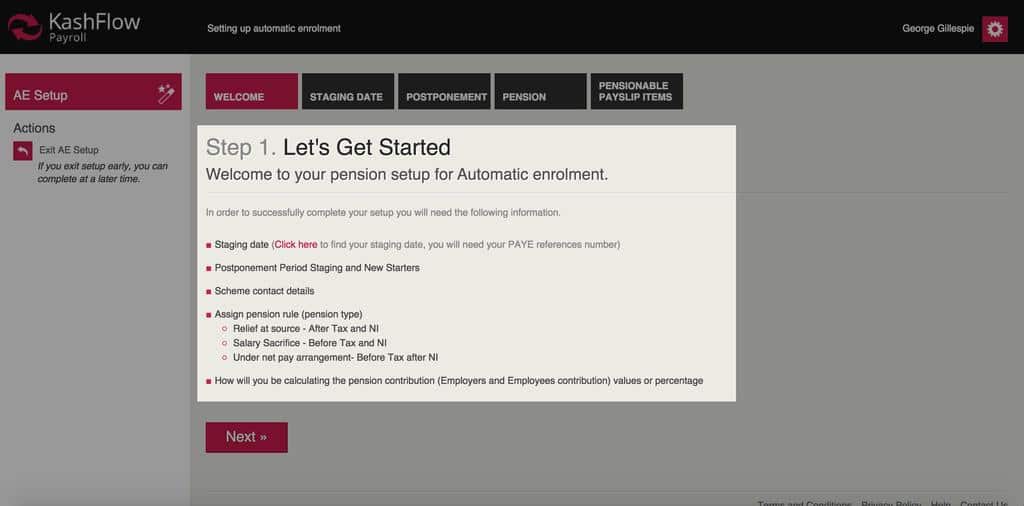

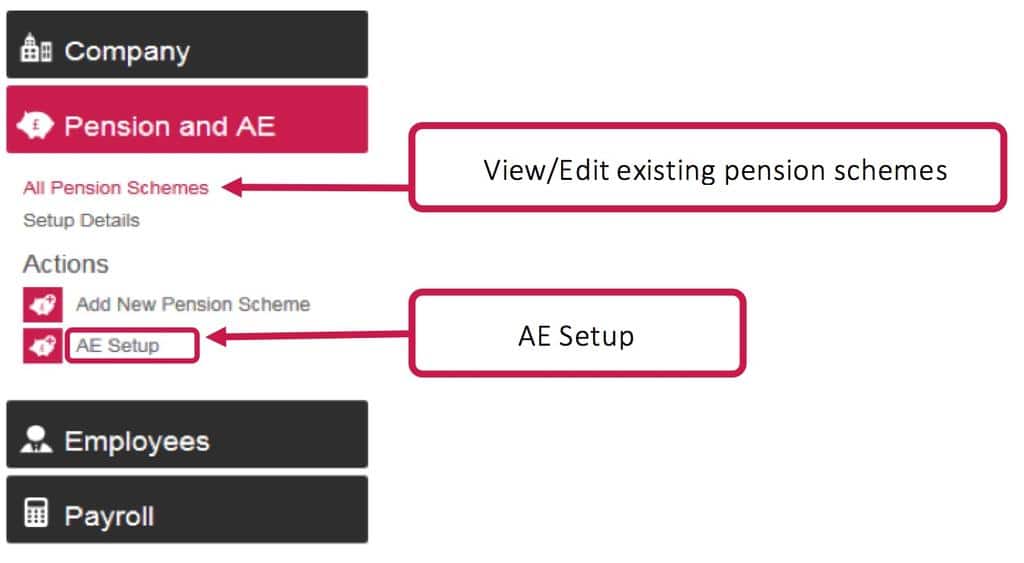

Using the AE Setup wizard, enter details of your chosen pension scheme, contribution amounts and staging date/postponement arrangements

