Welcome to KashFlow Payroll Release 1.5.1.

This update of the software concerns the support for the latest changes to furlough legislation from HMRC in KashFlow Payroll, making it easier to calculate what you can claim back from the government, using the Coronavirus Job Retention Scheme.

Further information can be found here.

The Coronavirus Job Retention Scheme has been subject to numerous changes. We have summarised some of those upcoming changes in this below.

Important Dates

10th June 2020

The last date to furlough an employee who has not been furloughed before was the 10th June. Newly furloughed employees had to be furloughed on or before the 10th June, ensuring they met the criteria of a minimum 3-week period by the 30th June.

There are exceptions to the rule. This relates to employees returning from extended leave of absence, such as maternity/paternity leave. However, this will only apply where they work for an employer who has previously furloughed employees. For further information on this announcement, click here.

1st July 2020

From the 1st of July, you have the flexibility to bring previously furloughed employees back to work part time and can apply for a scheme grant to cover any of their normal hours they are still furloughed for. When making a claim, HMRC require the normal hours worked in a claim period, the actual hours worked in the claim period, and the furlough hours not worked in the claim period.

From 1st July, any future CJRS claims must be for calendar months only and cannot span different months, for instance 6th July – 5th August.

31st July 2020

For both newly furloughed employees and those previously furloughed and claimed for, you have up until the 31st July to make a claim for any periods of furlough up until the 30th June.

1st August 2020

Employers must start contributing for the wage costs of paying furloughed employees. From the 1st August, an employer cannot claim Employer’s NI or Employer’s pension contributions on any future furlough payments.

1st September 2020

Employers must still pay furloughed employees 80% of their wage but can only reclaim 70%.

1st October 2020

Employers must still pay furloughed employees 80% of their wage but can only reclaim 60%.

Summary of contribution changes

Changes to government contributions, required employer contributions and the amount the employee receives when they are 100% furloughed:

| July | August | September | October | |

| Government contribution: employer NICs and pension contributions | Yes | No | No | No |

| Government contribution: wages | 80% up to £2,500 | 80% up to £2,500 | 70% up to £2,187.50 | 60% up to £1,875 |

| Employer contribution: employer NICs & pension contributions | No | Yes | Yes | Yes |

| Employer contribution: wages | – | – | 10% up to £312.50 | 20% up to £625 |

| Employee receives | 80% up to £2,500 per month | 80% up to £2,500 per month | 80% up to £2,500 per month | 80% up to £2,500 per month |

What the software will and will not do

Will do

You must continue to pay furloughed staff 80% of their pay, using the furlough payments payslip item. During September and October, the employer cannot claim back the full 80% of the furlough payment, but you must continue to pay your furloughed employees the full 80% of their pay. The software will automatically calculate the reduced reclaim value for you when you create the CSV output file, details below.

From the 1st July onwards, all claim periods must fall within a calendar month and so you will not be able to enter a claim date range that spans across multiple calendar months e.g. you cannot claim for 16th June to 15th July. You can claim for 16th to 30th June then make a separate claim in July.

Will not do

From the 1st July onwards the software may not be able to calculate the reclaim values accurately due to the changes in legislation and so you will not be able to create the standard CSV output file directly. You will be able to use the export function and the spreadsheet we refer to in this release, details below, to help you.

