This article guides you through the process of ceasing your company’s PAYE scheme. You will need to complete the steps below straight away if your business stops employing people.

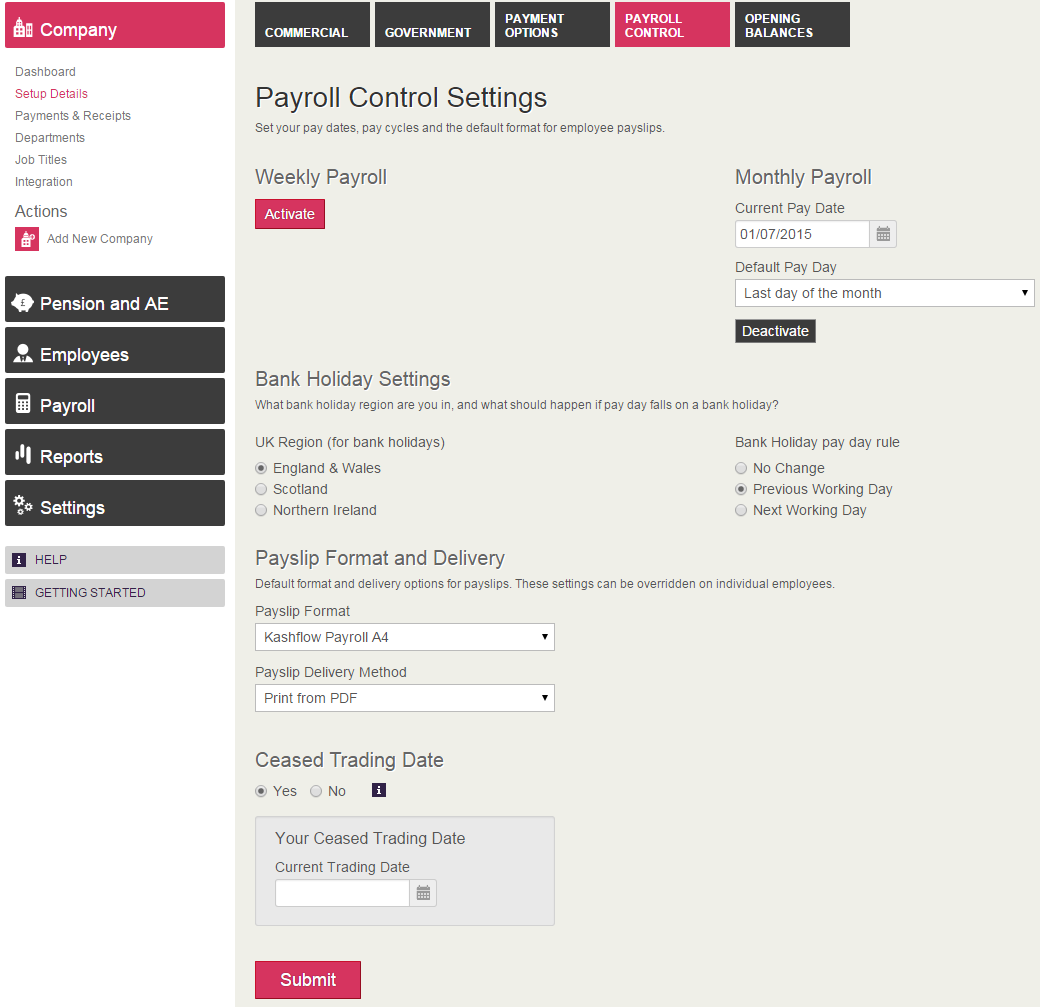

To begin, select the Company in the left-hand side navigation and then select Setup details > Payroll Control > Cease Trading > ‘Yes’ > Enter in the final date > Submit.

Please note, the Cease Trading date should be entered before the last payroll period has been finalised. This will be the date that the software will send to HMRC along with your RTI submission.

If you have already finalised your final period, you will need to restore it. In order to do this, simply navigate to Payroll > Payslips & Periods and focus on the ‘Finalised Periods’ section. You need to go into your most recent Payroll run to see the ‘Restore’ option.

To restore a period further back than this, you need to keep restoring until you reach its date range. Once finished, you will have to enter in your ‘Cease Trading’ date as above and re-finalise the period. The RTI will be submitted anew automatically.