Welcome

Welcome

Ensure relevant information is available. Setup Wizard will direct you to the relevant source of information, should you require any further details please visit www.thepensionsregulator.gov.uk

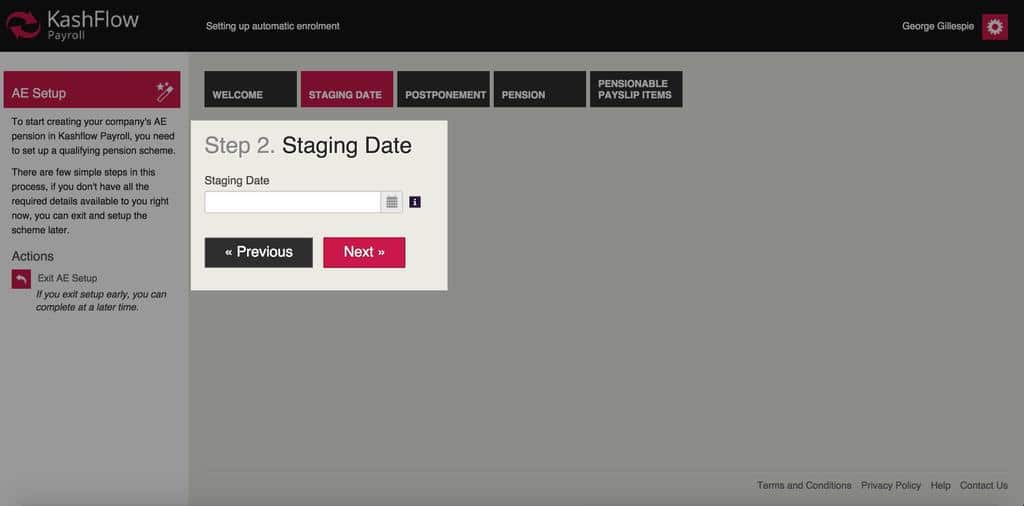

Staging Date

Enter your staging date, excluding any postponement period. You can locate your unique staging date by entering their PAYE reference number at www.thepensionsregulator.gov.uk. The staging date is based upon the total number of employees in your PAYE scheme.

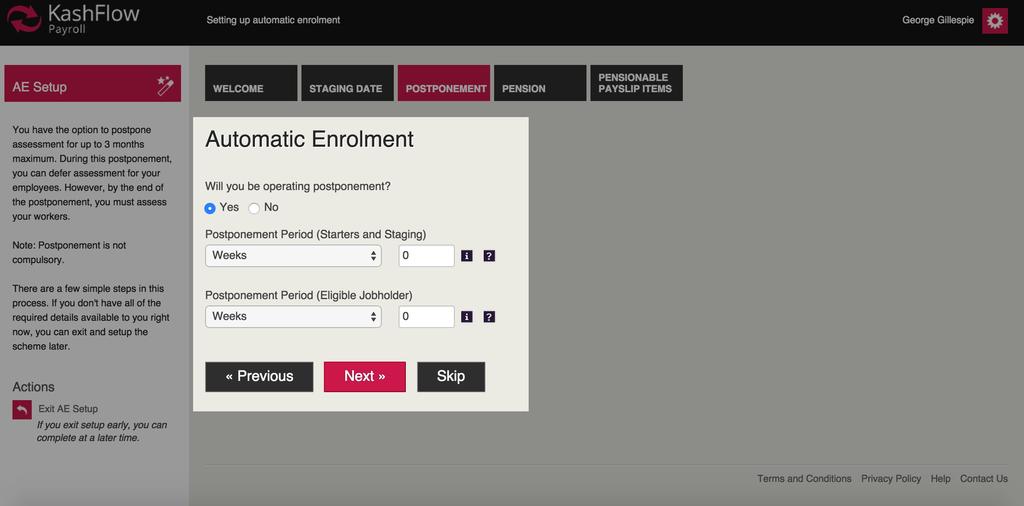

Postponement

Enter desired postponement period at staging date, for new starters and for employees that become eligible at a certain point but should not remain so (for example, if an employee becomes eligible due to an irregular rise in wage but should not be enrolled straight away as following wage will drop back below threshold).