What to do in KashFlow Payroll

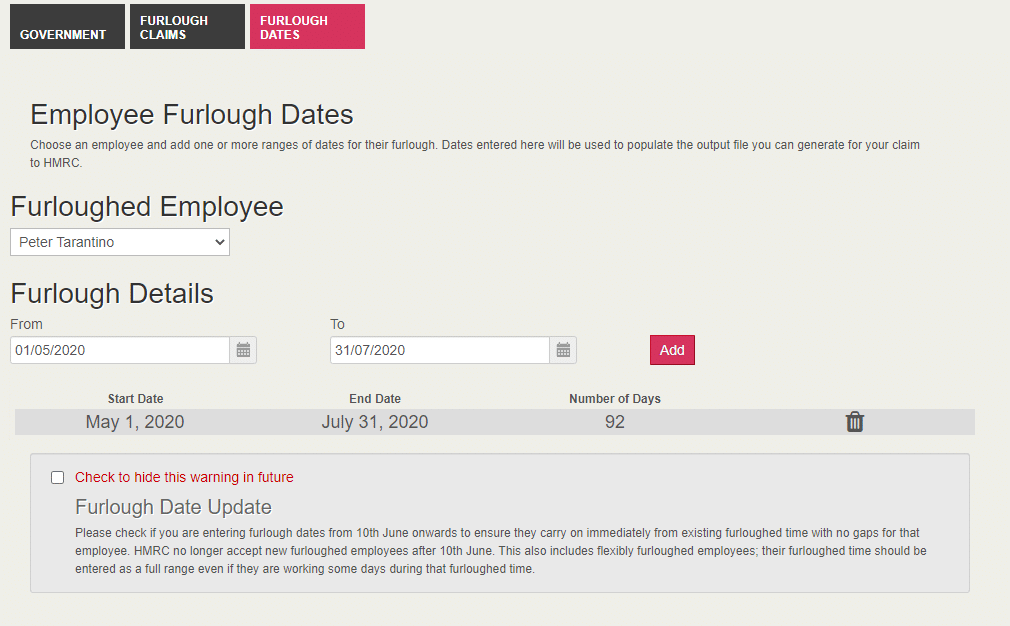

Step 1 – Enter Your Furlough Dates

In the Company | Payments & Receipts | Furlough Dates tab, enter your employee’s Furlough Start and End dates. If you do not know the Furlough End date enter a date far enough in the future to make your claims. You can always extend the Furlough end date by adding a new date range that starts on the next day.

You should not enter a Furlough From Date later than 10th June 2020, unless you are furloughing any employees who are returning from maternity, paternity leave etc.

Step 2 – Make Furlough Payments

The next step is to calculate pay for the periods where your employees are furloughed. The recommended way is to use the Furlough Payment payslip item the 80% Furlough Payment. If you want the employee to be paid at their normal rate, we also recommend you use the Furlough Top Up payslip item for the remaining 20% of their pay.

Don’t worry if you have already calculated payroll for furloughed employees and did not use these payslip elements, as you will still be able to create the file to upload to HMRC or the new spreadsheet we have provided – you will just need to add some more information manually.

Finally finalise the pay period to be able to use that information in a claim.

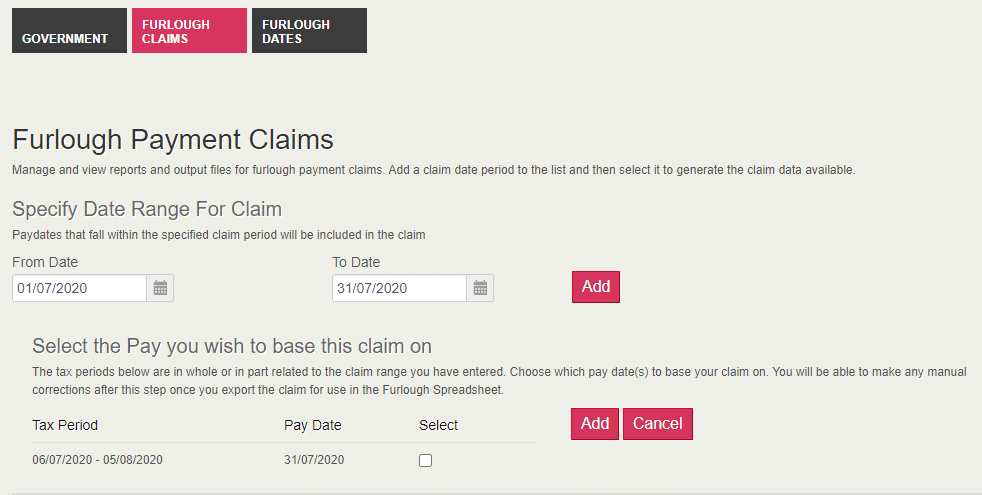

Step 3 – Furlough Claim

In the Company | Payments & Receipts | Furlough Claims tab.

