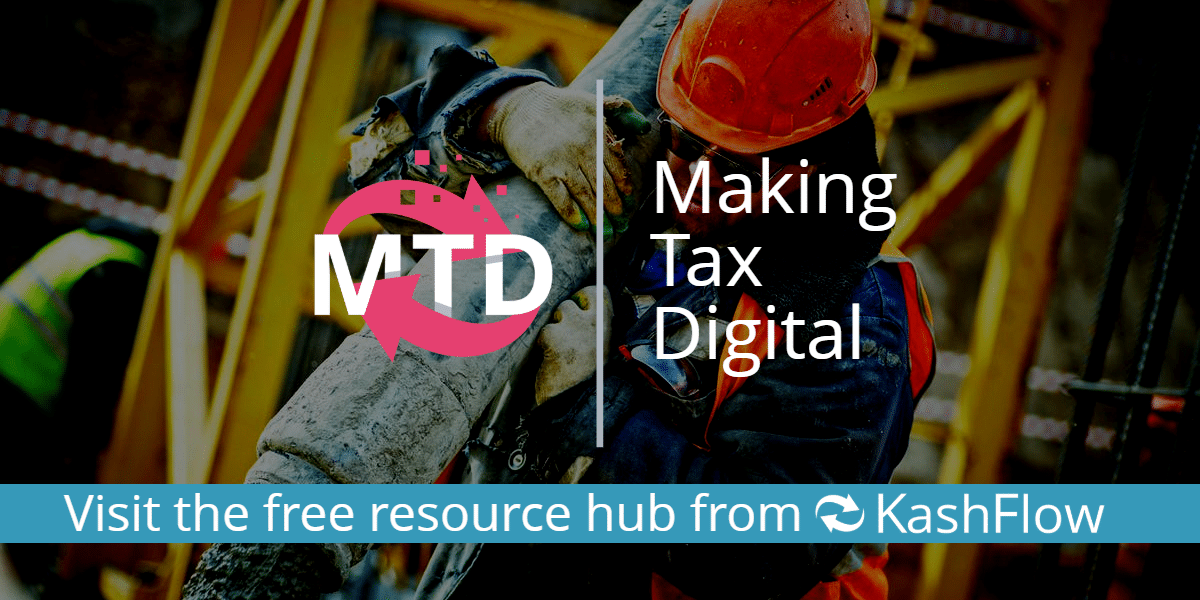

Small Business Advice Week: The Impact of Making Tax Digital

In this year’s Small Business Advice Week, we’ve been looking at growth and productivity in UK small businesses.

As a key part of this, we’ve taken a look at the impact Making Tax Digital, recently reintroduced in the Finance Bill 2017-2019, is having on small businesses across the UK.

How tax and accounts affect growth and productivity

KashFlow’s recent survey among UK small businesses found that they had two main causes of stress in common: completing their tax returns and managing their business finances.

Our survey also found that 20% of those asked ran their own business because they wanted control of their time, and because they wanted to do something they love. These same owners said that managing their finances and complying with tax rules was one of the main downsides to running a business.

Despite it being considered a disadvantage of business ownership, small business owners are spending a disproportionate number of hours per week on their books. This time spent on accounts is taken away from other important business activity, like targeting new customers or clearing outstanding work.

There’s every chance that Making Tax Digital, which requires more frequent updates to HM Revenue and Customs, will increase the amount of time spent on bookkeeping, unless small businesses make a change now.

How Making Tax Digital is going to change small businesses

Though Making Tax Digital has been delayed, it’s still scheduled to launch in the next couple of years. For those already worrying about their books, this will result in more time spent on finances and tax rules, so it’s important to start looking at ways to minimise its impact.

KashFlow’s CEO, Oliver Shaw, says that small business should look at adopting technology and consulting advisors to make sure they’re doing everything properly. In doing this, he says, small businesses will be giving themselves time to get back to what they love.

Moving forwards, the world of business will only become more digital. In one scenario seen in Norway (who adopted a system similar to MTD back in 2011), the entire invoicing system is digitalised.

If an invoice is electronic, it is delivered electronically and goes into the pay run. This way, up to 80% of invoices never get reviewed. At the moment lots of people work with keying and manual processing, but introducing a digital solution removes a lot of delays and room for error.

What small businesses need to do now

In order to get ahead, small businesses need to start adopting solutions that’ll help them be compliant. The penalties and fines that come with Making Tax Digital are unlikely to take teething troubles into account, so it’s important you successfully adopt a system ahead of time.

Once we move into a digital environment, being able to use bookkeeping software and track your finances will be key to your continued success. As you’ll be filing quarterly tax returns, you’ll be expected to keep track of receipts and invoices to ensure your tax returns are accurate.

The most important thing small businesses can do at this stage is to educate themselves, reading as much as they can about Making Tax Digital and making sure they understand what’s expected of them and how they’ll meet those expectations.

