Important note: Before importing Invoices you will need to create your customers or import them in to KashFlow.

Required Fields

The Invoices import requires four fields;

- Customer Code – this is the Customers unique identification code, the customer must already be in KashFlow – i.e. “CUST0001”

- Invoice Number – this is the Invoice Number that the line item will be applied to – it must be numbers only – i.e. “123”

- Invoice Date – this is the date the invoice was issued – it must be in DD/MM/YYYY format – i.e. “01/01/2012”

- Due Date – this is the date the invoice was/is due by– it must be in DD/MM/YYYY format – i.e. “01/02/2012”

Please note that if you leave the Invoice Number blank, or it is populated with an Number that already exists within the KashFlow account then one will be automatically assigned to it in line with the highest existing Invoice Number within the account before the data is imported. It is imperative this is checked as being correct before a import.

Optional Fields

The other fields you can have are listed below, along with a description, how it should be formatted and example text:

- Customer Reference – i.e. “Trade Show”

- Line-Quantity – the quantity of line items – this must be a whole number – i.e. “5”

- Line-Description – the description of your line item – i.e. “White Shoes”

- Line-Charge Type/Sales Code– this is the Sales Code of your Line Item, these can be found in your Chart of Accounts and must exist therein– i.e. “Sale of Goods”

- Line-Rate – this is the price of a single Line Item and must be a number with a maximum of two decimal places and not include the currency symbol – i.e. “5.50”. This amount should not include VAT.

- Line-VAT Amount – this is the amount of VAT that was charged on the Line Item. It should not include the currency symbol and be to a maximum of two decimal places – i.e. “0.50”

- Line-VAT Rate – the rate of VAT in percent that was applied to this Line Item. This should be to a maximum of one decimal places and not include the percentage symbol – i.e. “17.5”

- N/A VAT – to set your VAT rate as N/A, enter -1.

- Project Number – if you have projects set up you can attach this line item to the project by entering in the number here, this must already be set up in Projects of the KashFlow account – i.e. “1”

- Currency Code – this is the standardised code for the line item currency, if you are using a foreign currency it must already be set up in KashFlow – i.e. “USD”

- Exchange Rate – if you billed your line item in a foreign currency you can specify an exchange rate here, this must be a number to a maximum of four decimal places – i.e. “1.1234”

You do not need to include a column for the gross amount (Net + VAT) as this is automatically calculated from the Line-Rate and Line-VAT Amount columns on the CSV file.

Uploading the template

To import

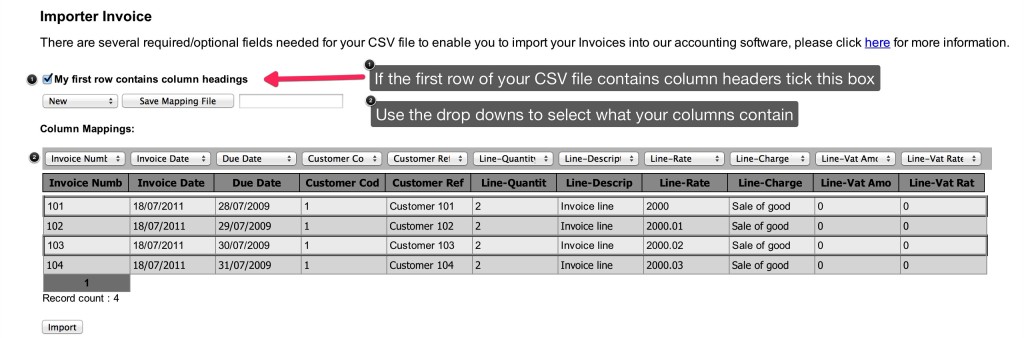

Settings > Import Data > Import CSV Files > Enter in your Username & Password (Please note if you have specified an alternative API Password you would need to use it here) > CSV > Invoice > Upload your file > Tick the box ‘ My first row contains column headings; if appropriate > Use the drop downs to map the file > Import

Please note, if the CSV file contains any special characters such as, ‘ ; ( ) {} & * £ $ “ ” <> ? / @ ~ # etc… Please remove as these may cause errors to the import process.