We have updated the Furlough Claims screen to behave differently depending on whether your claim is for dates before 1st July 2020 or from 1st July 2020, due to the change in legislation. For dates before July 2020 the furlough claim works as it did previously. For claims made for 1st July onwards the behaviour is described below.

- Enter the Date Range that you are making the furlough claim for. If you have weekly and monthly paid employees, they must all be included in a single claim.

- Take care when entering the Date Range. You can only make a single claim for the same claim period and the dates must fall within the same calendar month. Your claim period cannot cross calendar months e.g. 27th July to 2nd August.

- Click Add. This brings up a choice of pay periods which has calendar days that overlap with the furlough claim date range you have entered.

- Example, if your pay periods are tax months they run from the 6th of one month to the 5th of the next. This means is you enter a claim period for 1st July to 31st July you will be default see two tax periods displayed to select: 6th June to 5th July & 6th July to 5th August. Your claim can only be for the calendar days in July. If the employee’s payslip was the same in those months then you could choose either one. However, if they were paid differently you will need to choose one, say the 6th July to 5th August, and remember to make manual changes later on the spreadsheet described below to remove pay from 1st to 5th August but add pay from 1st to 6th July from the previous payslip.

- Similarly to the above, if your employees are weekly paid you will need to ensure for any weeks that go over the end of a calendar month the pay is split between two different claims.

- Once you have chosen the pay periods you want to base the claim for, evenif you may need to make some adjustments later, choose the Add to make that an active claim.

- Clicking on the added claim will then generate and download a .csv file which you can open in Microsoft Excel or similar as described below.

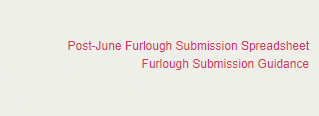

Step 4 – Using the Furlough Spreadsheet

Download a copy of the spreadsheet and associated guidance from the link at the top right of the Furlough Payment Claims page.

Follow the steps below to import your data into the spreadsheet:

- Browse to the location where you have saved the export file from Step 3 part 5.

- Open the exported file

- Highlight and copy the contents displayed in the file (do not include the headers)

- Browse to the location of the spreadsheet

- Open the spreadsheet and paste the information into the Import tab. To ensure that that information is pasted into the correct fields, click into the first field listed below the headings – when the spreadsheet is empty this will be field A3, then paste the data. You will now see the data that you have exported from the software

What data may I need to enter manually?

It is important to note that not all the required information is available to be exported. You may need to enter some required details manually.

Note: If an employee is in more than one pay period in the claim period, each pay period’s data must be entered in a different row

Ensure all rows have the following columns completed:

- Employee Code (Payroll ID), National Insurance Number, or both

- Employee Name

- Employee Furlough Start and Furlough End dates

- Either Furlough Payments (most employees) or Pay for Furlough Hours in Pay Period (some hourly paid employees)

- Furlough Hours in Pay Period

The following fields may require manual input, where applicable:

- Pay Period Start Date (column I) – this is the start date of the work period

- Pay Period End Date (column J) – this is the end date of the work period

- Part Time Furlough Hours in Pay Period (Hrs)) (column N) – this is the number of hours worked by any flexibly furloughed employee in the pay period

- Pay for Part Time Furlough Hours in Pay Period (£) (column O) – this is the value of the hours worked to any flexibly furloughed employee in the pay period

- Furlough Hours in Claim Period (column R) – this is the number of furlough hours paid to any furloughed employee for each period included in the claim period

- Pay for Furlough Hours in Claim Period (£) (column S) – this is the value of the furlough hours paid to any furloughed employee for each period included in the claim period

- Part Time Furlough Hours in Claim Period (column T) – this is the number of furlough hours paid to any flexibly furloughed employee for each period included in the claim period

- Pay for Part Time Furlough Hours in Claim Period (£) (column U) – this is the value of the furlough hours paid to any flexibly furloughed employee for each period included in the claim period

How do I generate the data?

