9 auto enrolment responsibilities for small business owners

Thousands of small businesses across the UK are coming up to their auto enrolment staging dates (the dates their chosen workplace pensions schemes are set to come into force), and yet many business owners aren’t aware of what they need to do next.

The workplace pensions laws are changing, and business owners will be required to provide and contribute towards a pensions scheme for their employees by 2018. It is a legal requirement, and the government, through The Pensions Regulator, can issue fines for non-compliance. The penalties are as follows:

Fixed Penalty: £400

Escalating Penalties: Daily fines of £50 up to £10,000

Civil Penalties: £5,000 for individuals and up to £50,000 for organisations

If you run a business, and employ staff, there are 9 key auto enrolment responsibilities you need to be aware of:

1) Know your staging date

Your staging date is based on the PAYE data provided to The Pensions Regulator (TPR) by HMRC on 1st April 2012 – employers will then be contacted by TPR 12-18 months before their staging date and then again 3 months before their staging date. Click here to find out yours.

2) Define your automatic enrolment plan

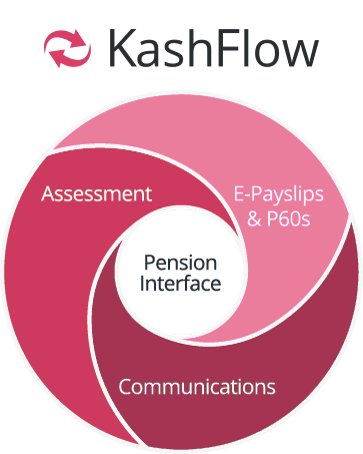

How will your company prepare? Industry experts and TPR advise beginning this process 12 months before your staging date, but if haven’t planned yet, it’s not too late to ensure you are compliant. Consider using payroll software that can make the process easier, such as KashFlow Payroll.

3) Choose how your automatic enrolment process will be managed

Do your research and decide what type of solution is best for managing auto-enrolment. Question the best options for your business: Manual? Middleware? Payroll or HR system compatible?

4) Assess your workforce for eligibility

You will need to do this every pay period after you’ve staged. You will need to assess them for auto enrolment based on their ages and how much they earn. Click here to find out more.

5) Review your current pension arrangements

Does your current pension qualify? If you are providing a pension for your team, don’t make the potentially costly mistake of assuming it already qualifies under new the workplace pensions laws.

6) Communicate the changes to all your workers

Communications is an important part of the auto enrolment process, so consider using software that does this for. KashFlow Payroll can help you communicate these changes smoothly to your workforce with emails and letters.

7) Automatically enrol your eligible jobholders

Employees must be automatically enrolled on a scheme when they fit the eligible criteria. This must be assessed and reassessed every pay period for eligibility changes in your workforce.

8) Complete your declaration of compliance

Records must be maintained for 6 years. Keep TPR in the know of your compliance.

9) Contribute to your workers’ pensions

The minimum contributions are being phased in from 2% from October 2012 growing to 8% from October 2018.