For full details on postponement, deferral and contribution amounts please visit www.thepensionsregulator.gov.uk

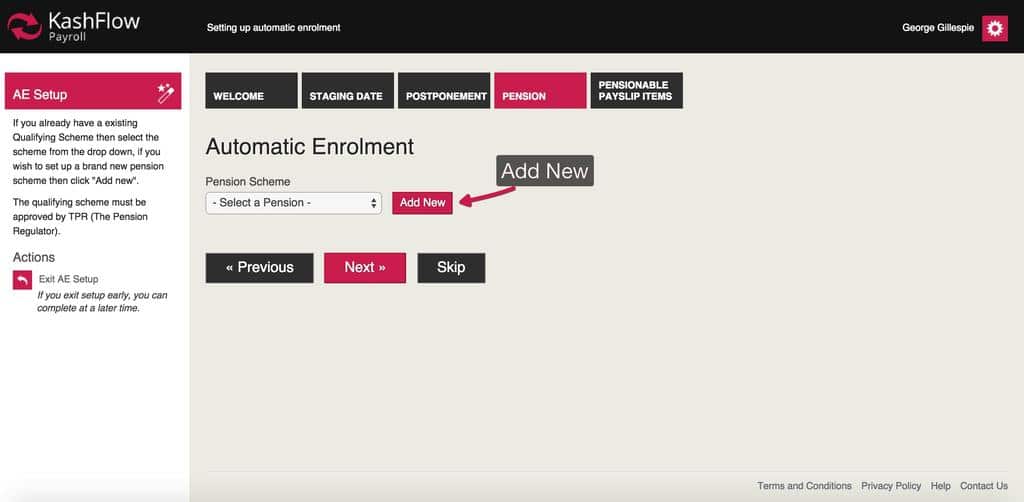

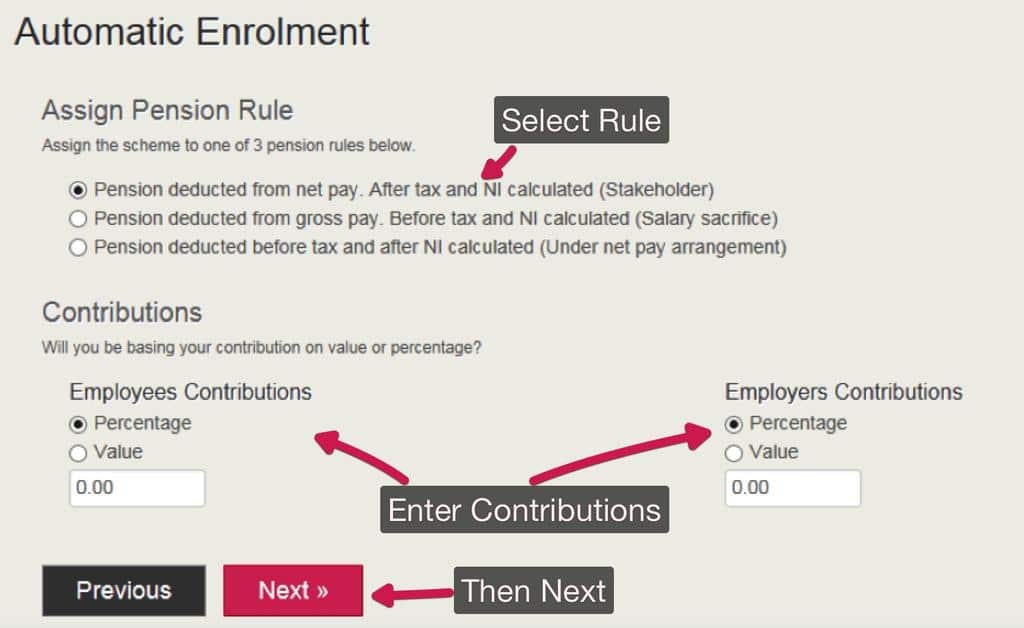

Pension

Add details of new qualifying pension scheme. A qualifying pension scheme must comply with all areas of automatic enrolment legislation, an existing pension scheme may not necessarily be qualifying. For further information on qualifying pension schemes, please visit www.thepensionsregulator.gov.uk/employers/does-your-existing-scheme-qualify.aspx