When you are happy with the information included for your furloughed employees on the Import tab:

- Click on the Detail tab

- Complete the following fields at the top of the sheet:

- Company

- Claim Start: First date of calendar days in claim

- Claim End: Last date of calendar days in claim: note this must be in the same calendar month as the Claim start date

- Output File Path: the location to save the file to

- Export File Name: the name of the file you can generate

- Click the Get Data button. The information is imported into the Furlough Calculator and the Furlough Reclaim calculation will be performed for you, where possible. If the results need amending, you can return to the Import tab to make manual adjustments in the relevant fields and follow the data generation process again.

How do I use the result to make a claim?

- Click on the Generate Export File button to export the data into the Export tab of the spreadsheet.

- This tab is in the same format is the CSV output file. You can then:

- Use this information as reference when entering the data into the HMRC portal manually

- Save this as a separate file and upload to the HMRC portal

Please note that to report employees who are flexibly furloughing to HMRC, you are required to know their normal hours worked, the actual hours worked and the furloughed hours and enter those manually as that information will not have been entered into KashFlow Payroll as part of the normal payroll process.

How Furlough Reclaim is calculated up to 30th June 2020

If eligible, you will receive a grant from HMRC to cover the lower of 80% of an employee’s regular wage or £2,500 per month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that subsidised wage.

Your furlough pay reclaim value is therefore the sum of three values:

- Furlough Pay

- Employer’s NIC

- Employer’s Pension

Furlough Pay

The furlough payment you make to employees, that is 80% of the employee’s normal pay or £2500 – whichever is lower is reclaimed.

Employer’s NIC

The Employer’s National Insurance contributions calculated on the furlough pay amount.

If the employee is only furloughed for part of the month the system will pro-rata the calculation to apply to the number of days the employee is furloughed, based on the dates you entered.

If the employee has received furlough pay only in the selected date range, then the Employer’s NI reclaim is:

- Furlough reclaim minus the current Secondary Threshold (ST) multiplied by the Employer NIC rate (13.8%)

The calculation becomes more complex if the employee was not furloughed for the whole period:

- NI-able Pay minus ST multiplied by 13.8% = Employer’s NI

- Divide the Employer’s NI by the number of days in the pay period (e.g. for April this would be 30 days)

- Multiply the value at step 2 by the number of days the employee was furloughed for in the period

If the employee was not furloughed for the whole period AND also received a top up payment, then the above steps are followed plus a further step:

- Multiply the value at step 3 by Furlough Pay divided by Furlough Pay plus top up pay

For example: Employee was furloughed on 15th April. Their normal salary is £2400. The employer has agreed to top up the furlough pay so that they receive 100% of salary whilst furloughed. Their pay consists of the following elements:

- Basic Pay £1200 (£2400/30 days * 15 days)

- Furlough Pay £960 (£2400/30 days * 80% * 15 days)

- Top Up Pay £240 (£2400/30 * 20% * 15 days)

Employer’s NI Reclaim:

- £2400 – £732 (ST) = £1668 * 13.8% = £230.184

- £230.184/30 days = £7.6728

- £7.6728 * 15 days = £115.092

- £115.092 * £960/£1200 = £92.07

£92.07 is the Employer’s NI reclaimable value.

How the calculation changes from 1st July 2020

From 1st July 2020, the furlough process changes. Please see the Important Dates section at the beginning of this guide for details. In addition to those changes mentioned, any top up payments i.e. payments you have made to employees to ‘top up’ the furlough payment will not be included in either the Employer NI and Employer Pension reclaim figures.

If you have not claimed to the end of June, you must make a separate claim up to 30th June and then process a separate claim from 1st July.

Furlough Payment Reclaim

Up to the end of August, the employer can recover all their furlough payment, i.e. 80% of employees’ pay.

From September 1st, you should still enter 80% of employee wages as furlough payment, because that is what is due to the employee. The reclaim calculation will adjust the entered 80% to 70% (i.e. Furlough Pay / 80% * 70%) e.g. if an employee normally gets £1000 per month and you are paying them £800 furlough pay, the reclaim value in September will be £700.

From October 1st, you should still enter 80% of employee wages as furlough payment because that is what is due to the employee. The reclaim calculation will adjust the entered 80% to 60% (i.e. Furlough Pay / 80% * 60%) e.g. if an employee normally gets £1000 per month and you are paying them £800 furlough pay, the reclaim value in October will be £600.