Going digital as a small business

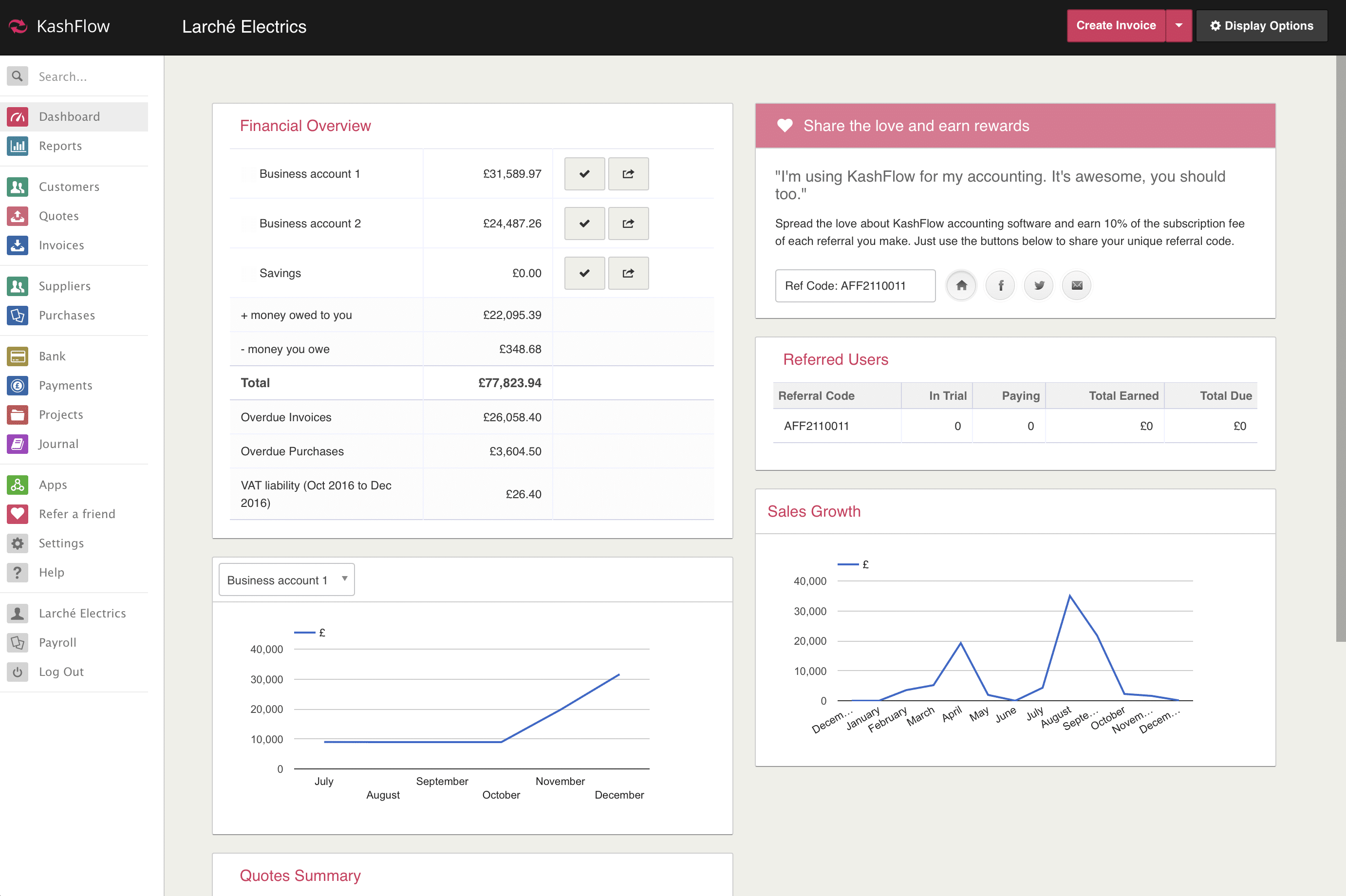

Adopting software isn’t just about completing tax returns or making sure that your payroll submissions are right; it also helps you run your business in general.

Being able to work on your books and data in one place in the evening or in gaps between jobs is key to staying productive in a fast-paced environment.

Similarly, being able to provide invoices or quotes on site, or as soon as you get back to the office, is a great way to stay on top of business and encourage prompt payments.

In addition to chasing late payments, bookkeeping software also lets you see exactly where your numbers are and reconcile them with your bank for full picture of your finances.

When it comes to tax, having all your information stored and processed digitally means that you can easily communicate with your accountant and advisors, and that they can help you on your annual returns by using real-time accurate data.

If you’re choosing software, go for flexibility

If you’re a sole trader and you have a small number of customers and transactions, then the core functionality of bookkeeping software like KashFlow will work for you.

If you’re a sole trader and you have a small number of customers and transactions, then the core functionality of bookkeeping software like KashFlow will work for you.

However, if you hire staff or become a limited company, then your requirements are likely to change and you’ll move into slightly more complicated regulatory territory. As a result, your choice of software needs to be able to adapt its offering to continue to support you.

Your needs will also vary depending on your sector, for example those of you working in construction will need to comply with CIS.

The needs of small businesses will change according to individual circumstances. But what doesn’t change is that, across all stages of the small business journey, software can help you become compliant and run your business in a more structured way.

Looking for a software to guide you through Making Tax Digital, help you chase late payments, adapt to cover staff and make everything easy-to-do? Start a free trial.