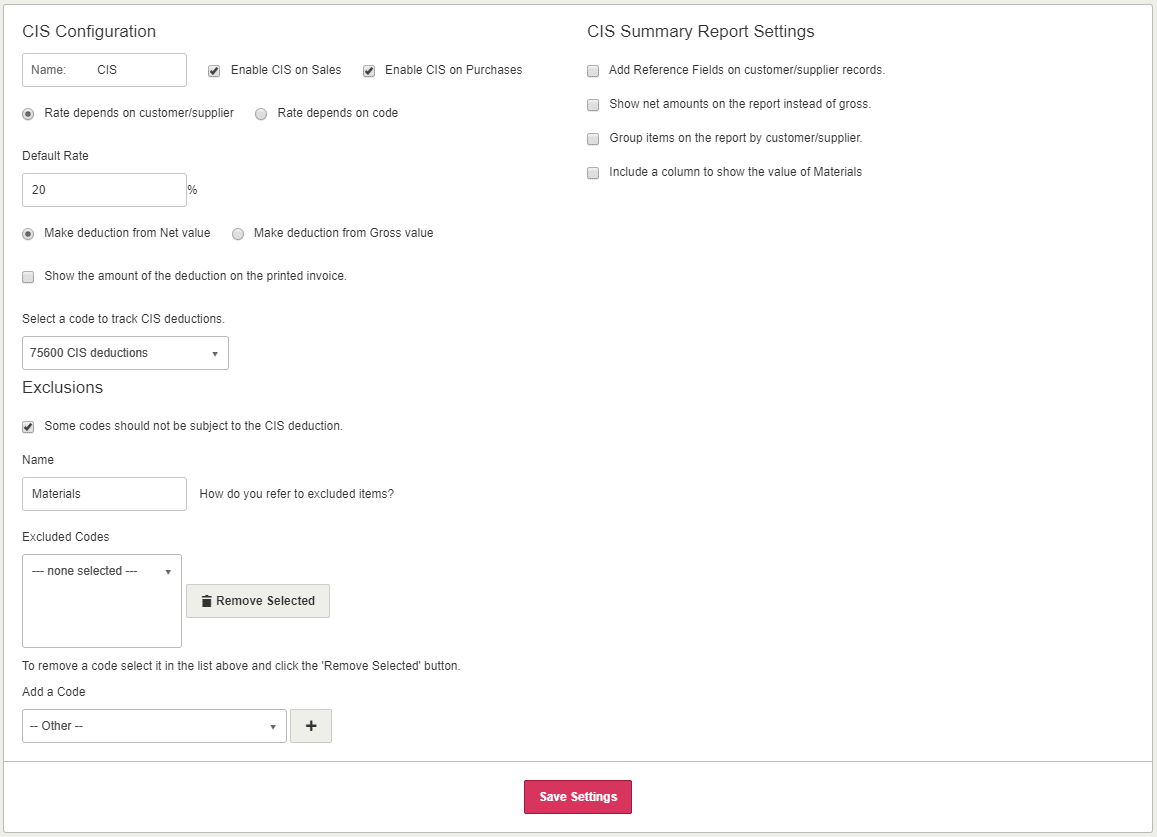

KashFlow supports CIS (construction industry scheme) withholding taxes. Access this page by going to Settings > CIS Options. This guidance describes what each of the settings on this page does.

- Name – By default we refer to withholding tax as CIS. If you’re using KashFlow in another country you may find it better to rename CIS to something more appropriate. Buttons and reports that refer to CIS will be renamed to this throughout KashFlow.

- Enable CIS – Use the tick boxes here to turn on CIS on sales and/or purchases. You can then apply CIS to your invoices and purchases with a click of a button.

- Rate depends on customer/supplier – this means that the CIS rate can be variable and will depend on the rate set in the customer/supplier profile (in customers/suppliers > selecting the customer/supplier > CIS & other info)

- Rate depends on code – this means that the CIS rate will be dependent on the rate that’s set in the sales/outgoing code, accessible by going to sales > sales codes > selecting the sales code and modifying the CIS rate, or purchases > outgoing codes > selecting the outgoing code and modifying the CIS rate).

- Default Rate – Set the default % deduction here.

- Rate to be deducted as a percentage of gross or net – use the option here to choose if to perform the deduction on the gross or net amount

- Show Deduction – Ticking this box will show the total amount that has been deducted at the bottom of the invoice.

- Nominal Code – Select the nominal code where to record your CIS deductions. This should be a code that’s only used for CIS deductions.

- Exclusions – some things that you sell may not be eligible for CIS deductions. To enable exclusions tick this box. You can then decide on a per sales/outgoing type basis what should be excluded.

- CIS Summary Report Settings

- Reference Fields – Depending on how you use CIS you may be obligated to record certain information on the customer/supplier (in customers/suppliers > selecting the customer/supplier > CIS & other info) that you’re deducting CIS from. Ticking this box will setup up to 5 fields on the customer or supplier profile. By default we set up 4 fields;

- UTR Number

- Company Reg Number

- NI Number

- Verification Number

- Show net amounts instead of gross

- Group items by customer/supplier

- Add a column to show the value of materials

- Reference Fields – Depending on how you use CIS you may be obligated to record certain information on the customer/supplier (in customers/suppliers > selecting the customer/supplier > CIS & other info) that you’re deducting CIS from. Ticking this box will setup up to 5 fields on the customer or supplier profile. By default we set up 4 fields;