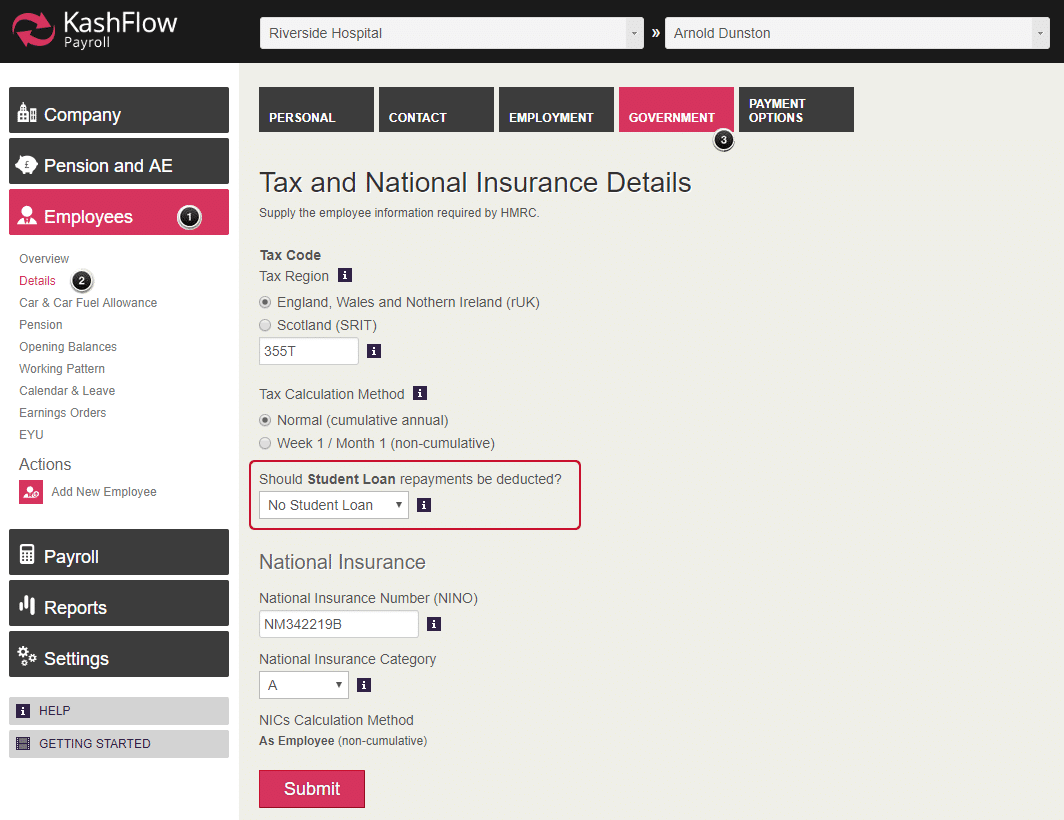

To activate student loan deductions, first, select the appropriate employee from the list at the top of your screen:

With the employee selected go to “Employees” | “Details” | “Government”

You then need to select which student loan plan type to use.

Student Loan Plan Type

As of the 2016/17 tax year, there is now an option of which student loan plan type the employee should be set to. The difference in the plan types is the threshold at which deduction will begin. The threshold for plan type 1 (18/19 tax year) is £18,330. The threshold for plan type 2 (18/19 tax year) is £25,000. BOTH plan types calculate deduction at 9% of the NIC liable pay. When you receive the SL1 from HMRC it will specify which plan type to use.

Please Note: There is no provision on the p45 form to indicate which plan type an employee should be on. When you add a new starter to the system, the employee needs to confirm the following;

• Did they live in Scotland or Northern Ireland when they started the course? OR

• Did they live in England or Wales and started the course before 1 September 2012?

If so, set them to plan type 1.

• Did they live in England or Wales and started the course on or after 1 September 2012.

If so, set them to plan type 2.

If your employee cannot confirm these details, ask them to contact the Student Loan Company (SLC). If they’re still unable to confirm their plan type, start making deductions using plan type 1 until you receive further instructions from HMRC.

Student Loan Calculation

Please note: Student loans will not be deducted if the employee’s earnings are below the Student Loan Threshold. For tax year 18/19 this is £18,330.00 (type 1) or £25,000 (type 2) . Student loans contributions are then 9% of all NIable pay over this amount. The deducted amount is always rounded down to the whole pound value.

Example calculation 1 (Plan type 1):

The employee is paid £1600.00 NIable pay for the month.

Monthly Student Loan Threshold = 18330 ÷ 12 = £1527.50

Employee Pay subject to Student Loan = £1600.00 – £1527.50 = £72.50

9% of £72.50 = £6.53, rounded down the whole pound employee contribution is £6

Example calculation 2 (Plan type 2):

The employee is paid £2000.00 NIable pay for the month.

Monthly Student Loan Threshold = 25000 ÷ 12 = £2083.33

Employee Pay subject to Student Loan = £2000.00 – £2083.33 = £-83.33

No student Loan deduction as below monthly threshold.

Stopping a student loan

When you receive the SL2 message from the HMRC, return to the screen above and change the status to “No Student Loan“.