How to minimise the impact of Auto Enrolment on your cashflow

It’s stagin’ time!

By 2018, every UK business will have to offer, and contribute to, a workplace pension for their employees. For the 1.3 million SMEs with between 1 and 30 members of staff, staging begins this January and rolls out over the next two years. (Find your staging date here.)

For businesses who’ve already staged, the key focus has been on the specifics of AE compliance and legislation, e.g. choosing their pension providers, assessing their staff, communicating changes to their employees and contributing to their pensions.

What’s become apparent is that many have failed to consider the impact that AE legislation will have on their short and long term cashflow.

For some, the idea of compiling and maintaining a financial plan may seem time-consuming and unnecessary, especially with the staging process itself to deal with, but for small-businesses owners, planning is key.

Initially, the company contribution levels are at a low level but by 2018 employers must pay a minimum 3% per employee into a pension scheme. In addition, the scheme will require admin time to set-up and maintain.

With your salary bill increasing you’ll need to develop a strategy to ensure your business and profitability don’t suffer as a result. This is especially important for new or seasonal businesses, and those who are breaking even or barely making a profit.

The company contributions to the scheme will be an additional cash cost and this should be factored into your business cashflow planning for the years ahead. The good news is that it’s easy to understand the cashflow impact of any change in your business – including the workplace pension.

Comprehensive forecasting

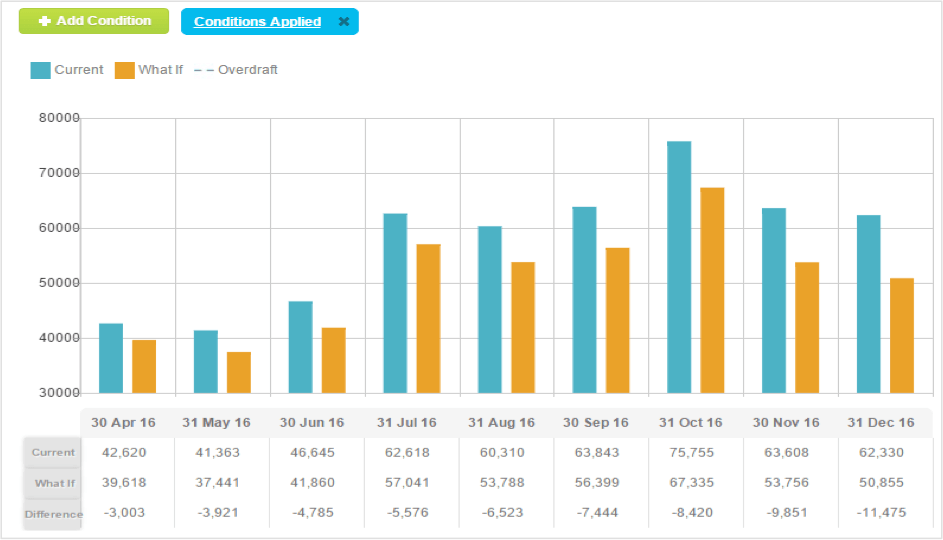

Fortunately, with KashFlow you can produce forecasts quickly and easily using GearShift’s forecasting software. Using GearShift, you’ll be able to quickly model ‘what if’ scenarios – i.e. your projected pension contributions – and instantly see the impact on your cashflow, giving you the clarity you need to plan effectively for the changes ahead. See the image above for an example.

Once you’ve formulated a plan you can track your financial progress, reviewing and updating over time to ensure you’re hitting your targets. Try it out here.

With a plan in place, the next logical step is to ensure you’re on top of your credit control and that your business remains healthy from a liquidity perspective, something KashFlow can provide via our new KashFlow Payments feature.

Get paid on time, every time

KashFlow Payments is a powerful and innovative credit control tool that grants you the power to control the entire chain of events in the payment process. By taking instant card and/or bank payments from customers using our secure payment gateways, you can dramatically improve your cashflow and productivity.

You can add a ‘pay online’ button to your invoices, automate communications to late-paying customers and all your transactions are recorded systematically – key features ensuring you’re always on top of your finances and equating to vital time saved, leaving you to get on with what you do best: building your business.

Activation is easy, and once you’ve signed up you’ll see an immediate increase in the flow of cash into your company.

Through this integrated combination of careful credit control and forecasting, your business will be fully equipped to deal with any financial fallout caused by Auto Enrolment, and with KashFlow you’ll have all the tools you’ll need at your disposal.