Making Tax Digital and additional VAT functionality update

We’ve always prided ourselves on being specialists in straightforward bookkeeping for sole traders, freelancers, small and micro businesses. Paying VAT is one of the biggest and most daunting parts of any small business’s accounting journey, whether you’re preparing to register for the first time or you’re a tax veteran.

VAT has gotten a lot of attention recently thanks to HMRC’s digital-tax system ‘Making Tax Digital’ or MTD for short. Making Tax Digital will mean businesses and individuals will be able to access all their tax affairs online via a digital tax account supplied by HMRC. Businesses will be able to update and view their tax information in real time through their online accounting software (such as KashFlow). HMRC’s vision for MTD is to give businesses a clear view of their finances, making taxing more effective, efficient and easier for taxpayers to get it right.

For users above the VAT threshold of £85,000 Making Tax Digital sign-up is mandatory beginning 1st April 2019. For those below the threshold, MTD sign-up isn’t mandatory, but it is available should businesses wish to get their MTD journey underway. It is likely that HMRC will make MTD compliance mandatory for all registered companies at a later date, though this has yet to be confirmed. Businesses looking for more information on MTD can visit the KashFlow MTD hub where we’ve got a whole range of blogs, videos and guides covering what you need for the upcoming legislation.

KashFlow and Making Tax Digital

For KashFlow users, we’re already on HMRC’s list of recognised MTD-ready software suppliers and we’re set to release our MTD functionality in the coming weeks. We strongly recommend that KashFlow users do not register their businesses for MTD until this functionality becomes fully available as this will mean users will not be able to submit any VAT submissions via current methods (online filing, HMRC portal etc) and will be unable to revert to these existing systems once MTD sign-up is complete. We will keep users informed when MTD functionality is available within KashFlow via the usual means of communication.

While we prepare for the full launch of our MTD functionality, we’ve improved the existing self-assessment and VAT elements within KashFlow. Based on feedback from our users, we’ve made some changes in our latest release to the self-assessment and VAT area of KashFlow.

What’s included in these Self Assessment and VAT improvements?