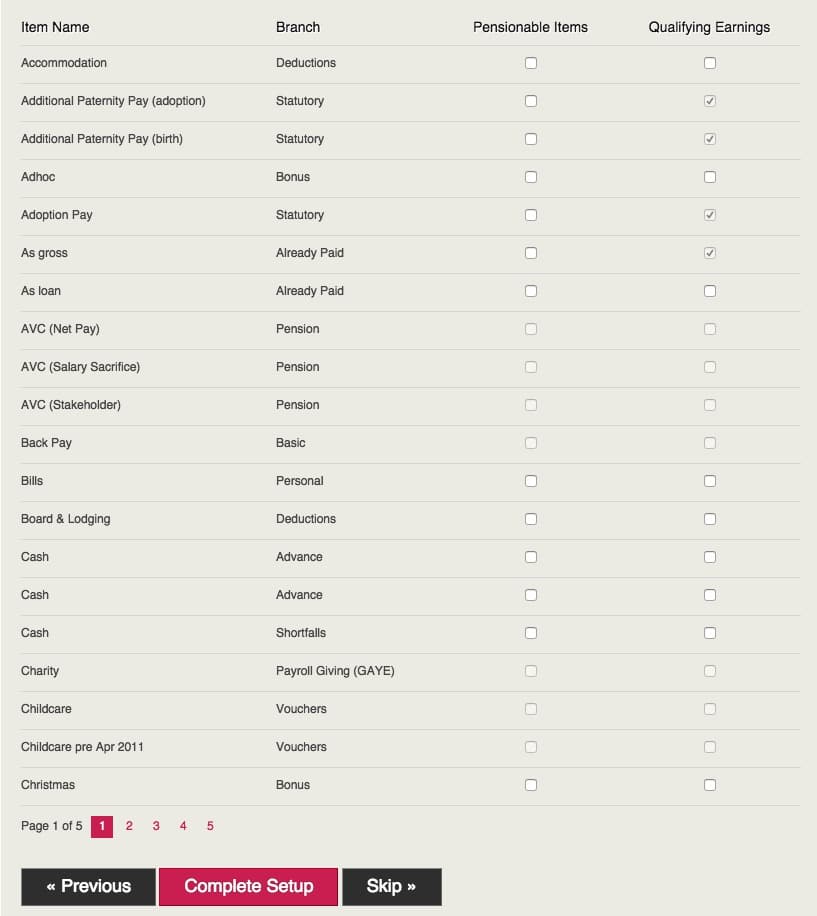

Pensionable Payslips Items

Choose which pension rule you wish to assign the pension scheme to and enter contribution for employee and employer