NI Reclaim

If your employee is furloughed for the whole pay period and you do not top up their pay (claims ending on or before 30th June 2020)

To work out how much you can claim to cover employer NICs:

- Start with the grant you are claiming for employee’s wages

- Deduct the relevant secondary NICs threshold

- Multiply this amount by 13.8%

If your employee is not furloughed for the whole pay period, or you top up their pay (claims ending on or before 30th June 2020)

If your employee is not furloughed for the whole of the pay period, or you top up your employee’s pay over the amounts covered by the grant, then the following steps will help you calculate the amount of employer NICs you can claim for each employee:

- Start with the employee’s total pay

- Deduct the relevant secondary NICs threshold

- Multiply by 13.8%

- Divide by the number of calendar days in the pay period

- Multiply by the number of furlough days in the pay period

- Divide by the employee’s total pay for the furlough days in the pay period

- Multiply by the amount of grant for employee wages

Check that the result of this calculation is not more than the maximum that can be claimed for employer NICs. The following steps will show you how to calculate the maximum employer NICs you can claim for each employee:

Working out what you can claim – for claims between 1st July and 31st July 2020

From 1st July 2020, your employees will be able to return to work part-time and be furloughed for the rest of their usual hours. You should calculate the employer NICs that you need to pay in the normal way.

For claim periods between 1st July 2020 and 31st July 2020, you need to work out how much you can claim towards these costs. You should do this calculation separately for each pay period that falls into your claim period. You cannot claim a higher amount than the employer NICs that is due.

Before you calculate the amount you can claim, you first need to adjust the amount of the relevant secondary NICs threshold.

| Tax year | National Insurance contributions thresholds |

| 2020 to 2021 | £169 per week, £732 per month or £8,788 per year |

To adjust the amount of the relevant secondary NICs threshold:

- Start with the relevant secondary NICs threshold that corresponds to the pay period

- Divide by the number of days in the pay period

- Multiply by the number of days in the furlough or flexible furlough claim

If your employee is flexibly furloughed, you must also:

- Divide by the number of usual hours in the flexible furlough claim

- Multiply by the number of furloughed hours in the flexible furlough claim

Next you will need to use the adjusted secondary NICs threshold to calculate the amount of your grant.

- Start with the amount you are claiming for the employee’s wages

- Deduct the relevant adjusted secondary NICs threshold

- Multiply by 13.8%

Working out what you can claim – for claim periods starting on or after 1st August 2020

From 1st August 2020, you will no longer be able to claim a grant towards the employer NICs that you pay.

Pension Reclaim

Calculate your claim for pension contributions – claim periods up to and including 30th June 2020

- Start with the amount you are claiming for the employee’s wages

- Deduct the minimum amount your employee would have to earn in the claim period to qualify for employer pension contributions – this is £512 a month for periods before 5th April 2020, and £520 a month for periods after 6th April 2020

- Multiply by 3%

Calculate your claim for pension contributions – claim periods from 1st July to 31st July 2020

From 1st July 2020, your employees will be able to return to work part-time and be furloughed for the rest of their usual hours.

For claims between 1st July 2020 and 31st July 2020, you will be able to claim towards pension contributions you make on the gross pay grant for the hours they are furloughed. You should calculate this separately for each pay period that falls into your claim period. You cannot claim for more than you actually contribute to your employee’s pension.

Before you can claim, you will need to adjust the amount of the relevant Lower Level of Qualifying Earnings (LLQE).

| Tax year | Lower Level of Qualifying Earnings |

| 2020 to 2021 | £120 per week, £520 per month or £6,240 per year |

To adjust the amount of the LLQE:

- Start with the relevant LLQE that corresponds to the pay period

- Divide by the number of days in the pay period

- Multiply by the number of days in the furlough or part-time furlough claim

If your employee is flexibly furloughed, you must also:

- Divide by the number of usual hours in the flexible furlough claim

- Multiply by the number of furloughed hours in the flexible furlough claim

Next you will need to use the adjusted LLQE to calculate the amount of your grant.

- Start with the amount you are claiming for the employee’s wages

- Deduct the adjusted LLQE

- Multiply by 3%

You must not claim more towards pension contributions than you have paid into your employee’s pension.

