If an employee has received a salary increase in the new tax year 2022\23, the Employee Basic Contribution rate that the system has set will need to be checked and amended if necessary.

Example:

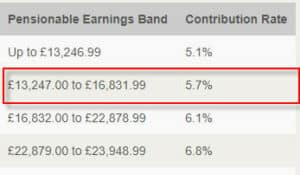

The pensionable Earnings for an employee for the year ending 21/22 were £16,700

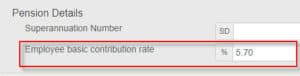

This means the system would set the Contribution Rate to 5.7% in Employees | NHS Pension | NHS Pension when finalising the September payroll run.

Employees | NHS Pension | NHS Pension:

If the employee has had an increase in salary between March 31st and September 30th 2022, this could mean that the Contribution Rate requires amending.

To check the current salary, navigate to Employees | Details | Salary

A calculation is required to check if the employee is on the correct Basic Contribution Rate based on the salary. This calculation is as follows (Salary * 12):

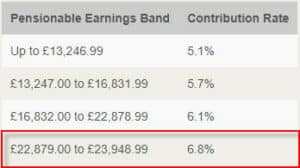

£1,908.33 * 12 = £22,899.96.

Once this figure is known, check this against the post October 1st NHS Pension Rates. The bands and rates can be found at Employees | NHS Pension | NHS Pension Rates

This amount is in the Earnings Band for 6.8%

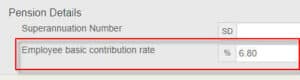

To amend this, navigate to Employees | NHS Pension | NHS Pension, and change the Employee basic Contribution Rate from 5.7% to 6.8%