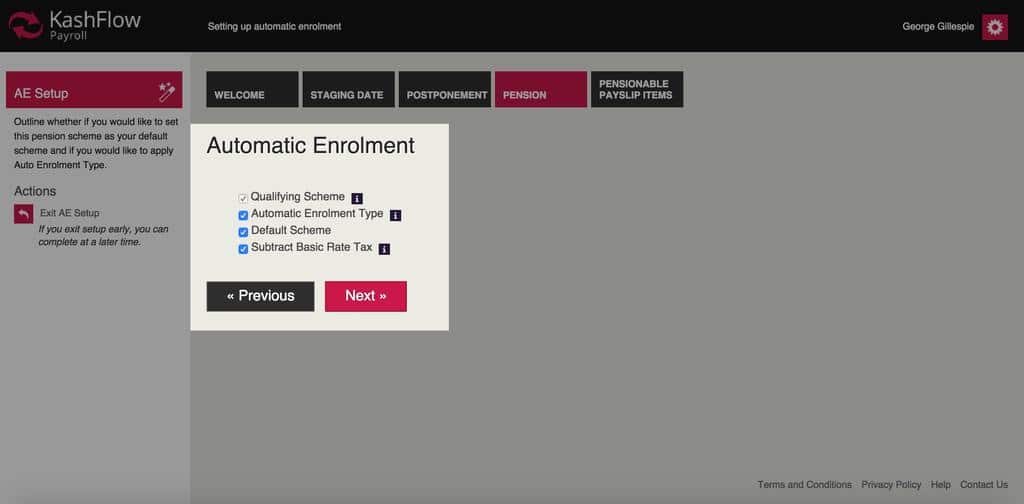

Before continuing, confirm that your pension scheme is a qualifying scheme (see step 4), meets the requirements of automatic enrolment (contribution levels, postponement etc) and is to be taken as the default scheme for all new employees

Select payslip items that are pensionable and those that are qualifying earnings. For example, a Christmas Bonus may form part of the total payslip but does not contribute towards the required earnings threshold for that employee. Similarly, items on the payslip may not be pensionable and therefore cannot have contribution amounts removed from them

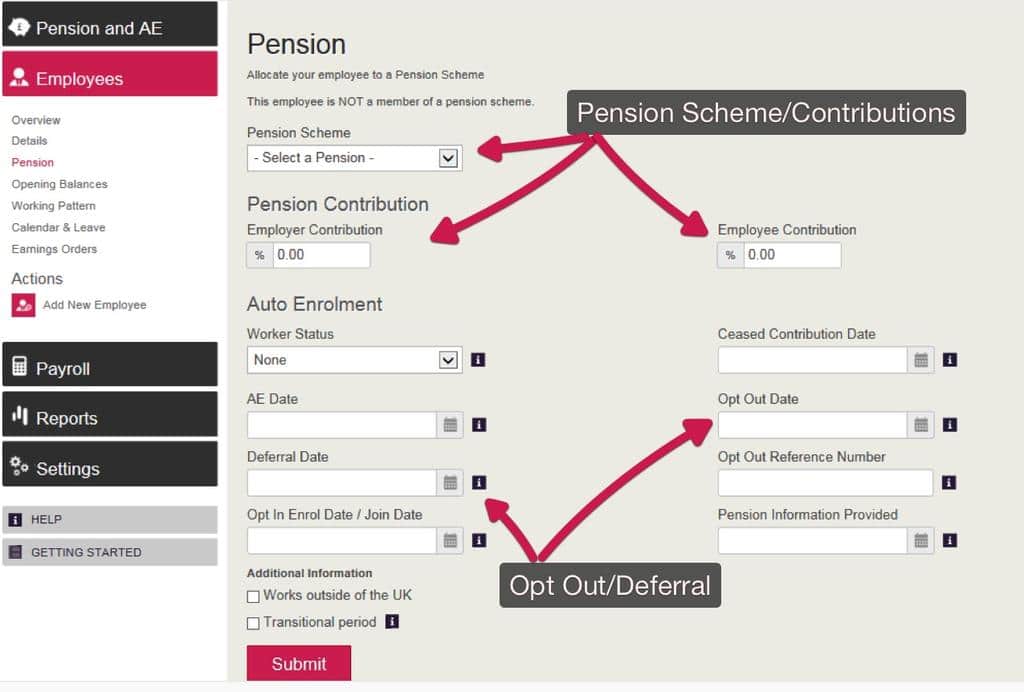

Employee Details

Edit an individual employees pension arrangements, including pension scheme, contributions and opt out settings. If an employee does opt out, they must obtain an opt-out reference number that needs to be entered into this area. For further information on opting out, please visit www.thepensionsregulator.gov.uk/employers/opting-out.aspx