Calculate your claim for pension contributions – claim periods from 1st August 2020

From 1st August 2020, you will no longer be able to claim towards contributions you make into your employees’ pensions.

Examples

Example 1 – Full Month is a single pay period

Monthly Paid from 1st to end of month – June

Employee is normally paid £1250 per month so 80% furlough pay = 1000.00

These calculations are the same as the initial calculations, including top-up pay and part period furlough, if there is any

- Enter a claim period e.g. 1st June to 30th June

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000.00

- NI reclaim = £1000.00 – £732 * 13.8% = £36.98

- Pension reclaim = £1000.00 – £520 * 3% = £14.40

Monthly Paid from 1st to end of month – July

- Enter a claim period e.g. 1st July to 31st July

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000.00

- NI reclaim = £1000.00 – £732 * 13.8% = £36.98

- Pension reclaim = £1000.00 – £520 * 3% = £14.40

Monthly Paid from 1st to end of month – August

- Enter a claim period e.g. 1st August to 31st August

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000.00

Monthly Paid from 1st to end of month – September

- Enter a claim period e.g. 1st September to 30th September

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000 /80% * 70% = £875.00

Monthly Paid from 1st to end of month – October

- Enter a claim period e.g. 1st October to 31st October

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000 /80% * 60% = £750.00

Example 2 – Full Month is a single pay period (part-time hours)

Monthly Paid from 1st to end of month – July

- Enter a claim period e.g. 1st July to 31st July

- Employee furloughed for whole month

- Part-time pay = 30 Hours at £10 = £300.00

- Furlough Pay = 100 Hours at £8 = £800.00

- NI reclaim = £800.00 – (£732/130*100) * 13.8% = £32.69

- Pension reclaim = £800.00 – (£520/130*100) * 3% = £12.00

Monthly Paid from 1st to end of month – August

- Enter a claim period e.g. 1st August to 31st August

- Employee furloughed for whole month

- Part-time pay = 40 Hours at £10 = £400.00

- Furlough Pay = 90 Hours at £8 = £720.00. Furlough Reclaim = £720.00

Monthly Paid from 1st to end of month – September

- Enter a claim period e.g. 1st September to 30th September

- Employee furloughed for whole month

- Part-time pay = 40 Hours at £10 = £400.00

- Furlough Pay = 90 Hours at £8 = £720.00. Furlough Reclaim = £720.00 / 80% * 70% = £630.00

Monthly Paid from 1 to end of month – October

- Enter a claim period e.g. 1st October to 31st October

- Employee furloughed for whole month

- Part-time pay = 40 Hours at £10 = £400.00

- Furlough Pay = 90 Hours at £8 = £720.00. Furlough Reclaim = 720.00 / 80% * 60% = £540.00

Example 3 – Full Month is a single pay period (part-month furlough)

Monthly Paid from 1st to end of month – July

- Enter a claim period e.g. 1st July to 31st July

- Employee furloughed up to 23rd July

- Furlough pay = £1000.00. Furlough reclaim = £1000.00

- NI reclaim = £1000.00 – (£732/31*23) * 13.8% = £63.05

- Pension reclaim = £1000 – (£520/31*23) * 3% = £18.43

Note: This calculation apportions the NI and Pension thresholds based on number of days furloughed in the pay period

Example 4 – Full Month is a single pay period (part-month furlough, part-time hours)

Monthly Paid from 1st to end of month – July

- Enter a claim period e.g. 1st July to 31st July

- Employee furloughed up to 23rd July

- Part-time pay = 30 Hours at £10 = £300.00

- Furlough Pay = 66.45 Hours at £8 = £531.10 Furlough Reclaim = £531.10

- Normal Pay = 33.55 Hours at £10 = £335.50

- NI reclaim = £531.10 – (£732/31*23/96.45*66.45) * 13.8% = £21.66

- Pension reclaim = £531.10 – (£520/31*23/96.45*66.45) * 3% = £7.96

Note: This calculation apportions the NI and Pension thresholds based on number of days furloughed and number of hours paid part-time during the furlough period