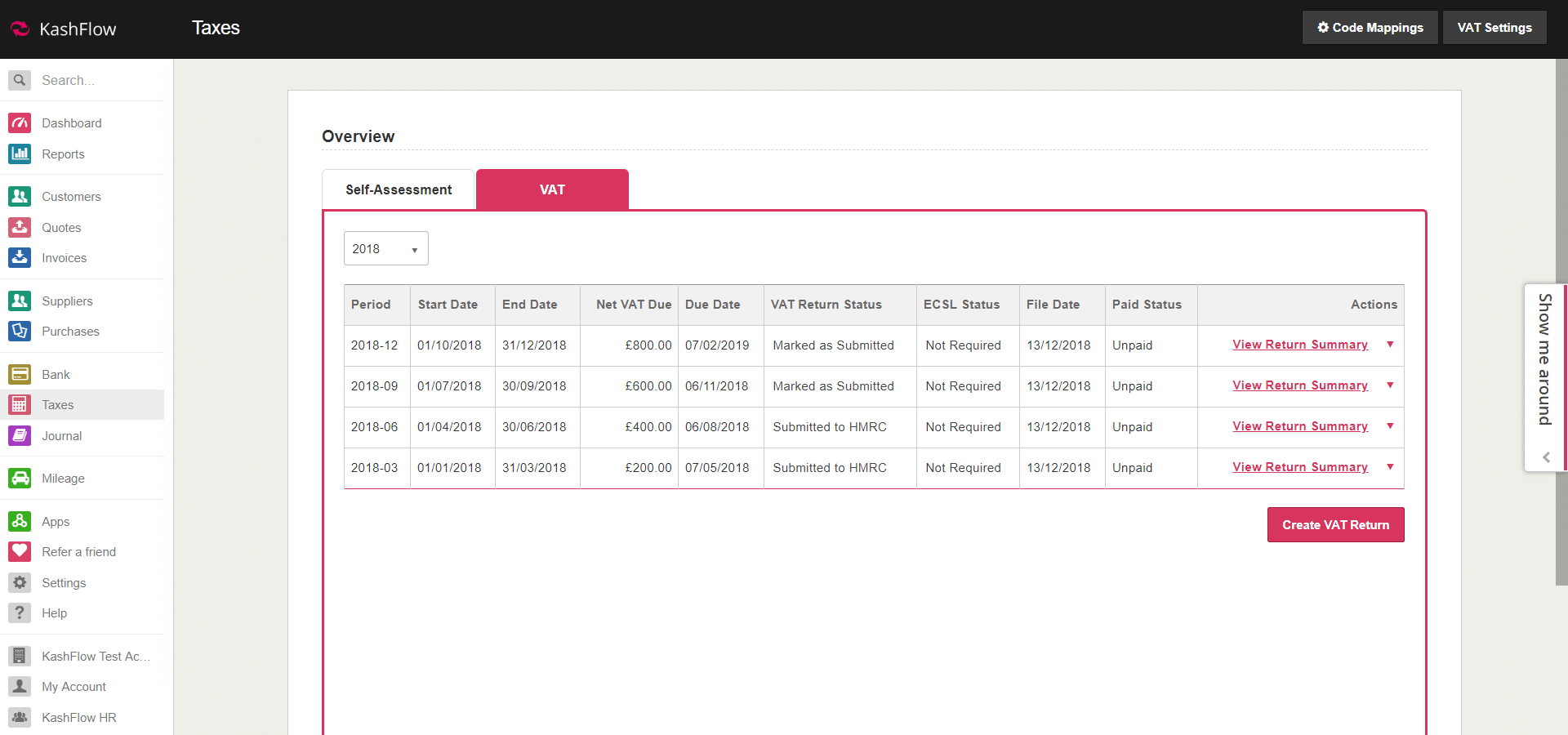

We’ve added a new ‘Taxes’ dashboard. Found in the main left-hand menu, the new ‘Taxes’ dashboard houses your VAT and Self Assessment information in an easy to find location.

