can then finalise the payroll by going to Payroll> Payslips & Periods> Finalise.

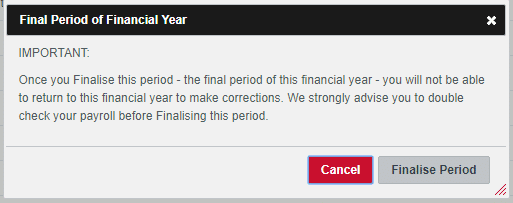

Please Note: You will see a warning when you try to finalise advising you that once you have finalised you will not be able to restore back under any circumstances. We strongly advise that you double check the values before finalising to ensure everything is correct.

- Once you have finalised, you can view the status of your RTI submissions by going to Payroll> Online Filing. The software will automatically send the final FPS/EPS for you and mark it as the final submission.

- You can print your P60’s by going to Reports> Statutory> P60, these need to be handed to the employees before 31st May 2018. You should only print the P60’s after your final pay date.

- If you have discovered that you have made a mistake on the employee’s final payroll run, you will need to send corrected figures to HMRC using the Earlier Year Update (EYU) by going to Employees> EYU. You should only ever submit the differences in the year to dates on an EYU, not the full year dates.

Kashflow Payroll Year-End FAQs

- How to print P60’s when last period for the year is finished?

- Reports->Statuary->P60->Select employee and P60 will be download.

(Please note – P60’s can only be printed 2 days before RTI is due to be sent (if you finalise your year-end payroll early)

- Are there any further steps I need to be when the final period is finalised?

- Once final period is finalised you need to make sure FPS was sent and EPS if required.

- Check that there are no issues regarding final submissions.

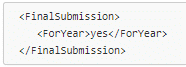

- Customer can check the RTI EPS for the indication which shows finalise submission, by going to: Payroll > Online Filing > click on M12 EPS/Week 52/53 > click ‘Submission XML’ > scroll down to the bottom and you should see the following:

- Can I submit FPS for previous tax year(s), using KashFlow payroll?

- No – KashFlow payroll will only enable you to submit RTI for current tax year only.

- To inform HMRC about payment submission missed for previous tax year, you will need to do and EYU (Earlier year submission). This can be done in the software under Employees>EYU.

- Can KashFlow Payroll generate end of year reports?

- Yes – the software will automatically generate a P60 end of year tax document for all employees.

- What are the deadlines for RTI submissions for year end?

- FPS – 19th of April 2018

- EPS – At any time after April however, if you finalised last period for the year you cannot restore the previous year.

- Deadline for P60s?

- Deadline for P60s to be given to employees is 31th of May 2018

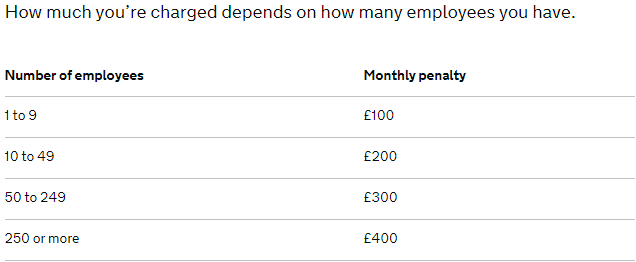

- What will happen if you don’t report payroll information on time?

- Information for employers about late/non filing PAYE penalties, specified charges, inaccurate reports and how to avoid penalties in future.

- What are the penalties for late reporting?

- Where I can find more information regarding penalties?

- You can find more information on the link provided below.

https://www.gov.uk/guidance/what-happens-if-you-dont-report-payroll-information-on-time

- What do I need to do if my RTI submissions fail at the year end?

- Firstly we need to find out why it failed and re-submit the submission.

- You can find the error message under Payroll->Online Filling->Select last period that failed.

- When you select period that RTI failed you will be able to see tab named “HMRC Error response”

- Select “HMRC Error response” you should be able to see XML file information

- See example provided below.

- Error provided is most common issue with HMRC.

- HMRC will be experiencing high volume of submissions this may cause RTI to fail.

- See example provided below.

- If you receive error provided above this mean HMRC may have received the RTI and you don’t need to take any action. However, you would need to contact HMRC and confirm this with them.

- In case they did not received submission you will need to submit the submission again.

- Make sure you are in the correct year under Online filling. Use arrow’s to navigate across to previous year.

- Go to Payroll->Online filling->Select period in question->Click on Resubmit XML.

- If you receive any different error you would need to contact payroll support via email [email protected]

- How to alter the online filling credentials?

- Make sure you are in the correct year under Online filling. Use arrow’s to navigate across to previous year.

- Company->Setup details->Government-> Your HMRC Online Filing Credentials.

- When Online Filling Credentials are revised you will need to re-submit submission.

- Go to Payroll->Online filling->Select period in question->Click on Resubmit XML

- How do I know if I need to run week 53?

- If youre final paydate for the year falls on the 5th April it will automaticly let you to do week 53