For Employees who have been in the NHS Pension scheme prior to April 6th 2023:

1. The system will check the annual rate of pensionable pay for the tax year ending 2022/23

2. For full time employees, this will be obtained from the following:

Full Time Employees:

- Field 19 of the NSR03 form (Scotland)

For part time employees, this will be obtained from the following:

Part Time Employees:

- Total of Pensionable Pay | Employee column of the NSR03 for (for Scotland schemes)

- The figure from step 2 is checked against the new tiers and contribution rates

- The new Employee Basic Contribution rate will be set accordingly when finalising month 6

Example Full Time Employee:

- For an existing full-time employee, field 19 of of NSR03 is checked

- The figure from step 1 (£39017.16) will be used to identify the Employee Basic Contribution rate (using Table 1)

Tier Pensionable Pay used to determine contribution rate £ Contribution rate (%) 1 £0.00 to £13,330 5.7% 2 £13,331 to £25,367 6.1% 3 £25,368 to £30,018 6.7% 4 £30,019 to £37,663 8.2% 5 £37,664 to £37,830 9.8% 6 £37,831 to £39,497 10.0% 7 £39,498 to £48,009 10.5% 8 £48,010 to £51,954 10.8% 9 £51,955 to £72,656 11.3% 10 £72,657 and above 13.7%

4. The Employee Basic Contribution Rate will be set to 10.0% automatically when finalising September payrun

Example Part Time Employee:

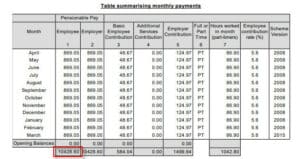

- Total of employee pensionable pay from table summarising payments from the SD55 or NSR03 is checked

- The figure from step 1 (£10428.60) will be used to identify the Employee Basic Contribution rate (using Table 1)

Tier Pensionable Pay used to determine contribution rate £ Contribution rate (%) 1 £0.00 to £13,330 5.7% - The Employee Basic Contribution Rate will be set to 5.7 % automatically when finalising September payrun