Directors

If the employee is or has been, a director since 6th April then KashFlow Payroll needs to know the date that the directorship started (and ended if in the current Tax Year) and the NIC Calculation Method (National Insurance Contributions). A director can choose to have their NICs calculated in one of two ways:

- As Director: NICs are calculated cumulatively, that is to say on a Year To date basis like Tax normally is.

- Like Employee: NICs are calculated non-cumulatively; which is the way NICs are normally calculated for employees. However, in the last payment for the year (or the directorship itself) KashFlow Payroll will automatically recalculate NICs on a cumulative basis as required by HMRC.

You can set an employee as director during the initial creation during step 1.

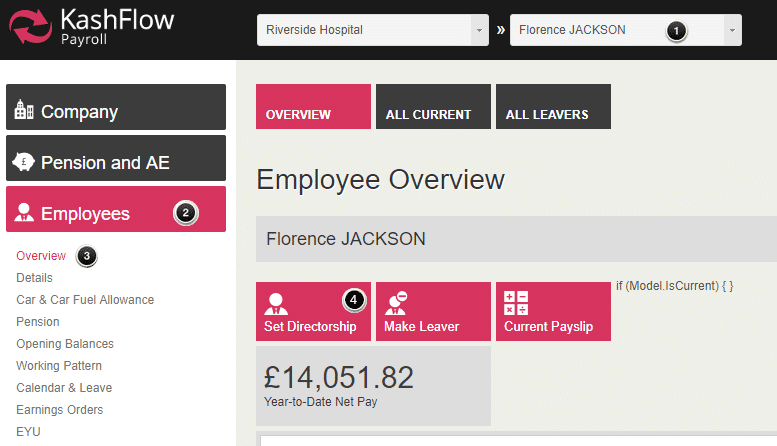

To set an employee as a director after the initial setup, ie. part way through a tax year, first select the appropriate employee from the list at the top of your screen. Then go to “Employees” | “Overview” and click “Set Directorship”

You will then need to set the start date of the directorship. This will have the effect of prorating the annual director NI allowance for the remaining part of the tax year.

Notes on Directors NI Calculation

Directors get ALL of the NI allowance up front and will not pay contributions until their NIable earnings for the year reach the Primary Threshold (PT). This is £8,424 for 18/19.

Once their earnings reach the PT they will pay 12% (assuming they are on NI rate A) on all their earnings until they reach the upper earnings limit (UEL). This is £46,350 for 18/19.

Once the NIable pay for the year exceeds the UEL the director will continue to pay 2% on all their NIable earnings.

An employee is promoted to a director during the tax year:

When activating an employee as a director you will be asked to specify from which date.

This has the effect of pro-rating the above values for the period of the year remaining. E.g. Employee becomes a director in week 22. There are 31 weeks remaining in the tax year (including week 22 which would be calculated on the director rules) So their allowance would become (£8424÷ 52)*31 = £5022. This new director would start to pay NI contributions once their pay reaches £5022.01 since being appointed a director.