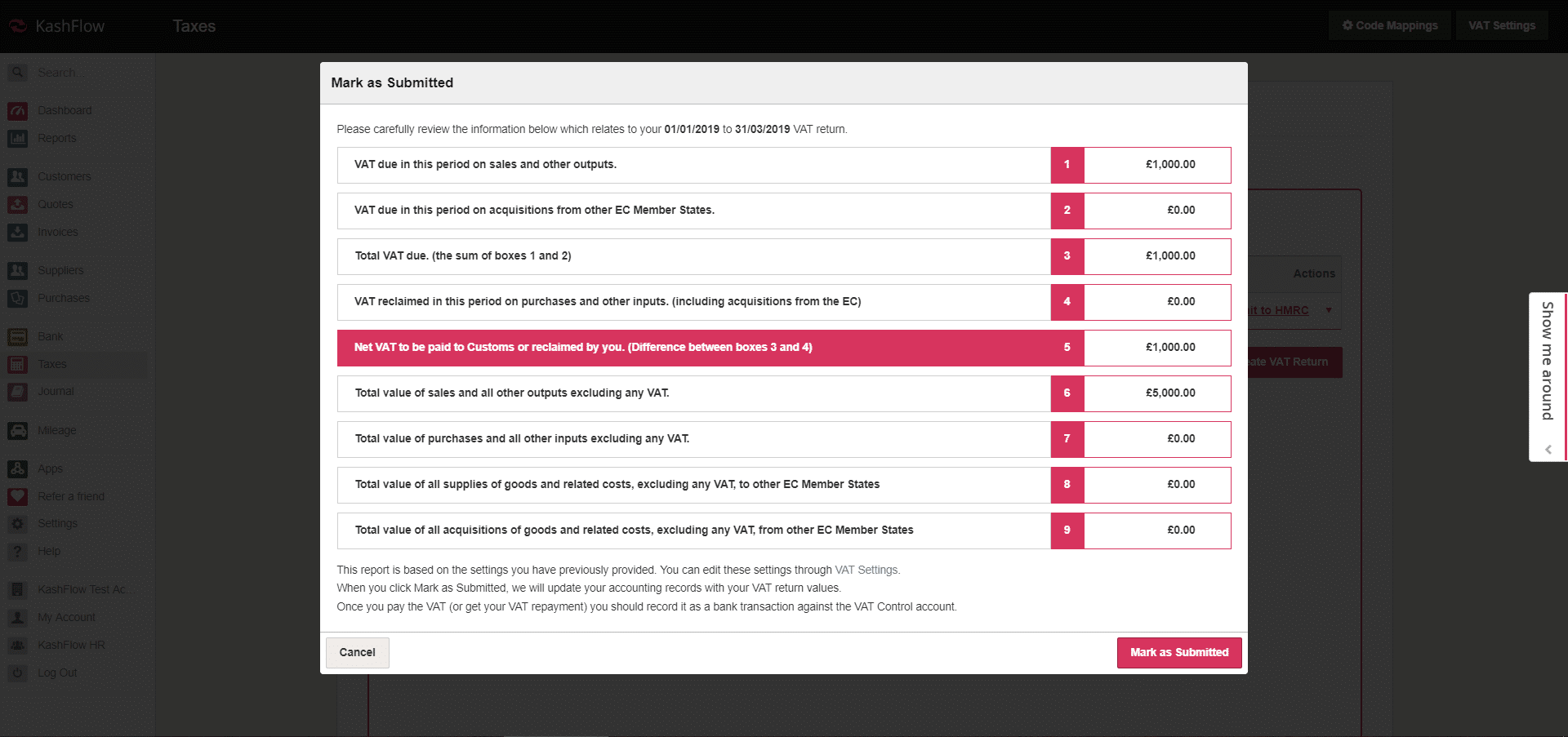

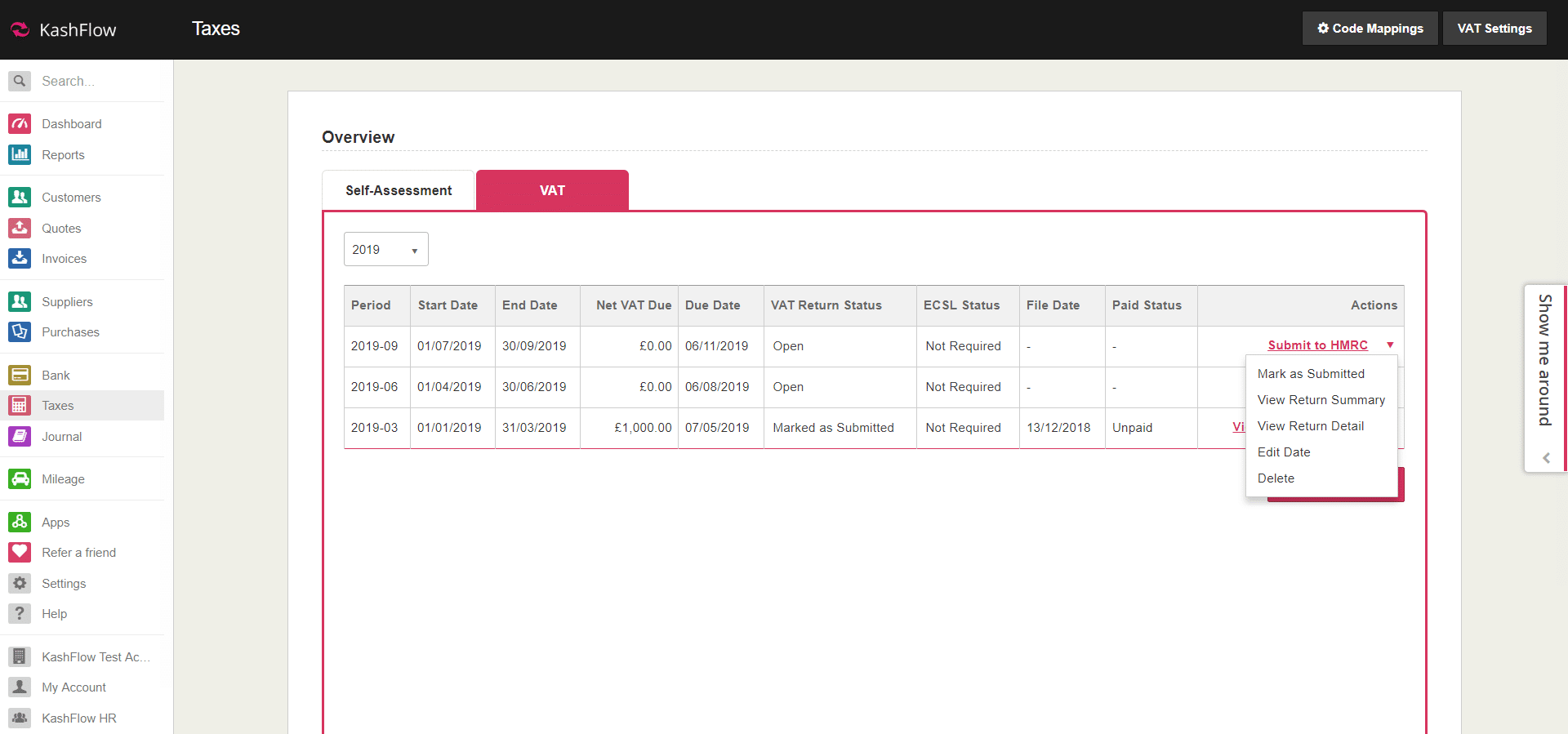

From the new Taxes menu, you can see a complete overview of your past submissions, and easily distinguish between created VAT returns and already submitted returns. All previously submitted returns from before the update will be available to see in this menu in the new and improved format. Creating new submissions is simple, and you’ll have the ability to ‘Mark as submitted’ for a manual upload or ‘Submit to HMRC’ if submitting direct to HMRC through KashFlow. While this functionality has always been available within KashFlow, we’ve made it a smoother process and made it clearer to see the status of submissions from the overview dashboard.

We’ve also improved the existing VAT return summary report to give you a better overview of your taxes alongside adding a brand-new VAT detailed report to give you a greater breakdown of transactions, who owes what and your cashflow.

These reports are now customisable, meaning you can add company branding and are available to download as a CSV file, PDF for printing or send via email.

Finally, we’ve taken away the ability to delete a transaction that has been previously recorded in a VAT return. KashFlow will instead now warn you before allowing you to continue and give you the option to reverse the transaction and post the relevant amendments to your next VAT return.

If you’re looking to learn more about the update visit our FAQ Knowledge Base page here which covers everything you need to know about this update.

With over 60,000 businesses submitting VAT through KashFlow, we are determined to continue delivering a clear, jargon-free bookkeeping solution that allows you to get your business’ tax right and meets the needs of Making Tax Digital. These changes have come thanks to feedback from our KashFlow users leaving suggestions on the KashFlow Canvass forum. With HMRC’s Making Tax Digital initiative on its way there’s never been a better time to get your taxes in order.