Example 5 – Monthly pay periods in two calendar months

Monthly paid on 16th of previous month to 15th of current month. Claim from 16th June to 30th June

– June

Employee is normally paid £1250 per month so 80% furlough pay = £1000.00

These calculations are the same as the initial calculations, including top-up pay and part period furlough, if there is any

- User enters a claim period e.g. 16th June to 30th June

- Employee furloughed for whole period

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/30*15 = £500.00

- NI reclaim = £500.00 – (£732/30*15) * 13.8% = £18.49

- Pension reclaim = £500.00 – (£520/30*15) * 3% = £7.20

Claim 1st to 31st July

Month 4 payment 1st to 15th July

- Employee furloughed for whole period. 16th June to 15th July (30 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/30*15 = £500.00

- NI reclaim = £500.00 – (£732/30*15) * 13.8% = £18.49

- Pension reclaim = £500.00 – (£520/30*15) * 3% = £7.20

Month 5 payment 16th to 31st July

- Employee furloughed for whole period. 16th July to 15th August (31 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/31*16 = £516.13

- NI reclaim = £516.13 – (£732/31*16) * 13.8% = £19.09

- Pension reclaim = £516.13 – (£520/31*16) * 3% = £7.43

Total for July

- Furlough Reclaim = £500.00 + £516.13 = £1016.13

- NI reclaim = £18.49 + £19.09 = £37.58

- Pension reclaim = £7.20 + £7.43 = £14.63

Claim 1st to 31st August

Month 5 payment 1st to 15st August

- Employee furloughed for whole period. 16th July to 15th August (31 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/31*15 = £483.87

- NI reclaim = 0.00

- Pension reclaim = 0.00

Month 6 payment 16th to 31st August

- Employee furloughed for whole period. 16th August to 15th September (31 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/31*16 = £516.13

- NI reclaim = 0.00

- Pension reclaim = 0.00

Total for August

- Furlough Reclaim = £483.87 + £516.13 = £1000.00

- NI reclaim = 0.00

- Pension reclaim = 0.00

Claim 1st to 30th September

- User enters a claim period e.g. 1st September to 30th September

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000 /80% * 70% = £875.00

Month 6 payment 1st to 15th September

- Employee furloughed for whole period. 16th August to 15th September (31 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/31*15/80%*70% = £423.39

- NI reclaim = 0.00

- Pension reclaim = 0.00

Month 7 payment 16th to 30th September

- Employee furloughed for whole period. 16th September to 15th October (30 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/30*15/80%*70% = £437.50

- NI reclaim = 0.00

- Pension reclaim = 0.00

Total for September

- Furlough Reclaim = £423.39 + £437.50 = £860.89

- NI reclaim = 0.00

- Pension reclaim = 0.00

Claim 1st to 31st October

- User enters a claim period e.g. 1st October to 31st October

- Employee furloughed for whole month

- Furlough pay = £1000.00. Furlough reclaim = £1000 /80% * 70% = £875.00

Month 7 payment 1st to 15th October

- Employee furloughed for whole period. 16th September to 15th October (30 days)

- Furlough pay = £1000.00 in pay period. Furlough reclaim = £1000.00/30*15/80%*60% = £375.00

- NI reclaim = 0.00

- Pension reclaim = 0.00

Month 8 payment 16th to 31st October

- Employee furloughed for whole allowable period. 16th October to 31st October (16 days)

- Note: Furlough ends on 31st October 2020

- Furlough pay = £500.00 in pay period. Furlough reclaim = £500.00/16*16/80%*60% = £375.00

- NI reclaim = 0.00

- Pension reclaim = 0.00

Total for October

- Furlough Reclaim = £375.00 + £375.00 = £750.00

- NI reclaim = 0.00

- Pension reclaim = 0.00

Employment Allowance

Note: If you are claiming Employment Allowance you must not claim Employer’s NIC until you have met your threshold. Fopr example, if you are claiming £4000 Employment Allowance and the Employer’s NIC due is less than £4000 your Employer’s NIC claim will be nil.

Furlough Pay Calculation

As advised in this document, you need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim.

Making the Furlough Claim

HMRC are endeavouring to make the claim process as straightforward as possible, for further information see: