Peer-to-peer lending could be the key to your growth

Guest blog by MarketInvoice

Denial, anger, bargaining, depression, acceptance. The five stages of grief? Yes. But also the five stages of bank related frustration.

Getting funding for your growing business can be an arduous process. For any company to grow it needs medium-term financial support to hire new staff, develop new products, increase supply, buy more equipment etc. In this blog, we look at the options you have to fund your business and why alternative finance could be the key to growth.

There are several ways you can fund growth for your business. You could invest previous profits back into the business; take out a loan; sell shares – equity – to outside investors (if the business is a limited company); or look for other sources of finance.

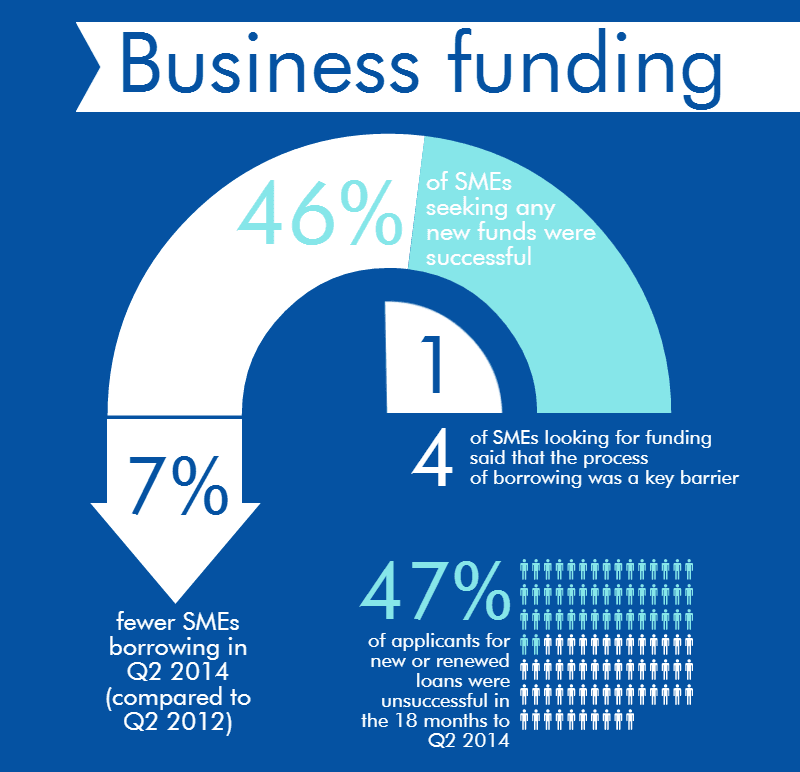

The majority of businesses’ first port of call will be to ask their bank for a loan. However, banks are not particularly keen on loans at the moment, given the current economic climate. After the credit crisis banks were made to tighten up their risk policies and take on less of it. As a consequence they’re less willing to fund smaller businesses with growth potential, as the infographic (below) shows.

52% of small businesses say that the availability of credit is “poor” or “very poor” and around half say that credit is unaffordable.[1] Amongst those businesses who thought that they would like to take out a loan in the future, 17% rated access to finance as a “major obstacle” in Q2 2014.[2] In the same period, net lending to SMEs is down at -£400m.[3]

This has been a long-term trend: businesses don’t want the products and banks aren’t keen on offering them. The banks’ policy of belt-tightening has affected growing businesses across the UK.

“So what,” we hear you ask, “am I to do?”.

You could sell equity in your business, but there are a number of disadvantages to this, chiefly giving up some control of your company.

Other sources of finance include grants, overdrafts (although these are unlikely to be big enough to cover any significant expense), leasing and asset finance, invoice factoring or discounting and, what we will be looking at, peer-to-peer lending.

What is peer-to-peer lending?

Peer-to-peer lending, usually shortened to “P2P”, enables people to put their money to work for competitive returns by lending it to other individuals or businesses through a range of online providers and platforms. Peer-to-peer lending is a type of alternative finance, which covers a variety of new financing models that have emerged outside of the banks that connect fundraisers directly with funders.

Some stats

Currently, the size of the alternative finance market is £1.74 billion. When compared with the banks this is, of course, a drop in the ocean. However, the market has been growing at over 150% a year, every year. The P2P business lending market alone is £750 million and has grown at an average rate of 250% in the past three years. Online invoice trading – where businesses can upload their invoices online and get them funded by investors within 24 hours – sits at roughly £300 million, with a growth rate of 174%.[4]

Alternative finance is now no longer a fringe movement but has matured and is mounting an ever-growing assault on outdated, slow and fee-heavy traditional finance.

The proof, as they say, is in the pudding… I mean, Nesta report. 33% of P2P business borrowers believed they would have been unlikely to get funds elsewhere. 63% also said that they saw a growth in profit and 53% seeing an increase in employment.

What are the main benefits?

For many, the main benefits are what define peer-to-peer lending against the pain points of traditional finance.

Speed: It can still take up to 6 weeks to get a loan from a bank. Alternative providers use technology to build automated credit scoring systems. This means they work at a speed that reflects the reality of modern day business. With the amount of data available online, there is no reason for a business to have to wait more than 24 hours to be accepted (or declined) for finance.

Bank: 6 weeks P2P: 24 hours

Simplicity and transparency: Standard contracts for bank finance are eye-wateringly long and often have charges hidden in the Ts & Cs. Alternative finance tends to be more flexible and usually significantly more transparent pricing. Most leading alternative finance providers have simple online tools to show how much you will be charged dependent on the terms you choose.

Bank: long, hidden fees P2P: flexible, transparent

Service: How many times have you been frustrated by how long it takes to speak to a real person who actually knows about you at a bank? Most alternative finance providers are run by entrepreneurs and so they have a natural propensity to understand the concerns and aspirations of small business owners looking to grow their business.

Bank: frustrating, uncaring P2P: understanding, cooperative

For a growing business to be able to access funding within 24 hours, instead of six weeks, could be crucial to its future success in the modern digital age. Additionally, being able to understand exactly what you’re getting and at what price will help immensely with financial planning at such a critical stage of a business’ life.

Having explored some of the options available to you as a growing business, we hope it’s clear that your business can get funding. You don’t need to be at a loss when considering funding options, even if the banks have said no. Medium-term financial support can be fast, simple and accessible and, therefore, the lifeline that a growing business needs at a crucial developmental stage.

This piece was written by Piers Garthwaite from MarketInvoice, the leading online invoice trading platform. They offer fast, flexible cashflow solutions to help businesses grow. If you’d like to find out more, visit their website (info.marketinvoice.com/kashflow) or give them a call on 0845 548 0508.

________________________________________________________________________________________________________________________________

[1] According to the Federation of Small Business

[2] According to the SME Finance Monitor

[3] Trends in Lending

[4] Nesta report