How to calculate and master VAT

How do I calculate VAT? Should I even register for VAT? We’ve answered these burning questions and more.

How do I calculate VAT? Should I even register for VAT? We’ve answered these burning questions and more.

As a small business owner new to balancing the books, you’ll have a whole heap of questions relating to VAT.

Some of these queries might include ‘How am I supposed to work out how much VAT to reclaim?’ and ‘What do I do with suppliers who regularly leave off VAT with their product listings?’

In this blog, we’ve rounded up and answered three common questions on VAT to help simplify what can often be an arduous and time-consuming task for many businesses up and down the country.

- Should I register for VAT?

You can only charge VAT if your business is registered for VAT. If your total sales in the previous 12 months exceeds the compulsory registration threshold then you must register for it. A failure to do so will result in a fine. If you haven’t exceeded the threshold for compulsory registration you can still register voluntarily. For more in depth information read our article here.

- How do I calculate VAT?

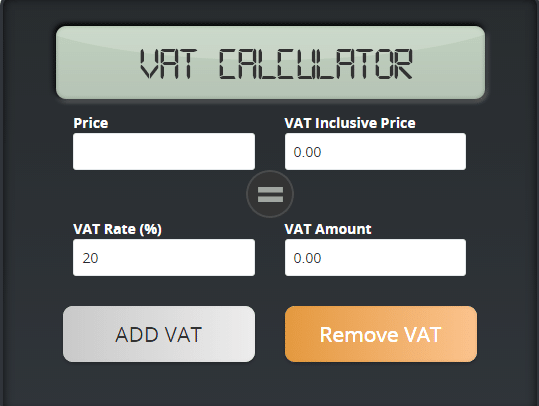

The UK government website gov.uk advise calculating VAT-inclusive and exclusive prices by applying a specific formula. However, you can scrap formulas and simplify calculating VAT by using the free KashFlow VAT calculator, which informs you of how much VAT to add to or remove from any given price, calculating the VAT inclusive/exclusive price for you.

Follow these simple steps to get you started:

Step 1: Click the ‘Add VAT’ button to calculate the VAT inclusive price and the amount of VAT that has been added

Step 2: To work out how much VAT there is on a VAT inclusive price, just enter the VAT inclusive price into the correct box, ensuring that the VAT rate is entered correctly

Step 3: Click the ‘Remove VAT’ button to find out both the item’s price without VAT and the amount of VAT that has been applied to it

- When do I not apply VAT?

Exempt goods or services are supplies that you can’t charge VAT on and must not include in your VAT records. Examples of exempt items include insurance, postage stamps or services and health services provided by doctors.

Some goods and services are outside the VAT tax system so you can’t charge or reclaim the VAT on them. These include goods or services that you buy and use outside of the EU or donations to a charity. For more information on exempt goods or services or anything else on VAT you can find more information on the HMRC’s website.

For a free no-obligation 1-2-1 demo just call the KashFlow on boarding team on 0844 815 5779.